Question: I am doing this question but don't understand what I did wrong, please help! Machinery purchased for $67,200 by Coronado Co. in 2021 was originally

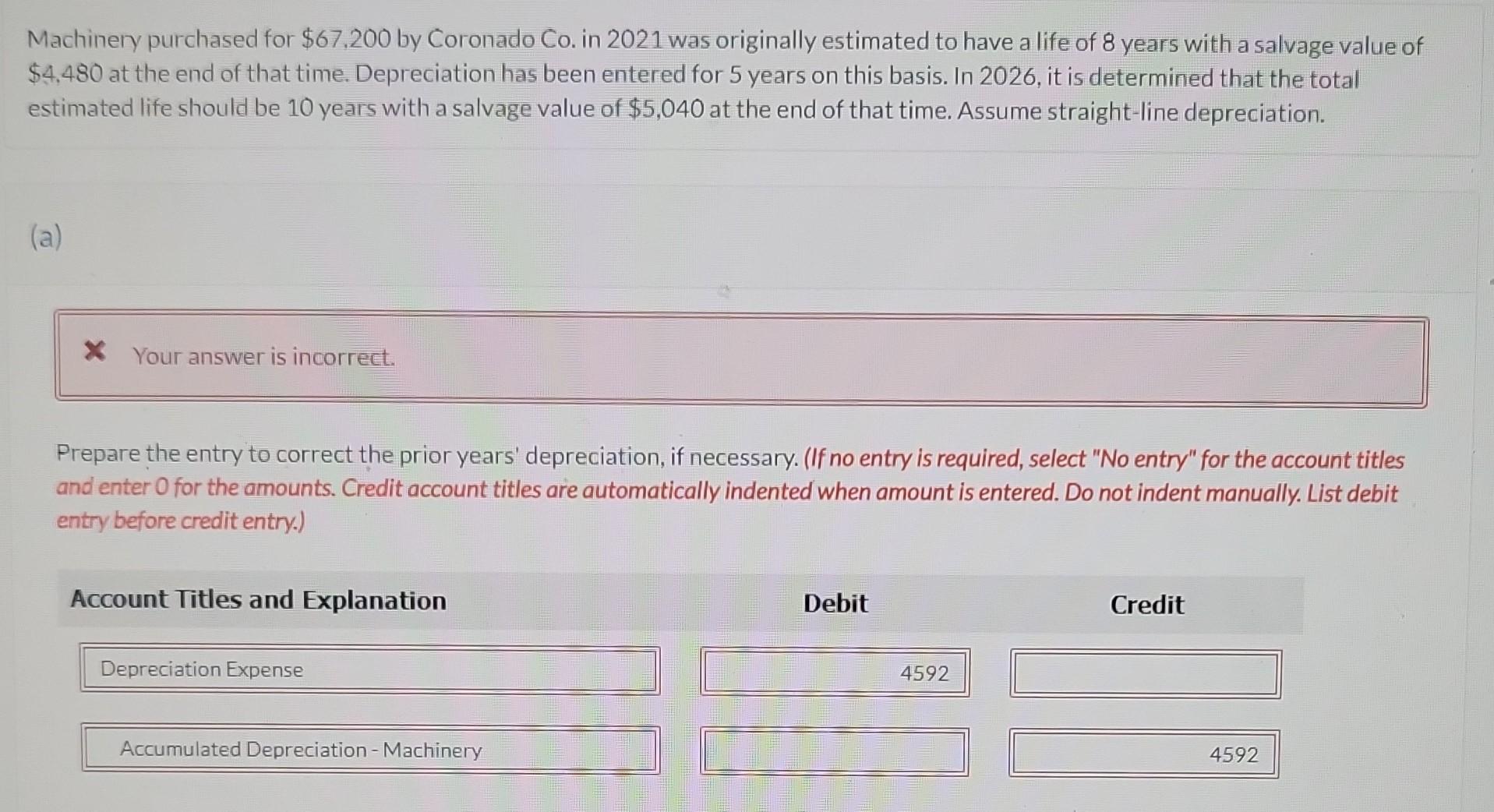

I am doing this question but don't understand what I did wrong, please help!

Machinery purchased for $67,200 by Coronado Co. in 2021 was originally estimated to have a life of 8 years with a salvage value of $4,480 at the end of that time. Depreciation has been entered for 5 years on this basis. In 2026 , it is determined that the total estimated life should be 10 years with a salvage value of $5,040 at the end of that time. Assume straight-line depreciation. (a) Prepare the entry to correct the prior years' depreciation, if necessary. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts