Question: I am doing the chapter 7 payroll project and it's asking me for the qtr taxable OASDI earning. can anyone help me Woek.h rate $600.00

I am doing the chapter 7 payroll project and it's asking me for the qtr taxable OASDI earning. can anyone help me

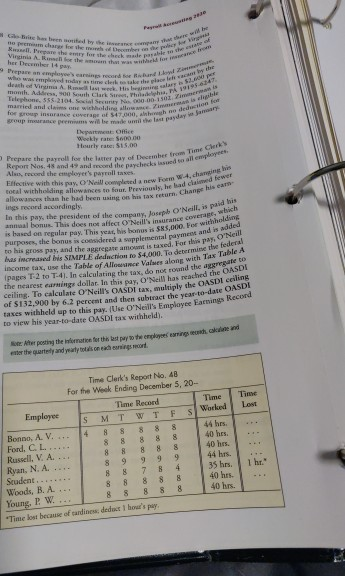

Woek.h rate $600.00 Alewily rated 5,15,00 Prepare the payroll for the laster pay of Decetmbee from Time Gierk's Reprart Nos, 48 and 49 and record the paychecks iasued 60 ail envioyeter Mlar, recond the etweloyer's parrull taves. Flfective with rhis pay, CY'Neil complesed a new Foem W-4, champinge his eocal wirhholding allowances 50 four. Previously, he lad chainwed fewer In this pay, the president of the company? Josepob Cl/Neili, is raid his annual bonus. This does noe affect CYMeill's insurance coveragery velyieh is based on regular pay. This year, his homes is 583,000 . Fot withholdione purposcs, the bonus is coesidered a swpplermental payment and is adided ro his gross pay, and the aggregase amoqm is taxed. Fot thio PaY, C'Meil. das increased bis SIMPIE dedncrion ro 34,000. To determine the federal income sax, use she Table of Alloovance Valaes alone. wirh Tax Table a ipages Tr.2 to T-4). In calculating the tax, do noc rownd the aggregafe to ceiling. To calculate O Neill's OMSDI cax, multiply she [OSDL cciling of 5132,900 by 6.2 percerit and shen subiract the year-to-dase CASDI taxes withheld up to ehis pay. IULe O'Neill's Employec Facmings Rrecurd. to view his year-to date OA 5DI tax withheld ). Woek.h rate $600.00 Alewily rated 5,15,00 Prepare the payroll for the laster pay of Decetmbee from Time Gierk's Reprart Nos, 48 and 49 and record the paychecks iasued 60 ail envioyeter Mlar, recond the etweloyer's parrull taves. Flfective with rhis pay, CY'Neil complesed a new Foem W-4, champinge his eocal wirhholding allowances 50 four. Previously, he lad chainwed fewer In this pay, the president of the company? Josepob Cl/Neili, is raid his annual bonus. This does noe affect CYMeill's insurance coveragery velyieh is based on regular pay. This year, his homes is 583,000 . Fot withholdione purposcs, the bonus is coesidered a swpplermental payment and is adided ro his gross pay, and the aggregase amoqm is taxed. Fot thio PaY, C'Meil. das increased bis SIMPIE dedncrion ro 34,000. To determine the federal income sax, use she Table of Alloovance Valaes alone. wirh Tax Table a ipages Tr.2 to T-4). In calculating the tax, do noc rownd the aggregafe to ceiling. To calculate O Neill's OMSDI cax, multiply she [OSDL cciling of 5132,900 by 6.2 percerit and shen subiract the year-to-dase CASDI taxes withheld up to ehis pay. IULe O'Neill's Employec Facmings Rrecurd. to view his year-to date OA 5DI tax withheld )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts