Question: I am having a hard time balancing the spreadsheet based off of the T chary H M D E G Create a journal entry and

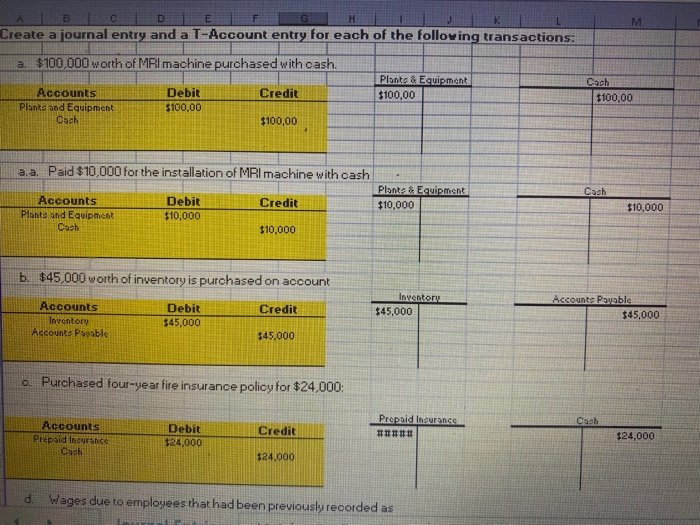

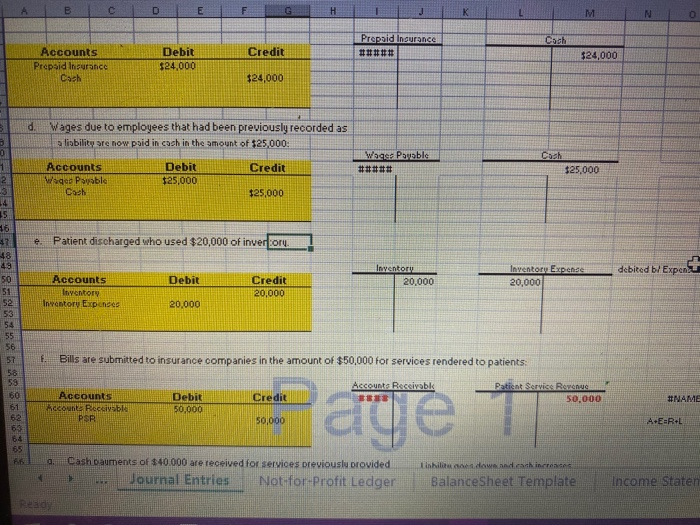

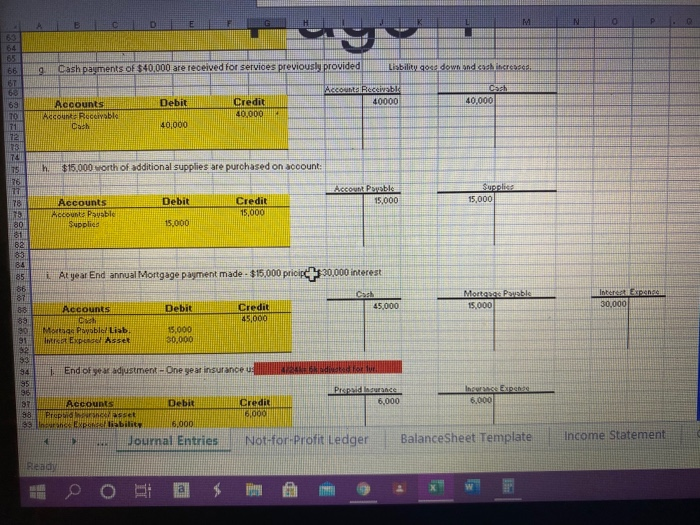

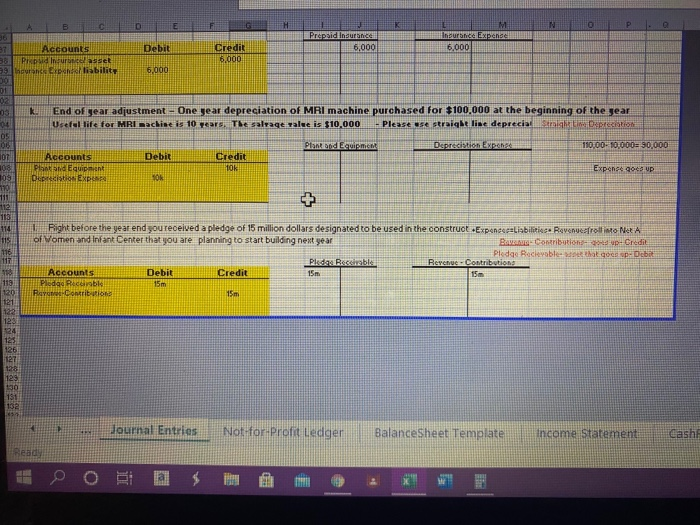

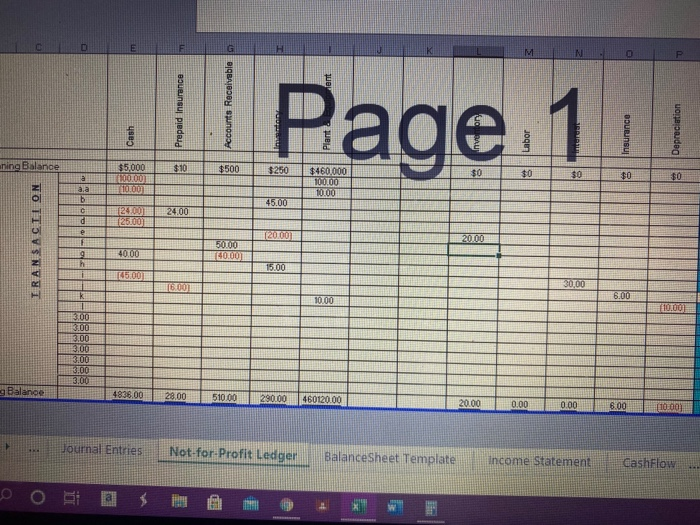

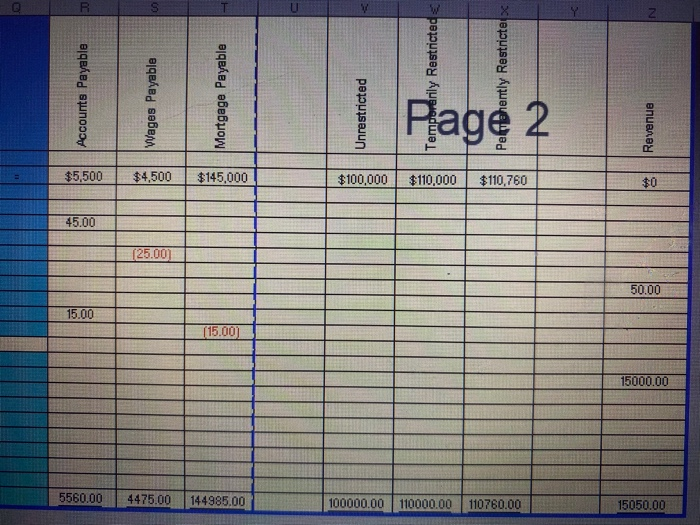

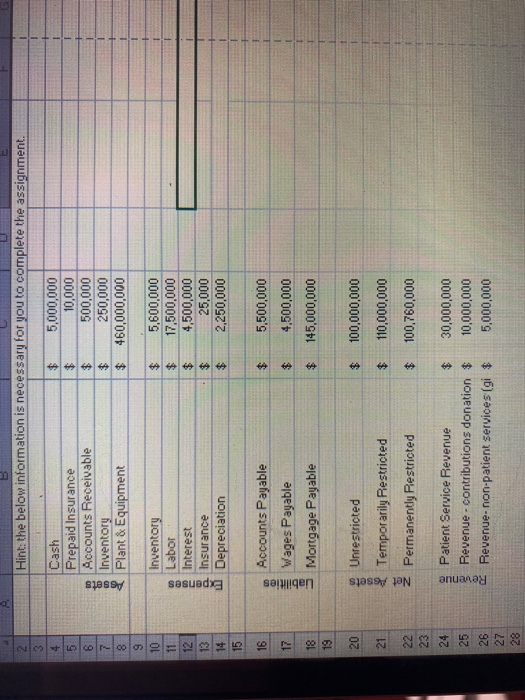

H M D E G Create a journal entry and a T-Account entry for each of the following transactions: a $100,000 worth of MRI machine purchased with cash. Plants & Equipment Accounts Debit Credit $100,00 Plants and Equipment $100,00 Cash $100,00 Cash $100,00 a.a. Paid $10,000 for the installation of MRI machine with cash Cash Credit Plants & Equipment $10,000 Accounts Planta and Equipment Cash Debit $10,000 $10,000 $10,000 b. $45,000 worth of inventory is purchased on account Credit Inventory $45,000 Accounts Inventory Accounts Payable Debit $45,000 Accounts Payable $45,000 $45,000 o. Purchased four-year fire insurance policy for $24,000: Cash Accounts Prepaid Insurance Cash Debit $24,000 Credit Prepaid insurance ##### $24,000 $24,000 d. Wages due to employees that had been previously recorded as B D G H J K M N Prepaid Insurance ##### Coch Credit Accounts Prepaid Insurance Cach Debit $24,000 $24,000 $24,000 o. Wages due to employees that had been previously recorded as aliability are now paid in cash in the amount of $25,000 0 1 2 Credit Wages Payable ##### Debit $25,000 Cash $25,000 Accounts Wages Payable Cash $25,000 e Patient discharged who used $20,000 of inversory. debited by Expen Debit Inventory 20,000 Credit 20,000 Inventory Expense 20,000 Accounts Inventory Inventory Expenses 20,000 14 15 16 47 48 49 50 51 52 53 54 55 56 57 58 58 60 61 62 63 64 65 t. Bills are submitted to insurance companies in the amount of $50,000 for services rendered to patients: Accounts Receivabk Patient Service Revenue 50.000 Credit Debit 50,000 Accounts hecounts Receivable PSR #NAME 50,000 age 1 7 AE=R+L 4. Cash o auments of $40.000 are received for services previously provided Journal Entries Not-for-profit Ledger niedawnd each increases BalanceSheet Template Income Staten Read M N o + 64 65 66 g Cash payments of $40.000 are received for services previously provided Lisbility gou down and cash increased ST 65 Account Receivable Cach 69 Accounts Debit Credit 40000 40,000 TO Account Receivable 40.000 T Dah 40,000 12 TS 74 75 h $15.000, orth of additional supplies are purchased on account: 176 17 Account Payable Supplier 178 Accounts Debit Credit 15,000 15,000 Accounts Payable 15.000 80 Supplies 15.000 81 82 83 84 85 i At year End annual Mortgage payment made $15,000 pricic +30,000 interest 86 87 Mortabes Pouble 88 Accounts Debit Credit 45,000 15,000 88 45,000 180 Morts Payablel Liab. 15,000 91 IS Expense asset 30,000 32 93 94 End of year adjustment - One year insurance : 12 M Fortur 95 95 Pispaid lacurance Incore Expen Accounts Debit Credit 6,000 6.000 98 Prepasset 6,000 99 Insurans EXPANAbility 16.000 Journal Entries Not-for-Profit Ledger BalanceSheet Template Interest, Expanel 30.000 S Income Statement Read O a C H N Prepaid Insurance 6,000 M Insurance Expand 6.000 Debit Accounts 38 Pret 39 Inga liability 30 Credit 6,000 6,000 03 04 OS 016 End of year adjustment - One year depreciation of MRI machine purchased for $100.000 at the beginning of the year Useful life for MRI machine is 10 years. The salrage ralue is $10,000 - Please use straight line depreciat straight Depreciation Plan dumat Depreciation Expo 110.00-10000= 90,000 10 Debit Accounts Pland Equipment Depreciation EXPR Credit 10k Expens op NOK 108 109 2011 111 112 113 114 115 116 1171 HUSET 115 120 121 122 123 124 123 126 127 128 123 130 151 Right before the year end you received a pledge of 15 million dollars designated to be used in the construct Expencereliabilities: Revenue moltino NetA of Women and Infant Center that you are planning to start building next year BAU-Contribution-up-Credit Pledas Recievable that goes op-Debit Plecas Receivable Revenue - Contributions Accounts Debit Credit 15m 15m Pledge Ricable Racorito 15m 15m 137 1 Journal Entries Not-for-profit Ledger Balance Sheet Template Income Statement Cashi Beady D E F G H U M N P Prepaid Insurance Accounts Receivable Cash Page 1 Depreciation ning Balance $10 $500 $250 $5,000 (100.00) 10.00 $0 $460,000 100100 10.00 lell 2 a.a B C d e 45.00 124.00 125.00 24.00 (2000) IRANSACLI ON 20.00 40.00 5000 120.00) h 15.00 300 1600) 30.00 10.00 6.00 10.00 K 1 300 3.00 3.00 13.00 3.00 3.00 3.00 Balance 4838.00 28.00 510.00 290,00 460120.00 20.00 0.00 0.00 6.00 10.00) Journal Entries Not-for-Profit Ledger Balance Sheet Template Income Statement Cashflow SIL R N Accounts Payable Wages Payable Mortgage Payable Temporarily Restricted hently Restricte Unrestricted Page 2 Revenue D $5,500 $4,500 $145,000 $100,000 $110,000 $110,760 9 45.00 (25.001 50.00 15.00 (15.00) 15000.00 5560.00 4475.00 144985.00 100000.00 110000.00 110760.00 15050.00 Hint: the below information is necessary for you to complete the assignment 3 Cash Prepaid Insurance Accounts Receivable Inventory & Plant & Equipment $ 5,000,000 $ 10,000 500,000 $ 250,000 $ 460,000,000 5 6 7 8 9 10 11 12 13 14 15 $ $ Expenses Inventory Labor Interest Insurance Depreciation 5,600,000 17,500,000 4,500,000 25,000 2,250,000 $ 16 $ 17 Liabilities Accounts Payable Wages Payable Mortgage Payable 5,500,000 4,500,000 145,000,000 18 19 $ 20 Unrestricted $ 100,000,000 21 Net Assets $ 110,000,000 Temporarily Restricted Permanently Restricted 100,760,000 22 23 24 25 Revenue Patient Service Revenue Revenue - contributions donation $ Revenue-non-patient services (gi $ 30,000,000 10,000,000 5,000,000 26 27 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts