Question: I already solved a ) and B ), please help me with the c). Thank you in advance. Consider a flat term structure of interest

I already solved a ) and B ), please help me with the c). Thank you in advance.

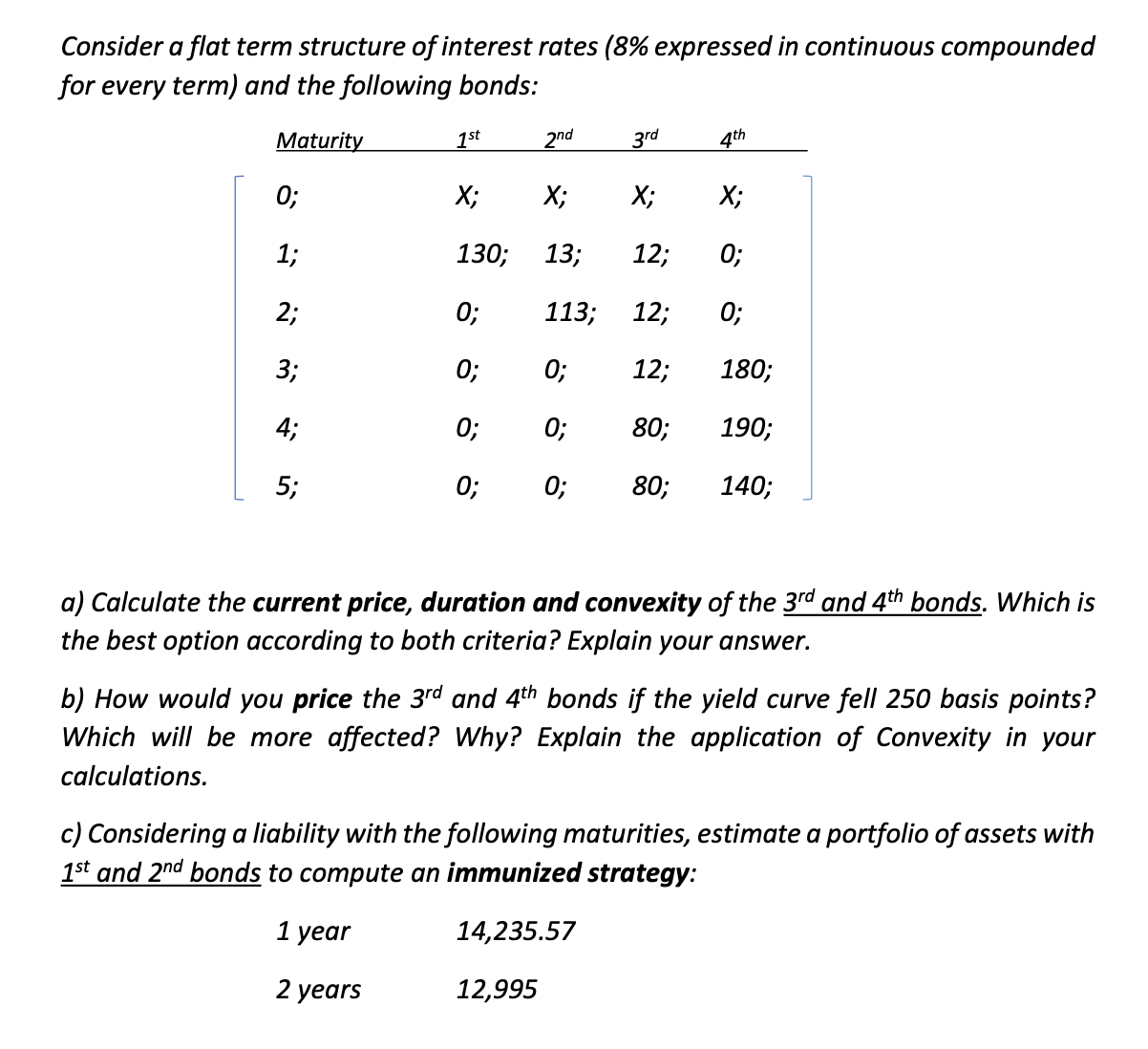

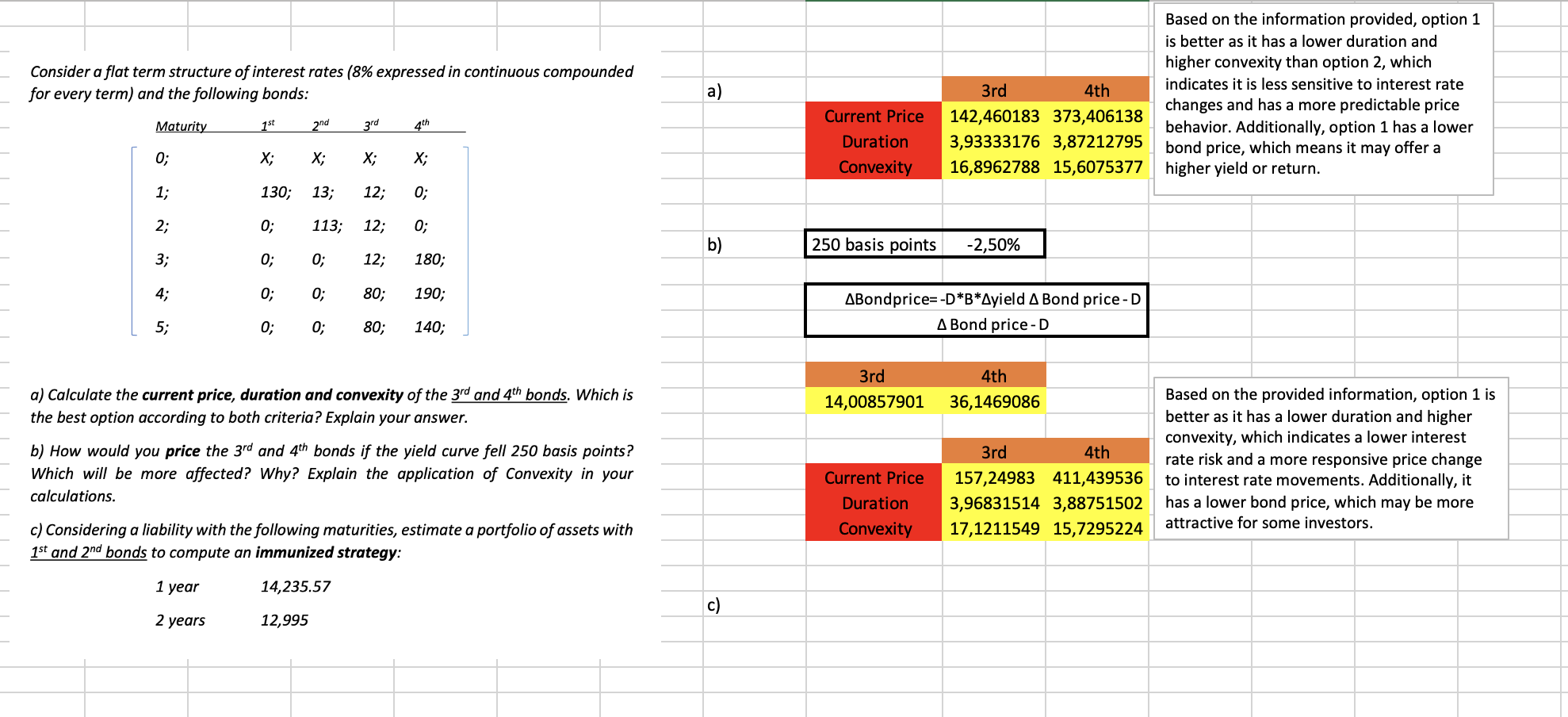

Consider a flat term structure of interest rates (8\% expressed in continuous compounded for every term) and the following bonds: a) Calculate the current price, duration and convexity of the 3rd and 4th bonds. Which is the best option according to both criteria? Explain your answer. b) How would you price the 3rd and 4th bonds if the yield curve fell 250 basis points? Which will be more affected? Why? Explain the application of Convexity in your calculations. c) Considering a liability with the following maturities, estimate a portfolio of assets with 1st and 2nd bonds to compute an immunized strategy: Consider a flat term structure of interest rates (8\% expressed in continuous compounded for every term) and the following bonds: a) Calculate the current price, duration and convexity of the 3rd and 4th bonds. Which is the best option according to both criteria? Explain your answer. b) How would you price the 3rd and 4th bonds if the yield curve fell 250 basis points? Which will be more affected? Why? Explain the application of Convexity in your calculations. c) Considering a liability with the following maturities, estimate a portfolio of assets with 1st and 2nd bonds to compute an immunized strategy: Consider a flat term structure of interest rates (8\% expressed in continuous compounded for every term) and the following bonds: a) Calculate the current price, duration and convexity of the 3rd and 4th bonds. Which is the best option according to both criteria? Explain your answer. b) How would you price the 3rd and 4th bonds if the yield curve fell 250 basis points? Which will be more affected? Why? Explain the application of Convexity in your calculations. c) Considering a liability with the following maturities, estimate a portfolio of assets with 1st and 2nd bonds to compute an immunized strategy: Consider a flat term structure of interest rates (8\% expressed in continuous compounded for every term) and the following bonds: a) Calculate the current price, duration and convexity of the 3rd and 4th bonds. Which is the best option according to both criteria? Explain your answer. b) How would you price the 3rd and 4th bonds if the yield curve fell 250 basis points? Which will be more affected? Why? Explain the application of Convexity in your calculations. c) Considering a liability with the following maturities, estimate a portfolio of assets with 1st and 2nd bonds to compute an immunized strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts