Question: I am asked to prepare a cash flow statement using the indirect method, please provide the answer asap! thanks! Shown below are comparative statements of

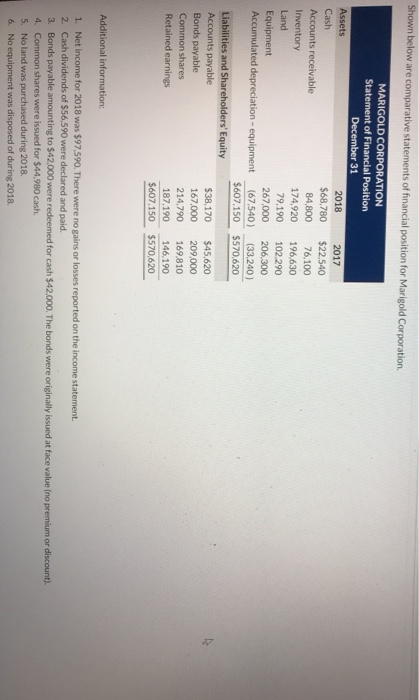

Shown below are comparative statements of financial position for Marigold Corporation MARIGOLD CORPORATION Statement of Financial Position December 31 Assets 2018 Cash $68,780 Accounts receivable 84,800 Inventory 174,920 Land 79.190 Equipment 267.000 Accumulated depreciation - equipment (67,540) $607,150 Liabilities and Shareholders' Equity Accounts payable $38,170 Bonds payable 167.000 Common shares 214,790 Retained earnings 187.190 $607,150 2017 $22.540 76,100 196,630 102290 206,300 (33.240) $570,620 $45,620 209,000 169,810 146,190 $570,620 Additional information: 1. Net Income for 2018 was $97,590. There were no gains or losses reported on the income statement. 2. Cash dividends of $56,590 were declared and paid. 3. Bonds payable amounting to $42.000 were redeemed for cash $42,000. The bonds were originally issued at face value (no premium or discount) 4. Common shares were issued for $44,980 cash. 5. No land was purchased during 2018, 6. No equipment was disposed of during 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts