Question: I already understand how to do section a and b, but I do not know how to calculate the Par Yield for section C. Please

I already understand how to do section a and b, but I do not know how to calculate the Par Yield for section C. Please show your work for this, and thank you for your help.

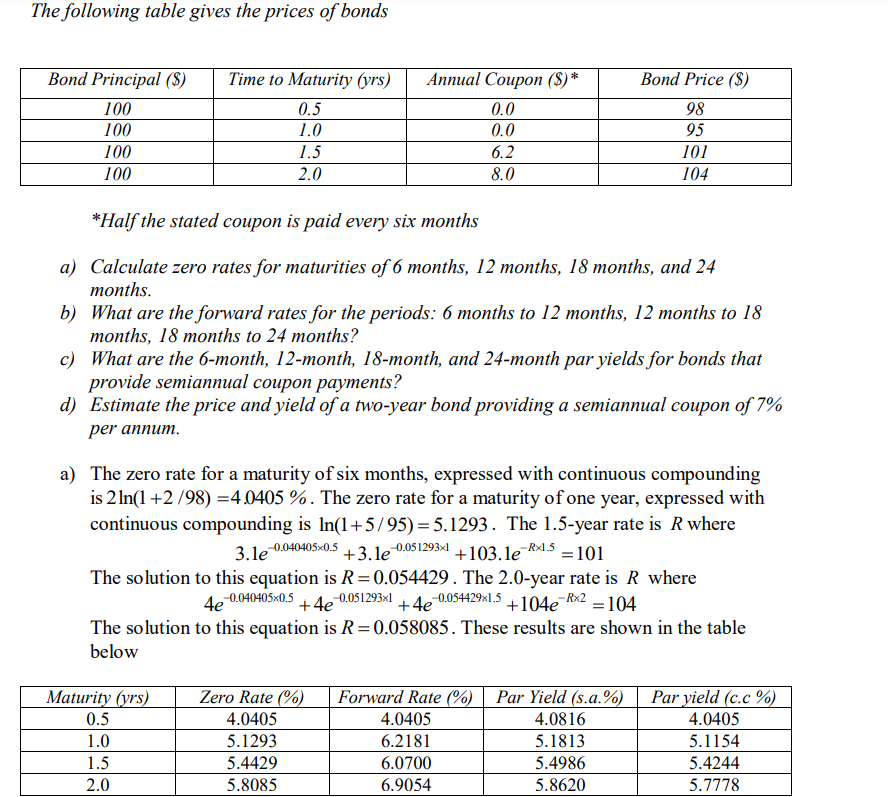

The following table gives the prices of bonds *Half the stated coupon is paid every six months a) Calculate zero rates for maturities of 6 months, 12 months, 18 months, and 24 months. b) What are the forward rates for the periods: 6 months to 12 months, 12 months to 18 months, 18 months to 24 months? c) What are the 6-month, 12-month, 18-month, and 24-month par yields for bonds that provide semiannual coupon payments? d) Estimate the price and yield of a two-year bond providing a semiannual coupon of 7\% per annum. a) The zero rate for a maturity of six months, expressed with continuous compounding is 2ln(1+2/98)=4.0405%. The zero rate for a maturity of one year, expressed with continuous compounding is ln(1+5/95)=5.1293. The 1.5 -year rate is R where 3.1e0.0404050.5+3.1e0.0512931+103.1eR1.5=101 The solution to this equation is R=0.054429. The 2.0 -year rate is R where 4e0.0404050.5+4e0.0512931+4e0.0544291.5+104eR2=104 The solution to this equation is R=0.058085. These results are shown in the table below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts