Question: I am a part of Team Chester. With the data, I will attach and the example (which we can't use) we were given can someone

I am a part of Team Chester. With the data, I will attach and the example (which we can't use) we were given can someone please help me analyze round four for my report, which should include the data as the example did below?

We were given this example,

"Round 4 Analysis.

Unit sold in this round for Daze was 1.603 million with an inventory of only 1,000. For Dot, units sold were 749,000 with 0 inventory on hand. Unit sold for Donut was 488,000 with inventory on hand of 156,000. Donut was a success, pulling in a net $3 million profit (having a payback period of less than a year). Due to 3 successful products, we have become overall leader in market share. We issued common stock worth $14.07 million and borrowed long term debt of $16.28 million. The reason for borrowing high amount was due to product refreshment (automation, capacity increase for prior product lines), and introducing a brand-new product in the high-end market called Dragon. Our rational for introducing Dragon was that we were going to let our previous product's specification stay where they are (implementing only minor changes to refresh the product in future rounds) as the perceptual map keeps moving.Just as previous round, we invested only in some category in TQM totaling $2.75 million. The statistic from this round shows that our market share rose to 24.39%, contribution margin was at 46.6%, sales was approximately $108.3 million (highest among the competitors). The stock price closed at $43.48 (increase of $15.74), the market cap was $132 million in this round."

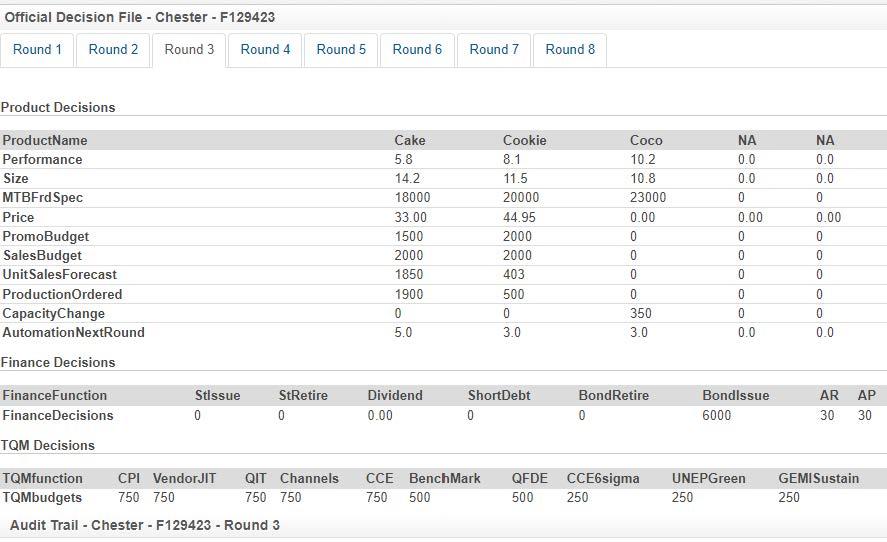

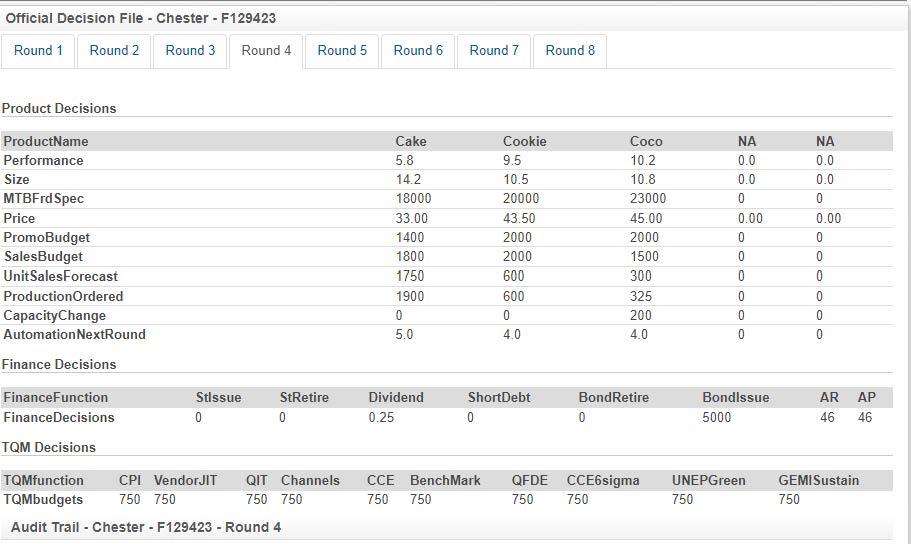

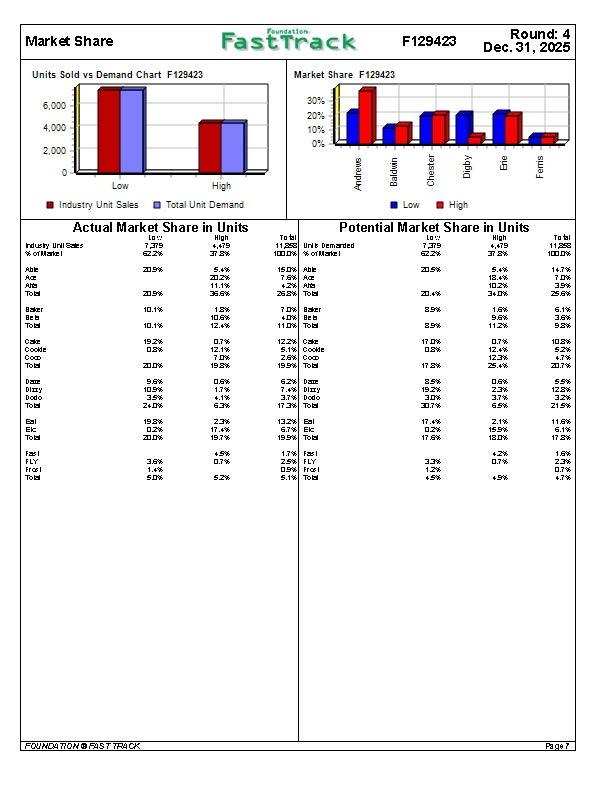

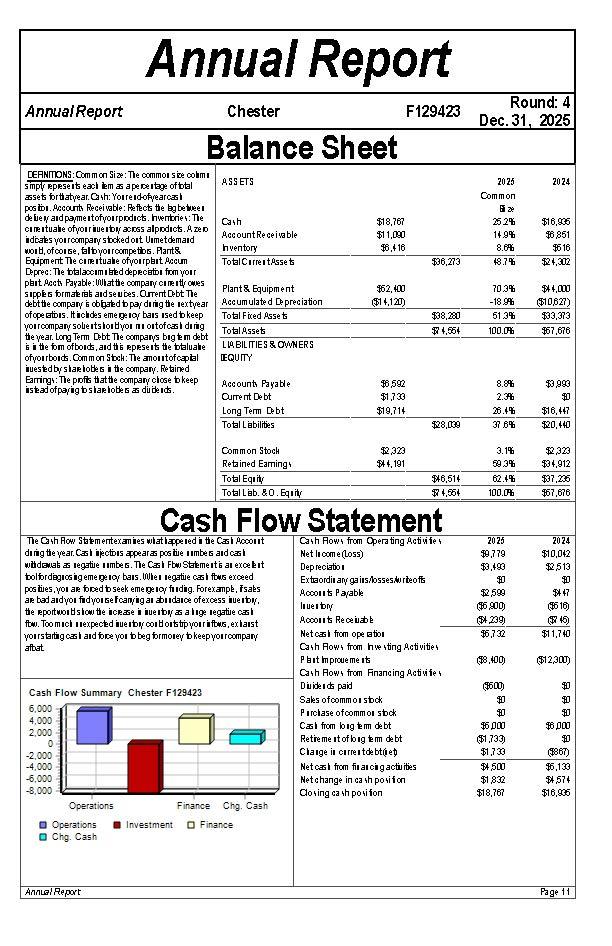

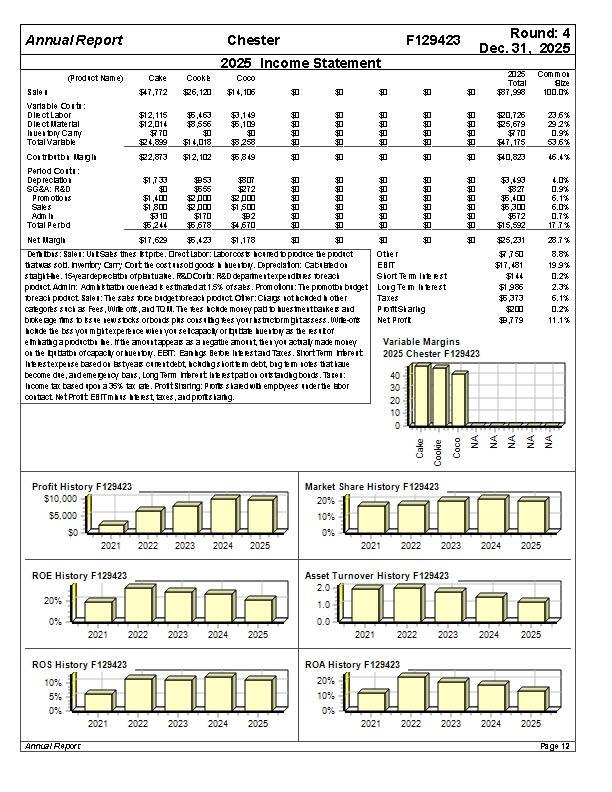

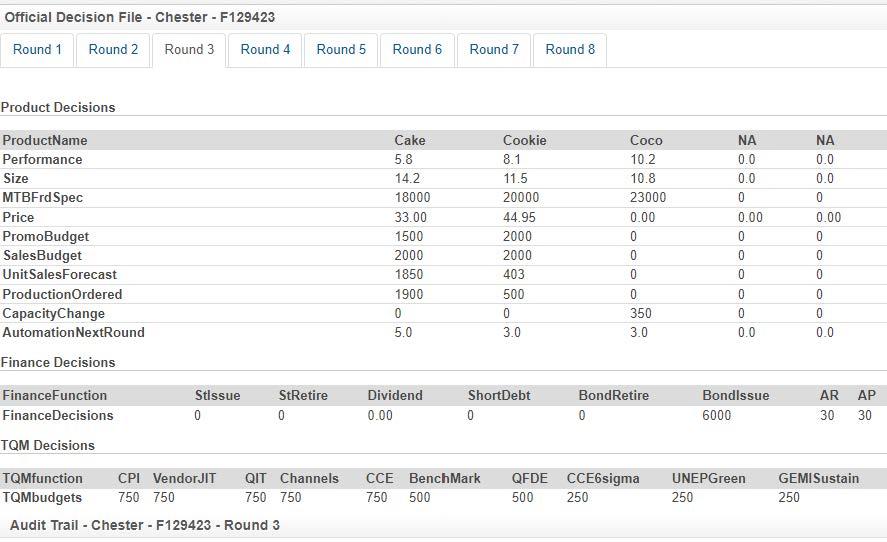

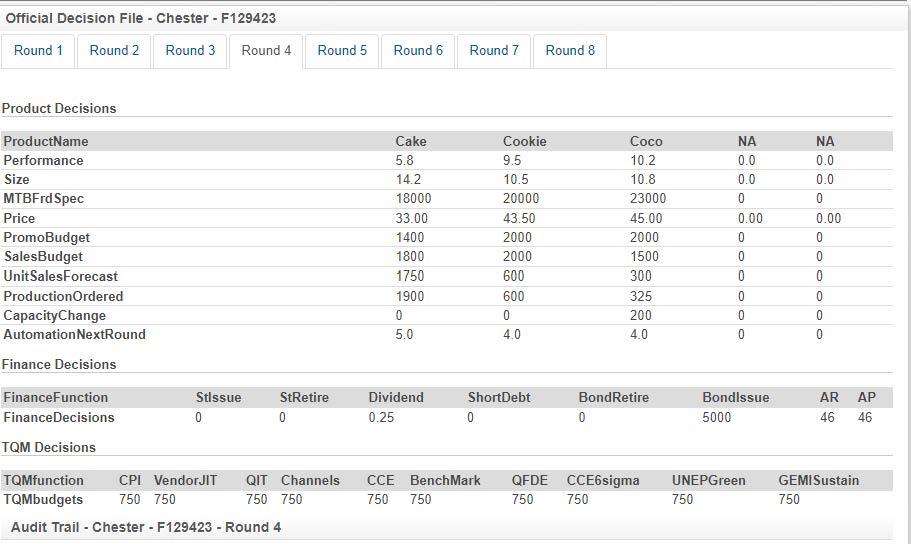

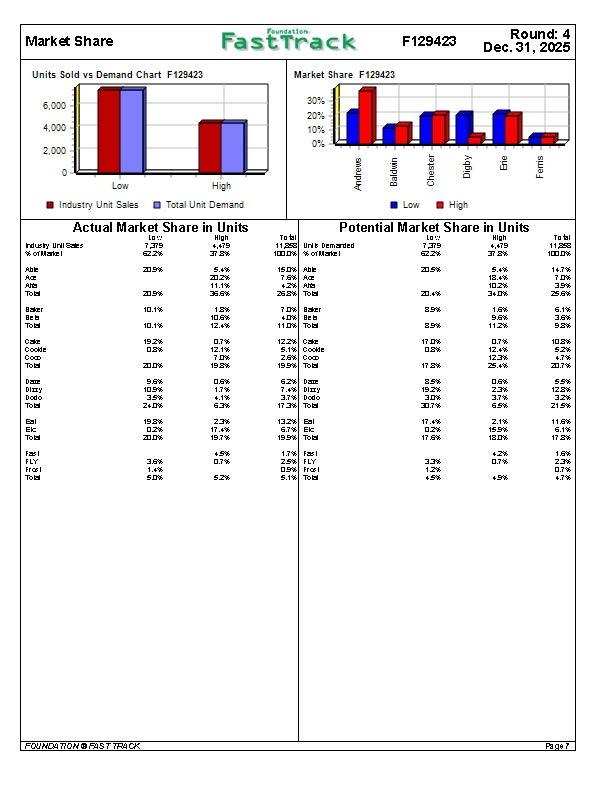

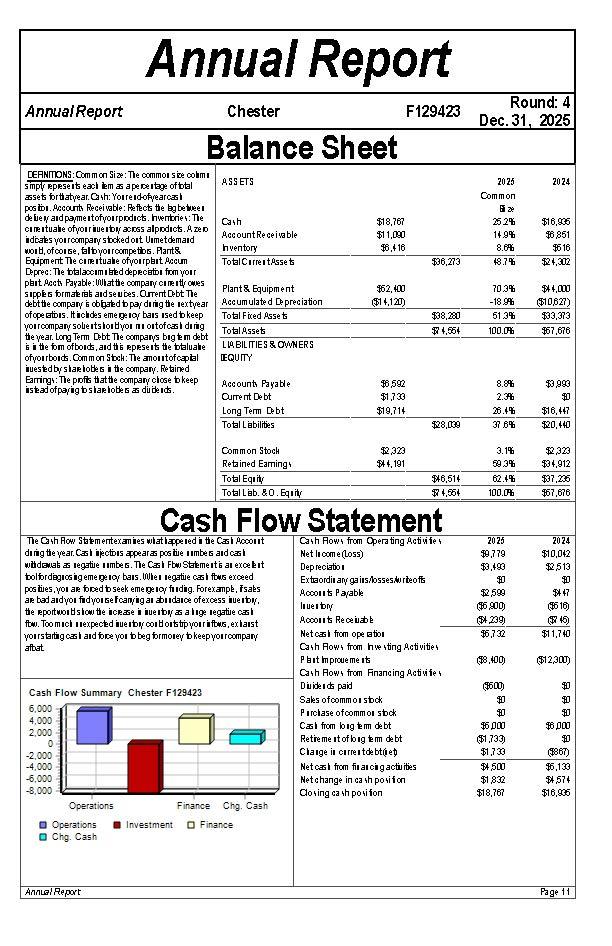

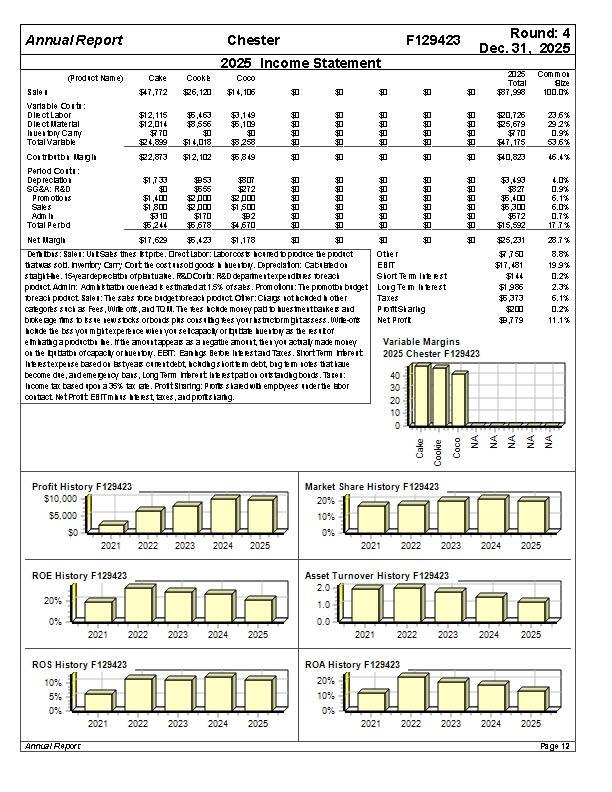

Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 Product Decisions NA ProductName Performance Size MTBFrd Spec Price PromoBudget Sales Budget Unit SalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1500 2000 1850 1900 0 5.0 Cookie 8.1 11.5 20000 44.95 2000 2000 403 500 0 3.0 Coco 10.2 10.8 23000 0.00 0 0 0 0 350 3.0 0.0 0.0 0 0.00 0 0 0 0 0 0.0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0.0 Finance Function Finance Decisions Stissue 0 StRetire 0 Dividend 0.00 ShortDebt 0 BondRetire 0 Bondissue 6000 AR 30 AP 30 0 TQM Decisions TQMfunction CPI Vendor JIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 3 CCE Bench Mark 750 500 QFDE 500 CCE6sigma 250 UNEPGreen 250 GEMISustain 250 Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 NA 0.0 Product Decisions ProductName Performance Size MTBFrd Spec Price PromoBudget SalesBudget UnitSalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1400 1800 1750 1900 0 5.0 Cookie 9.5 10.5 20000 43.50 2000 2000 600 600 0 4.0 Coco 10.2 10.8 23000 45.00 2000 1500 300 0.0 0 0.00 0 0 0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0 0 325 200 4.0 0 0 Finance Function Finance Decisions TQM Decisions Stissue 0 StRetire 0 Dividend 0.25 ShortDebt 0 BondRetire 0 Bondissue 5000 AR 46 AP 46 TQMfunction CPL VendorJIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 4 CCE Bench Mark 750 750 QFDE CCE6sigma 750 750 UNEPGreen 750 GEMISustain 750 Foundation Market Share Fast Track F129423 Round: 4 Dec. 31, 2025 Units Sold vs Demand Chart F129423 Market Share F129423 6.000 30%. 4,000 10% 0% 2.000 Andrews Baldwin Chester Digby Low High Low High Industry Unit Sales Total Unit Demand Actual Market Share in Units Low High Industry Unilates 725 4,479 * of Marke 622 Potential Market Share in Units Total Low High 11898 Unis Demanded 4,479 100 % of Market ZZX 12% Total 11 1000W 205 5.4% 20.5 Abt ACE Art 20.2% 11.1% 16.96 15.0Able 7.6%ACE +24 AM 258% TOLI 5.4* 18.4* 10.2% 340W 14.7 70% 39% 25.6% 2090 20.4% 10.16 89* BE Beba 12% 10.6% 12.6% 70% Baker +0% Beba 11.0% To 1.6% 9.6% 11 2 6.1% 3.6% 92% 10.16 89* 192 0.8% 0.7% 12.18 17 D* 02% 10.8% 5.2% 70% 1993 12.2 CSE 5.16 Coolde 2.6% COD 1994 To 0.7% 12.4% 123 25.4% 47% 200 17 2* 20.7% Car Coolde Coco DALLE DIETY Dodo 9.6% 1098 35% Z+D 0.6% 1.7% 4.1% 63% 6.7% Date 7.4* DIELY 3.7% Dodo 173 Total &5 1978 30% 1.7% 0.6% 23 3.7% 65% 55% 1284 3.28 219% 23 ESI El 1986 02W ID 17.4% 13.28 Tai 6.7% El 199* TOS 17.5 0.2% 17.6% 2.1% 155 11.6% 6.1% 17 23 19.74 +9* 0.7% +28 0.7% Fst FLY Fras! 3.6% 1.4 50% 1.7% Fasi ZSW FLY 09% Fres! 5.1% TOST 33% 12% +5% 1.6% 23* 0.7% 4.76 5.2% +9* FOUNDATION 2017 TTCX Page 7 Annual Report Annual Report Chester F129423 Round: 4 Dec. 31, 2025 Balance Sheet ASSETS 2024 2025 Common Cash Account Receivable hventory TotalCurrent Assets $18,767 $11,000 $8.416 25 24 1494 8.6% 18.74 $16.836 $6851 $616 24,302 $36,273 DERNIONS:Common Size: The common see olim smpy epesent each tema apetitage of btal aset for thatyear. Osh: Youre dorearcal posti. Accounts Receivable: Reflects the bg beweer de uew and paymentofyourpodict. Inventories: The cineituale ofyourbuerby across alpodict. A zen indicates your company sboked out Uimetdemaid word, of conge, talbyourcompetiba. Mant& Equipment The cineituale ofyourpart Accum Deprec: The balaccim i breddeprout fom your pant acts Payable: What the company cure it owes Sipples formaterial and seu des. Ourrent Debt The debt the company s obhated bpay dung the textyear ofopeators. It ichdes eme Decoy bans ised keep yourcompany soleitstorbyon ni ortofcal dung the year. Long Term Debt The companys bigtem debt si the fom ofbords, and the present the bteluale ofyourboids. Common Stch: The amoutofcaptal quested by sharobe s i the company. Retained Earring: The ports that the company close bkeep istadofparig bslalobes & dudents. $62,400 $14,120) Plant & Equipment Accumulated Depreciation Total Ficed Asset Total Asset LABILITIES & OWNERS EQUITY 7034 -1894 51 34 100.0% $44,000 $10627) $33,373 $67,676 $38,220 $ 4,364 Accounts Payable Ourrent Debt Long Term Debt Total Liabilities $8.592 $1,730 $19,714 8.8% 2.34 28.14 37 84 $3.990 40 $16,447 $20,440 98,630 $2 323 \2323 $44, 191 Common Stoch Retained Eaming Total Equity Total Lab. &0. Equity 3.14 59.34 62.44 100.0% $46,514 $74,564 $34,012 $37,236 $67,676 Cash Flow Statement 2024 $10,012 $2,513 90 The Oath Row Statementexamines what happened in the Cash Accout ding the year. Cal injections appear a positie imbes and cal wdenat a legative iimbes. The Cal Fbw Statements an excit bolfordegros igeme pero bars. When negative cash ftus exceed posties, you are fred b seek emeg: 1 fudig. Forexample, Isabs ar bad andyou fidyou gefcanyiga budaice ofexcess huendy. the sportmonoshow the iceze i jedy zalige negatie cash ftw. Too much nexpected huerby colborstp yorriftws, exhaust yourstarting cal ad fpe you beg formorey bkeepyourcompany aftat 2025 $9,779 $3,493 $0 $2.599 $6900 $4,239 $6,732 $447 $510) $16) $11,740 $8.400 Cash Row from Operating Activites Net Income (Loss) Depreciation Ex teordinary ga ins/osses.urteofs Accounts Payable Inuen DIY 4000nt Recewable Netcal from ope atio Cath Rows from investing Activities Pent improve me it Cash Row from Financing Activite Duided paid Sales ofcommonsbok Purchase ofcommoistok Cal from bigtem debt Retre me it of big tem debt Chaige is currentdebtret Netcal from financig activities Netchange in cash position Closing cash positon $12300) mm Cash Flow Summary Chester F129423 6,000 4,000 2,000 0 -2.000 -4.000 -6,000 -8.000 Operations Finance Chg. Cash Operations Investment Finance Chg. Cash $500) 90 $0 $6000 $1.733) $1,733 $4,500 $1 832 $18,767 $6 pou 40 $867) $5,130 $4,574 $16,836 Annual Report Page 11 m mmmm $ $ $50 Annual Report Chester F12943 Round: 4 Dec. 31, 2025 2025 Income Statement Cake Product Name) Cooke 2025 C000 Common Total Fe Sale! $47,772 4.65 $87.986 100.0% Variable Coito Dlect Labor $12,115 ,16.1 :19 D7% 236% Dlect Material $12,014 $ 556 , 5.79 292% Iue Dry Cany 7 0.9% Total Varable 4 14.08 8 29 47.13 Contrbitblagi 23 $12, 102 9 46.4% Perlod Ooit : Deprecato $1.730 $3,495 4.0% SG&A: R&D $655 0.9% Promotions $1,400 DD DD ,D 6.1% D 50 $300 6.0% 2 $672 0.7% Total Perbd 35211 58 450 $15,592 17.7% Net Margh $17.629 5.31 28.7% Dentis: Salen: Unt Saes thes Etprte. Orect Labor: Latorcat bined Dopodice the podict Other 8.8% thatnes s06. huentr; Garr; cout the costusoo goods buelty. Depreciaton: Catiedon EBIT $17,181 199% stagithe. 15eardepecebi otpantuahe. R&DCont: R&D deparmentexpedbes breach Short Tem lit est 44 0.2% podict Admin: Admittat que neades thated at 15% otsaes. Promotori: The promote budget Long Tem Interest $1906 2.3% breach product Saler: The sats te bidget treach podict Ofwr:Clags hot holded other Taxes 33 6.1% categores such as fees, Wite onts, and To M. The tes lche money pati dhuesmentbankes and Portsiarlig D 0.2% broke Bye ms D Isle newsboks orboid phs consibgtes your strcbrmgltassess. Wite-ott Net Prort 779 11.1% Ichde the bes you mgltexpertence when you selcapacy or guttate huendy as the esitor embang apodicto le. If the amontpear as a negatire amont, then you actually made money Variable Margins or the Gattat ofcapacy or buelty, EET: Eang dede lit estard Taces. Short Term more it 2025 Chester F129423 Inte estexpense besedo styeas cuentdebt, hchdhg shortem debt bugem notes that are become die andeme geror tans, Long Term here it intestation ont tadhg bords. Tater: 40 Income tax based upon a 35% tarat. Prottslering: Ports shardwb empbrees under the sbor 30 contact Nat Prott Eartmhus test, taces, and protstang, 20 10 $0 mm $1,178 Tim Cake Cookie Coco Profit History F129423 $10,000 $5,000 Lon Market Share History F129423 20% 10% $0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROE History F129423 Asset Turnover History F129423 2.0 1.0 20% C: 0.0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROS History F129423 10% 5%. ROA History F129423 20% 10%. 17: 2021 2022 2021 2022 2023 2024 2025 2023 2024 2025 ANRI Report ge 12 Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 Product Decisions NA ProductName Performance Size MTBFrd Spec Price PromoBudget Sales Budget Unit SalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1500 2000 1850 1900 0 5.0 Cookie 8.1 11.5 20000 44.95 2000 2000 403 500 0 3.0 Coco 10.2 10.8 23000 0.00 0 0 0 0 350 3.0 0.0 0.0 0 0.00 0 0 0 0 0 0.0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0.0 Finance Function Finance Decisions Stissue 0 StRetire 0 Dividend 0.00 ShortDebt 0 BondRetire 0 Bondissue 6000 AR 30 AP 30 0 TQM Decisions TQMfunction CPI Vendor JIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 3 CCE Bench Mark 750 500 QFDE 500 CCE6sigma 250 UNEPGreen 250 GEMISustain 250 Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 NA 0.0 Product Decisions ProductName Performance Size MTBFrd Spec Price PromoBudget SalesBudget UnitSalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1400 1800 1750 1900 0 5.0 Cookie 9.5 10.5 20000 43.50 2000 2000 600 600 0 4.0 Coco 10.2 10.8 23000 45.00 2000 1500 300 0.0 0 0.00 0 0 0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0 0 325 200 4.0 0 0 Finance Function Finance Decisions TQM Decisions Stissue 0 StRetire 0 Dividend 0.25 ShortDebt 0 BondRetire 0 Bondissue 5000 AR 46 AP 46 TQMfunction CPL VendorJIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 4 CCE Bench Mark 750 750 QFDE CCE6sigma 750 750 UNEPGreen 750 GEMISustain 750 Foundation Market Share Fast Track F129423 Round: 4 Dec. 31, 2025 Units Sold vs Demand Chart F129423 Market Share F129423 6.000 30%. 4,000 10% 0% 2.000 Andrews Baldwin Chester Digby Low High Low High Industry Unit Sales Total Unit Demand Actual Market Share in Units Low High Industry Unilates 725 4,479 * of Marke 622 Potential Market Share in Units Total Low High 11898 Unis Demanded 4,479 100 % of Market ZZX 12% Total 11 1000W 205 5.4% 20.5 Abt ACE Art 20.2% 11.1% 16.96 15.0Able 7.6%ACE +24 AM 258% TOLI 5.4* 18.4* 10.2% 340W 14.7 70% 39% 25.6% 2090 20.4% 10.16 89* BE Beba 12% 10.6% 12.6% 70% Baker +0% Beba 11.0% To 1.6% 9.6% 11 2 6.1% 3.6% 92% 10.16 89* 192 0.8% 0.7% 12.18 17 D* 02% 10.8% 5.2% 70% 1993 12.2 CSE 5.16 Coolde 2.6% COD 1994 To 0.7% 12.4% 123 25.4% 47% 200 17 2* 20.7% Car Coolde Coco DALLE DIETY Dodo 9.6% 1098 35% Z+D 0.6% 1.7% 4.1% 63% 6.7% Date 7.4* DIELY 3.7% Dodo 173 Total &5 1978 30% 1.7% 0.6% 23 3.7% 65% 55% 1284 3.28 219% 23 ESI El 1986 02W ID 17.4% 13.28 Tai 6.7% El 199* TOS 17.5 0.2% 17.6% 2.1% 155 11.6% 6.1% 17 23 19.74 +9* 0.7% +28 0.7% Fst FLY Fras! 3.6% 1.4 50% 1.7% Fasi ZSW FLY 09% Fres! 5.1% TOST 33% 12% +5% 1.6% 23* 0.7% 4.76 5.2% +9* FOUNDATION 2017 TTCX Page 7 Annual Report Annual Report Chester F129423 Round: 4 Dec. 31, 2025 Balance Sheet ASSETS 2024 2025 Common Cash Account Receivable hventory TotalCurrent Assets $18,767 $11,000 $8.416 25 24 1494 8.6% 18.74 $16.836 $6851 $616 24,302 $36,273 DERNIONS:Common Size: The common see olim smpy epesent each tema apetitage of btal aset for thatyear. Osh: Youre dorearcal posti. Accounts Receivable: Reflects the bg beweer de uew and paymentofyourpodict. Inventories: The cineituale ofyourbuerby across alpodict. A zen indicates your company sboked out Uimetdemaid word, of conge, talbyourcompetiba. Mant& Equipment The cineituale ofyourpart Accum Deprec: The balaccim i breddeprout fom your pant acts Payable: What the company cure it owes Sipples formaterial and seu des. Ourrent Debt The debt the company s obhated bpay dung the textyear ofopeators. It ichdes eme Decoy bans ised keep yourcompany soleitstorbyon ni ortofcal dung the year. Long Term Debt The companys bigtem debt si the fom ofbords, and the present the bteluale ofyourboids. Common Stch: The amoutofcaptal quested by sharobe s i the company. Retained Earring: The ports that the company close bkeep istadofparig bslalobes & dudents. $62,400 $14,120) Plant & Equipment Accumulated Depreciation Total Ficed Asset Total Asset LABILITIES & OWNERS EQUITY 7034 -1894 51 34 100.0% $44,000 $10627) $33,373 $67,676 $38,220 $ 4,364 Accounts Payable Ourrent Debt Long Term Debt Total Liabilities $8.592 $1,730 $19,714 8.8% 2.34 28.14 37 84 $3.990 40 $16,447 $20,440 98,630 $2 323 \2323 $44, 191 Common Stoch Retained Eaming Total Equity Total Lab. &0. Equity 3.14 59.34 62.44 100.0% $46,514 $74,564 $34,012 $37,236 $67,676 Cash Flow Statement 2024 $10,012 $2,513 90 The Oath Row Statementexamines what happened in the Cash Accout ding the year. Cal injections appear a positie imbes and cal wdenat a legative iimbes. The Cal Fbw Statements an excit bolfordegros igeme pero bars. When negative cash ftus exceed posties, you are fred b seek emeg: 1 fudig. Forexample, Isabs ar bad andyou fidyou gefcanyiga budaice ofexcess huendy. the sportmonoshow the iceze i jedy zalige negatie cash ftw. Too much nexpected huerby colborstp yorriftws, exhaust yourstarting cal ad fpe you beg formorey bkeepyourcompany aftat 2025 $9,779 $3,493 $0 $2.599 $6900 $4,239 $6,732 $447 $510) $16) $11,740 $8.400 Cash Row from Operating Activites Net Income (Loss) Depreciation Ex teordinary ga ins/osses.urteofs Accounts Payable Inuen DIY 4000nt Recewable Netcal from ope atio Cath Rows from investing Activities Pent improve me it Cash Row from Financing Activite Duided paid Sales ofcommonsbok Purchase ofcommoistok Cal from bigtem debt Retre me it of big tem debt Chaige is currentdebtret Netcal from financig activities Netchange in cash position Closing cash positon $12300) mm Cash Flow Summary Chester F129423 6,000 4,000 2,000 0 -2.000 -4.000 -6,000 -8.000 Operations Finance Chg. Cash Operations Investment Finance Chg. Cash $500) 90 $0 $6000 $1.733) $1,733 $4,500 $1 832 $18,767 $6 pou 40 $867) $5,130 $4,574 $16,836 Annual Report Page 11 m mmmm $ $ $50 Annual Report Chester F12943 Round: 4 Dec. 31, 2025 2025 Income Statement Cake Product Name) Cooke 2025 C000 Common Total Fe Sale! $47,772 4.65 $87.986 100.0% Variable Coito Dlect Labor $12,115 ,16.1 :19 D7% 236% Dlect Material $12,014 $ 556 , 5.79 292% Iue Dry Cany 7 0.9% Total Varable 4 14.08 8 29 47.13 Contrbitblagi 23 $12, 102 9 46.4% Perlod Ooit : Deprecato $1.730 $3,495 4.0% SG&A: R&D $655 0.9% Promotions $1,400 DD DD ,D 6.1% D 50 $300 6.0% 2 $672 0.7% Total Perbd 35211 58 450 $15,592 17.7% Net Margh $17.629 5.31 28.7% Dentis: Salen: Unt Saes thes Etprte. Orect Labor: Latorcat bined Dopodice the podict Other 8.8% thatnes s06. huentr; Garr; cout the costusoo goods buelty. Depreciaton: Catiedon EBIT $17,181 199% stagithe. 15eardepecebi otpantuahe. R&DCont: R&D deparmentexpedbes breach Short Tem lit est 44 0.2% podict Admin: Admittat que neades thated at 15% otsaes. Promotori: The promote budget Long Tem Interest $1906 2.3% breach product Saler: The sats te bidget treach podict Ofwr:Clags hot holded other Taxes 33 6.1% categores such as fees, Wite onts, and To M. The tes lche money pati dhuesmentbankes and Portsiarlig D 0.2% broke Bye ms D Isle newsboks orboid phs consibgtes your strcbrmgltassess. Wite-ott Net Prort 779 11.1% Ichde the bes you mgltexpertence when you selcapacy or guttate huendy as the esitor embang apodicto le. If the amontpear as a negatire amont, then you actually made money Variable Margins or the Gattat ofcapacy or buelty, EET: Eang dede lit estard Taces. Short Term more it 2025 Chester F129423 Inte estexpense besedo styeas cuentdebt, hchdhg shortem debt bugem notes that are become die andeme geror tans, Long Term here it intestation ont tadhg bords. Tater: 40 Income tax based upon a 35% tarat. Prottslering: Ports shardwb empbrees under the sbor 30 contact Nat Prott Eartmhus test, taces, and protstang, 20 10 $0 mm $1,178 Tim Cake Cookie Coco Profit History F129423 $10,000 $5,000 Lon Market Share History F129423 20% 10% $0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROE History F129423 Asset Turnover History F129423 2.0 1.0 20% C: 0.0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROS History F129423 10% 5%. ROA History F129423 20% 10%. 17: 2021 2022 2021 2022 2023 2024 2025 2023 2024 2025 ANRI Report ge 12