Question: I am auditing a class and trying to understand how to set up these problems. Thanks. I am trying to better understand bundling? Problem 17

I am auditing a class and trying to understand how to set up these problems. Thanks.

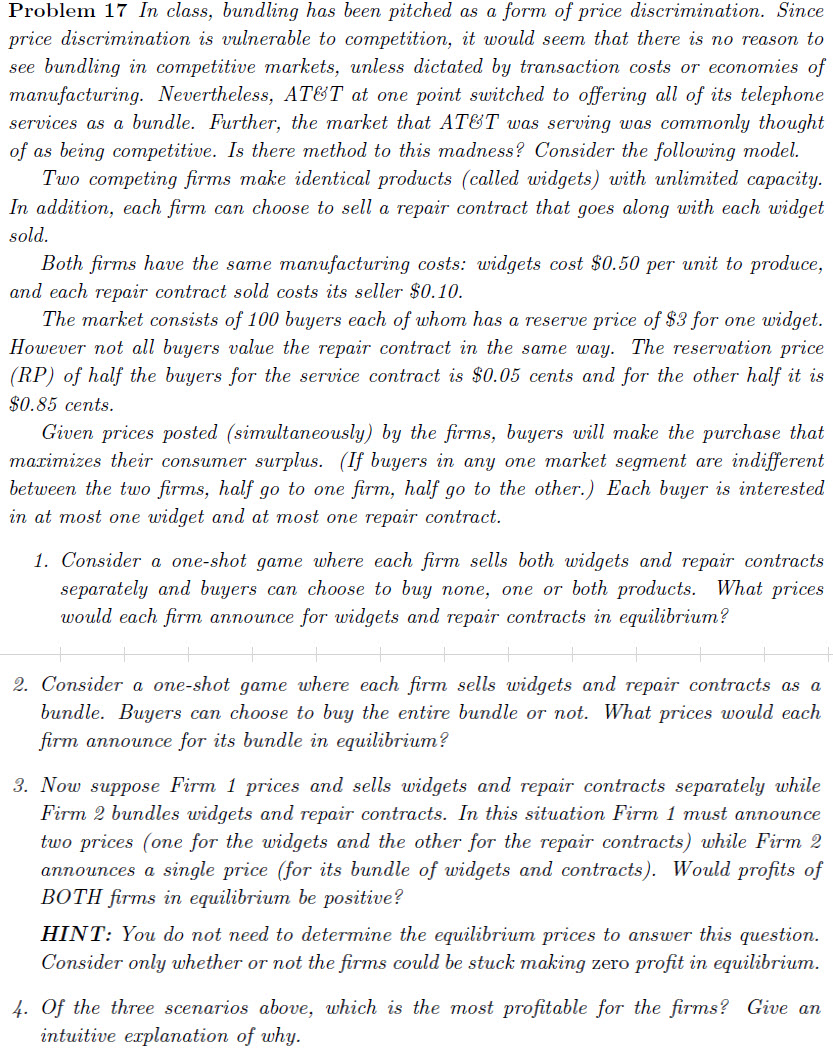

I am trying to better understand bundling? Problem 17 In class, bundling has been pitched as a form of price discrimination. Since price discrimination is vulnerable to competition, it would seem that there is no reason to see bundling in competitive markets, unless dictated by transaction costs or economies of manufacturing. Nevertheless, AT&T at one point switched to offering all of its telephone services as a bundle. Further, the market that AT&T was serving was commonly thought of as being competitive. Is there method to this madness? Consider the following model. Two competing firms make identical products (called widgets) with unlimited capacity. In addition, each firm can choose to sell a repair contract that goes along with each widget sold. Both firms have the same manufacturing costs: widgets cost $0.50 per unit to produce, and each repair contract sold costs its seller $0.10. The market consists of 100 buyers each of whom has a reserve price of $3 for one widget. However not all buyers value the repair contract in the same way. The reservation price (RP) of half the buyers for the service contract is $0.05 cents and for the other half it is $0.85 cents. Given prices posted (simultaneously) by the firms, buyers will make the purchase that marimizes their cons surplus. (If buyers in any one market segment are indifferent between the two firms, half go to one firm, half go to the other.) Each buyer is interested in at most one widget and at most one repair contract. 1. Consider a one-shot game where each firm sells both widgets and repair contracts separately and buyers can choose to buy none, one or both products. What prices would each firm announce for widgets and repair contracts in equilibrium? 2. Consider a one-shot game where each firm sells widgets and repair contracts as a bundle. Buyers can choose to buy the entire bundle or not. What prices would each firm announce for its bundle in equilibrium? 3. Now suppose Firm 1 prices and sells widgets and repair contracts separately while Firm 2 bundles widgets and repair contracts. In this situation Firm 1 must announce two prices (one for the widgets and the other for the repair contracts) while Firm 2 announces a single price (for its bundle of widgets and contracts). Would profits of BOTH firms in equilibrium be positive? HINT: You do not need to determine the equilibrium prices to answer this question. Consider only whether or not the firms could be stuck making zero profit in equilibrium. 4. Of the three scenarios above, which is the most profitable for the firms? Give an intuitive explanation of why. I am trying to better understand bundling? Problem 17 In class, bundling has been pitched as a form of price discrimination. Since price discrimination is vulnerable to competition, it would seem that there is no reason to see bundling in competitive markets, unless dictated by transaction costs or economies of manufacturing. Nevertheless, AT&T at one point switched to offering all of its telephone services as a bundle. Further, the market that AT&T was serving was commonly thought of as being competitive. Is there method to this madness? Consider the following model. Two competing firms make identical products (called widgets) with unlimited capacity. In addition, each firm can choose to sell a repair contract that goes along with each widget sold. Both firms have the same manufacturing costs: widgets cost $0.50 per unit to produce, and each repair contract sold costs its seller $0.10. The market consists of 100 buyers each of whom has a reserve price of $3 for one widget. However not all buyers value the repair contract in the same way. The reservation price (RP) of half the buyers for the service contract is $0.05 cents and for the other half it is $0.85 cents. Given prices posted (simultaneously) by the firms, buyers will make the purchase that marimizes their cons surplus. (If buyers in any one market segment are indifferent between the two firms, half go to one firm, half go to the other.) Each buyer is interested in at most one widget and at most one repair contract. 1. Consider a one-shot game where each firm sells both widgets and repair contracts separately and buyers can choose to buy none, one or both products. What prices would each firm announce for widgets and repair contracts in equilibrium? 2. Consider a one-shot game where each firm sells widgets and repair contracts as a bundle. Buyers can choose to buy the entire bundle or not. What prices would each firm announce for its bundle in equilibrium? 3. Now suppose Firm 1 prices and sells widgets and repair contracts separately while Firm 2 bundles widgets and repair contracts. In this situation Firm 1 must announce two prices (one for the widgets and the other for the repair contracts) while Firm 2 announces a single price (for its bundle of widgets and contracts). Would profits of BOTH firms in equilibrium be positive? HINT: You do not need to determine the equilibrium prices to answer this question. Consider only whether or not the firms could be stuck making zero profit in equilibrium. 4. Of the three scenarios above, which is the most profitable for the firms? Give an intuitive explanation of whyStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock