Question: I am confused about 2D? Have provided 2C for reference as it relates to 2D. Price 2C Suppose the Government imposed an $2 tax on

I am confused about 2D? Have provided 2C for reference as it relates to 2D.

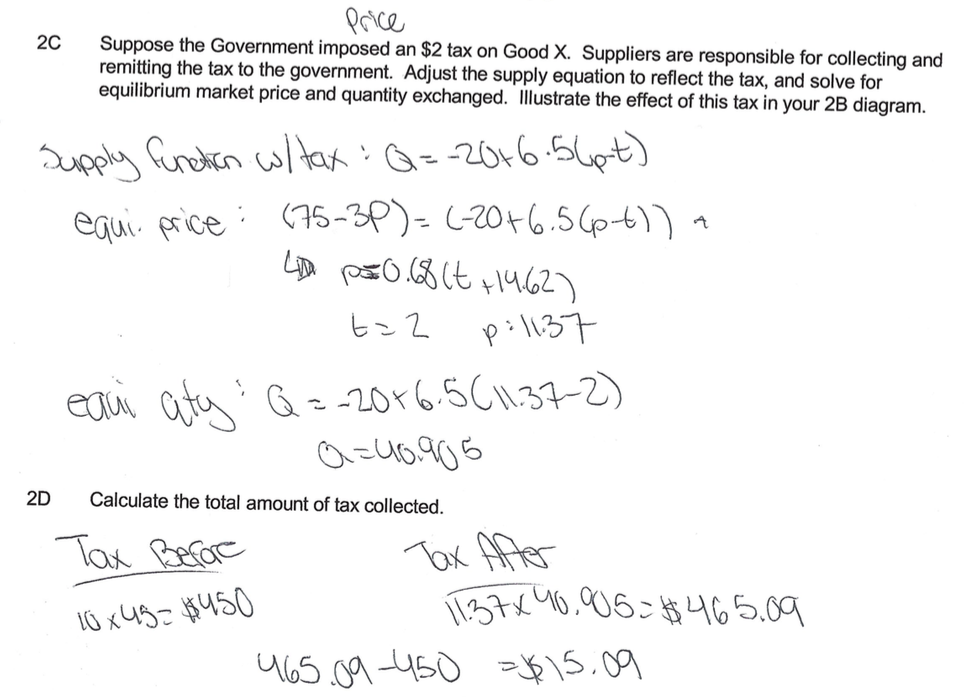

Price 2C Suppose the Government imposed an $2 tax on Good X. Suppliers are responsible for collecting and remitting the tax to the government. Adjust the supply equation to reflect the tax, and solve for equilibrium market price and quantity exchanged. Illustrate the effect of this tax in your 2B diagram. Supply function w/ tax : Q=- 20+ 6. 56put) equi. price: (75- 3P )= (- 20+ 6. 5 (p-t ) ) A LDP= 0. 68 (t + 14.62) t = 2 p:1137 eam aty Q = - 20+ 6. 5 ( 11:37-2) a = 40. 90 5 2D Calculate the total amount of tax collected. Tax Before Tax After 10 x 45 = $450 11:37x 46. 905= $ 46 5.09 465.09-450 =$15. 09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts