Question: i also uploaded the answer from previous chegg question that was incorrect ! need right answer Self-Supporting Growth Rate Maggie's Muffins Bakery generated $4 million

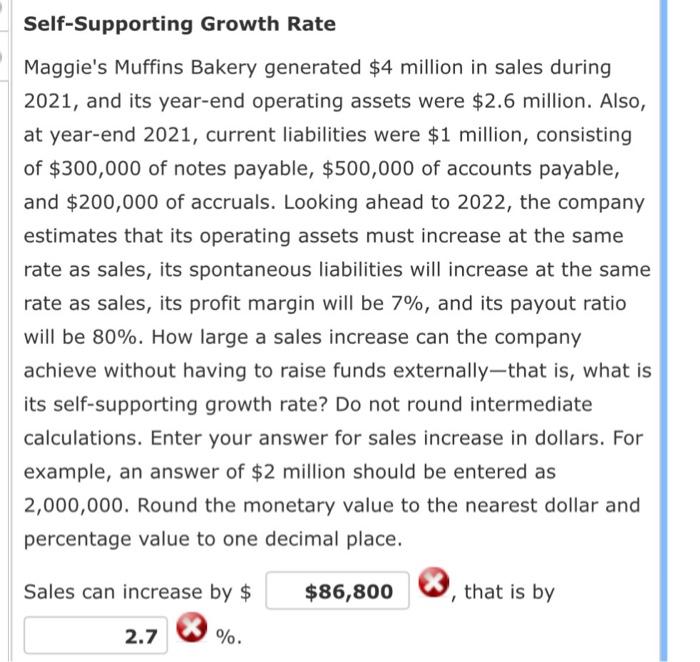

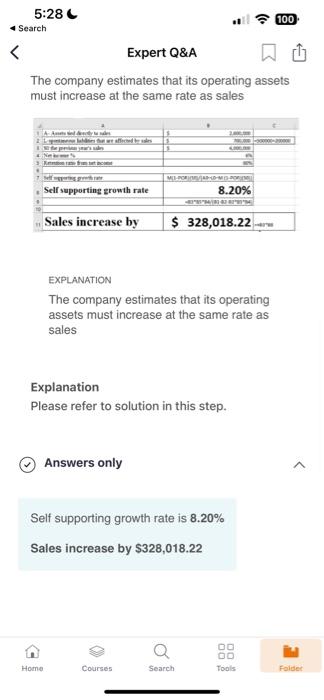

Self-Supporting Growth Rate Maggie's Muffins Bakery generated $4 million in sales during 2021 , and its year-end operating assets were $2.6 million. Also, at year-end 2021, current liabilities were $1 million, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $200,000 of accruals. Looking ahead to 2022, the company estimates that its operating assets must increase at the same rate as sales, its spontaneous liabilities will increase at the same rate as sales, its profit margin will be 7%, and its payout ratio will be 80%. How large a sales increase can the company achieve without having to raise funds externally-that is, what is its self-supporting growth rate? Do not round intermediate calculations. Enter your answer for sales increase in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round the monetary value to the nearest dollar and percentage value to one decimal place. Sales can increase by $ (3), that is by % The company estimates that its operating assets must increase at the same rate as sales EXPLANATION The company estimates that its operating assets must increase at the same rate as sales Explanation Please refer to solution in this step. Answers only Self supporting growth rate is 8.20% Sales increase by $328,018.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts