Question: I am having a problem with calculating the following problem. it's done in excel and I'm really bad in excel. please find a copy of

I am having a problem with calculating the following problem. it's done in excel and I'm really bad in excel. please find a copy of an example.If you can explain,it would be helpful thanks!

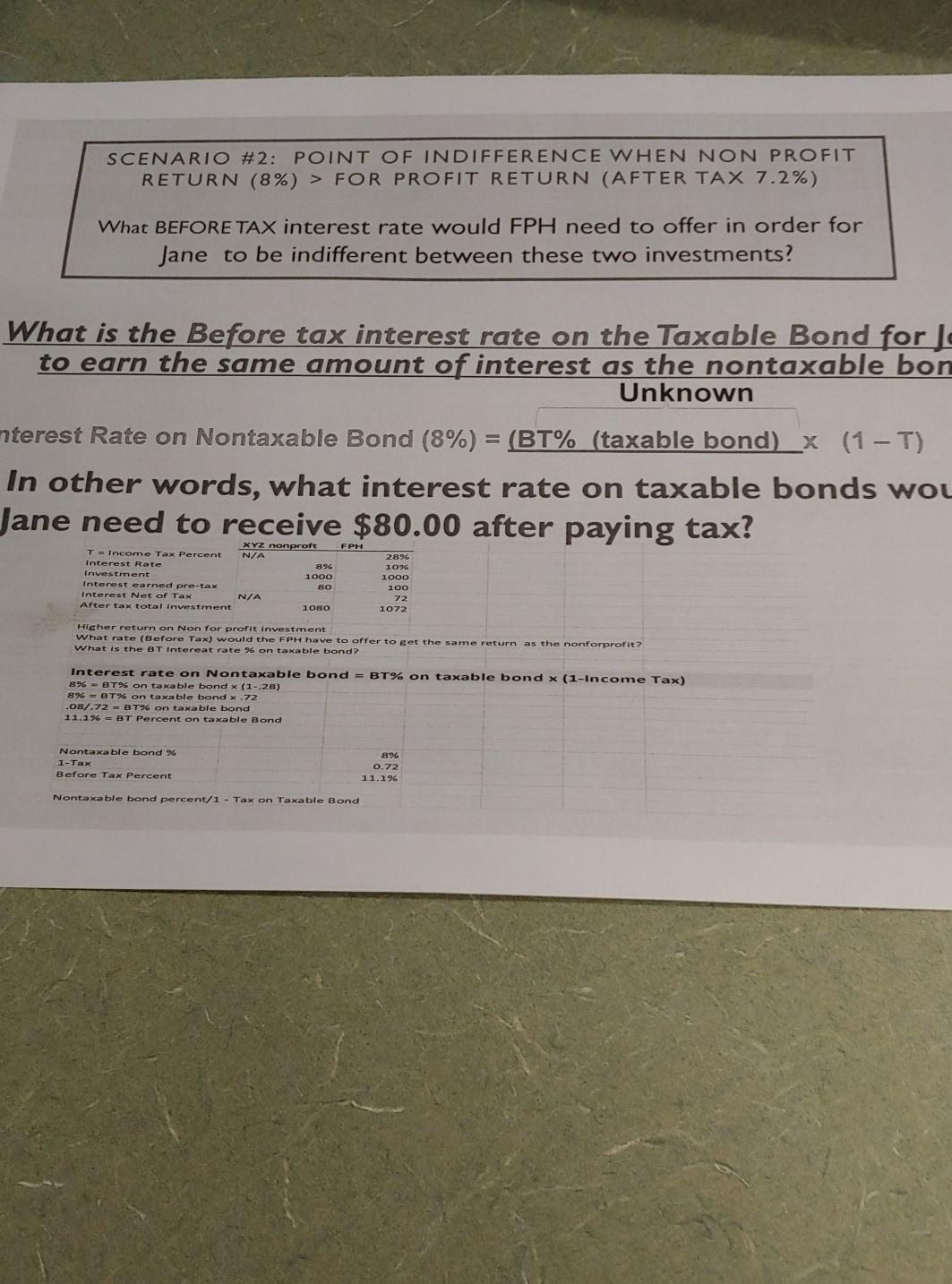

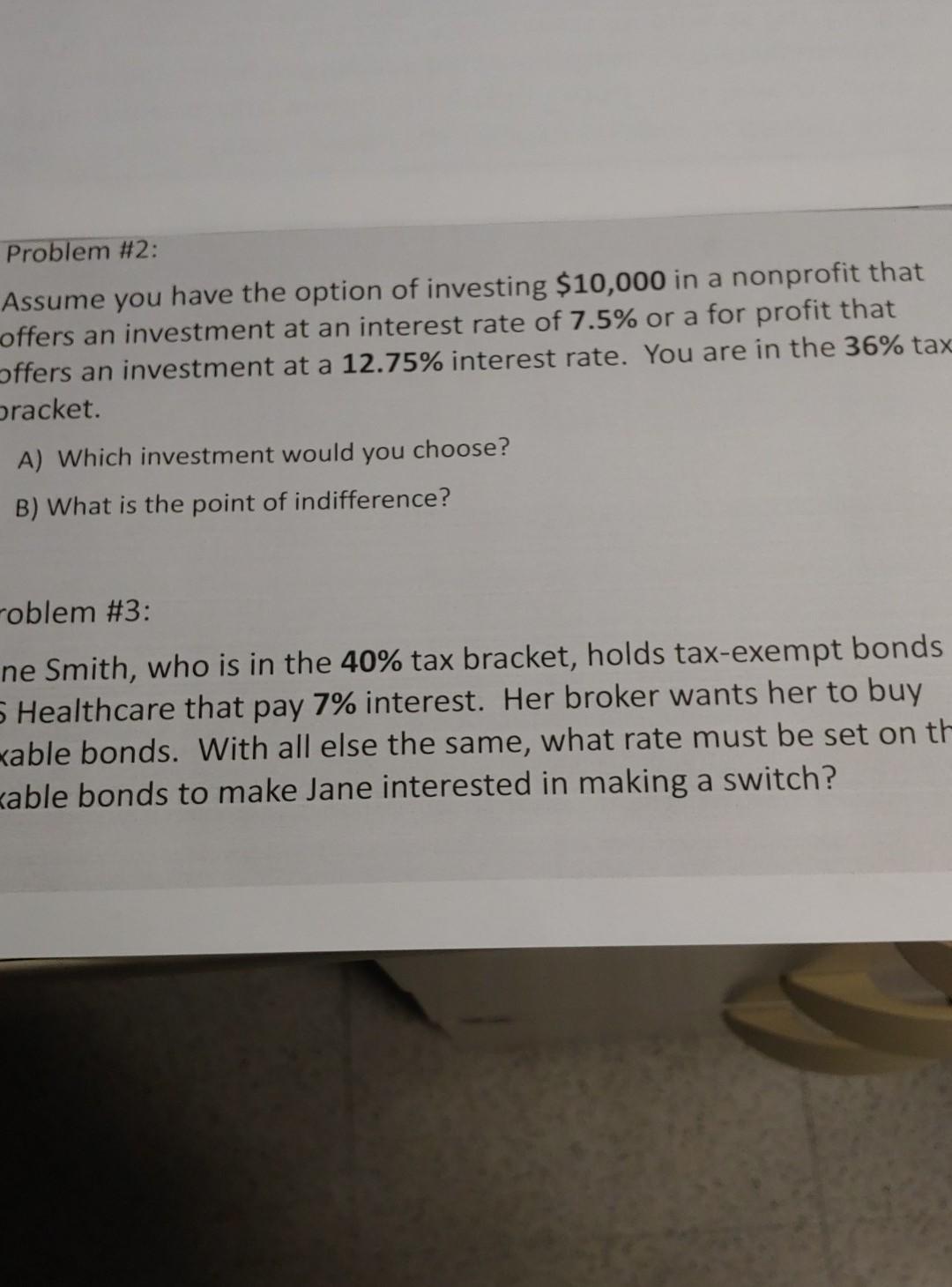

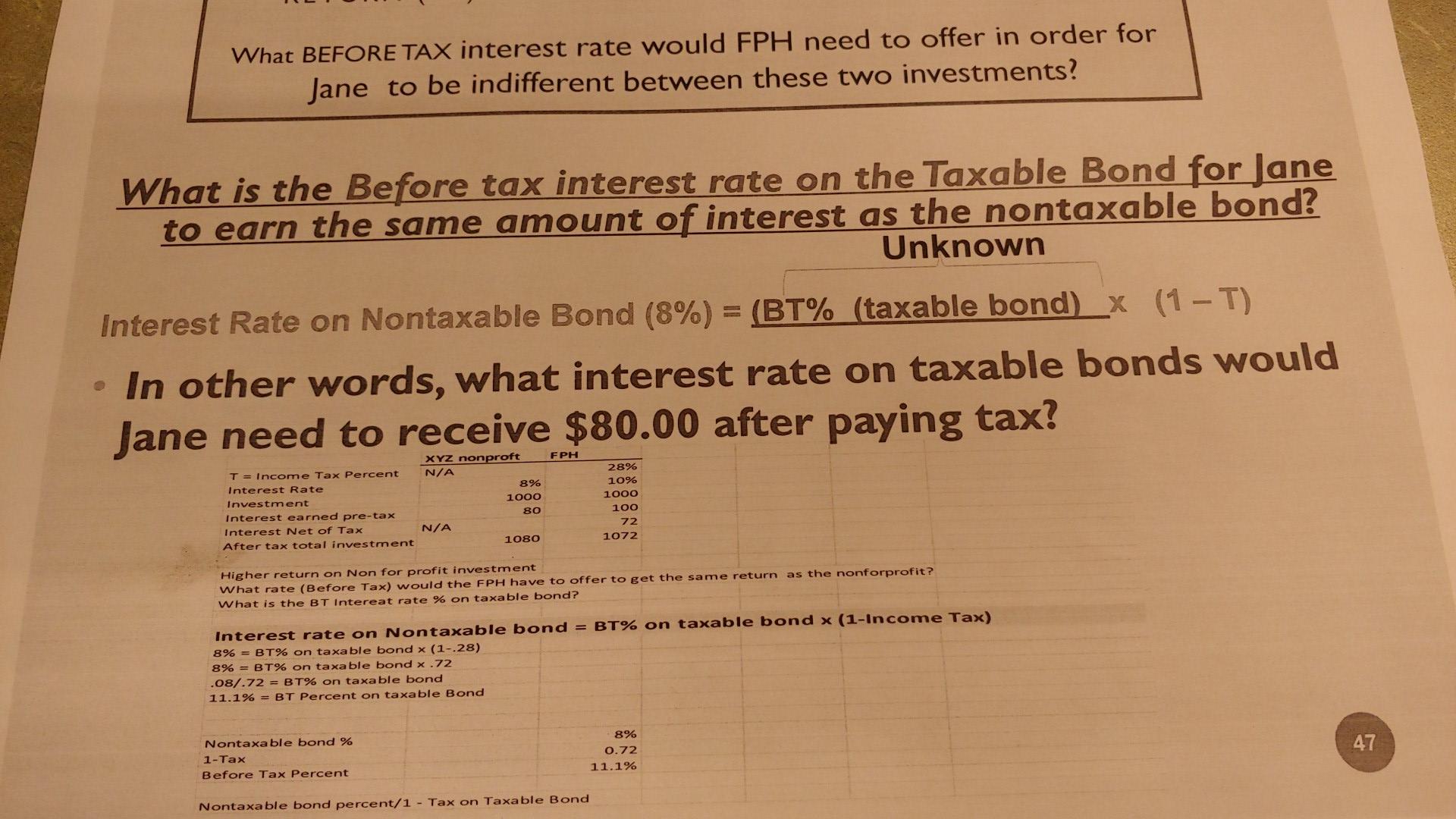

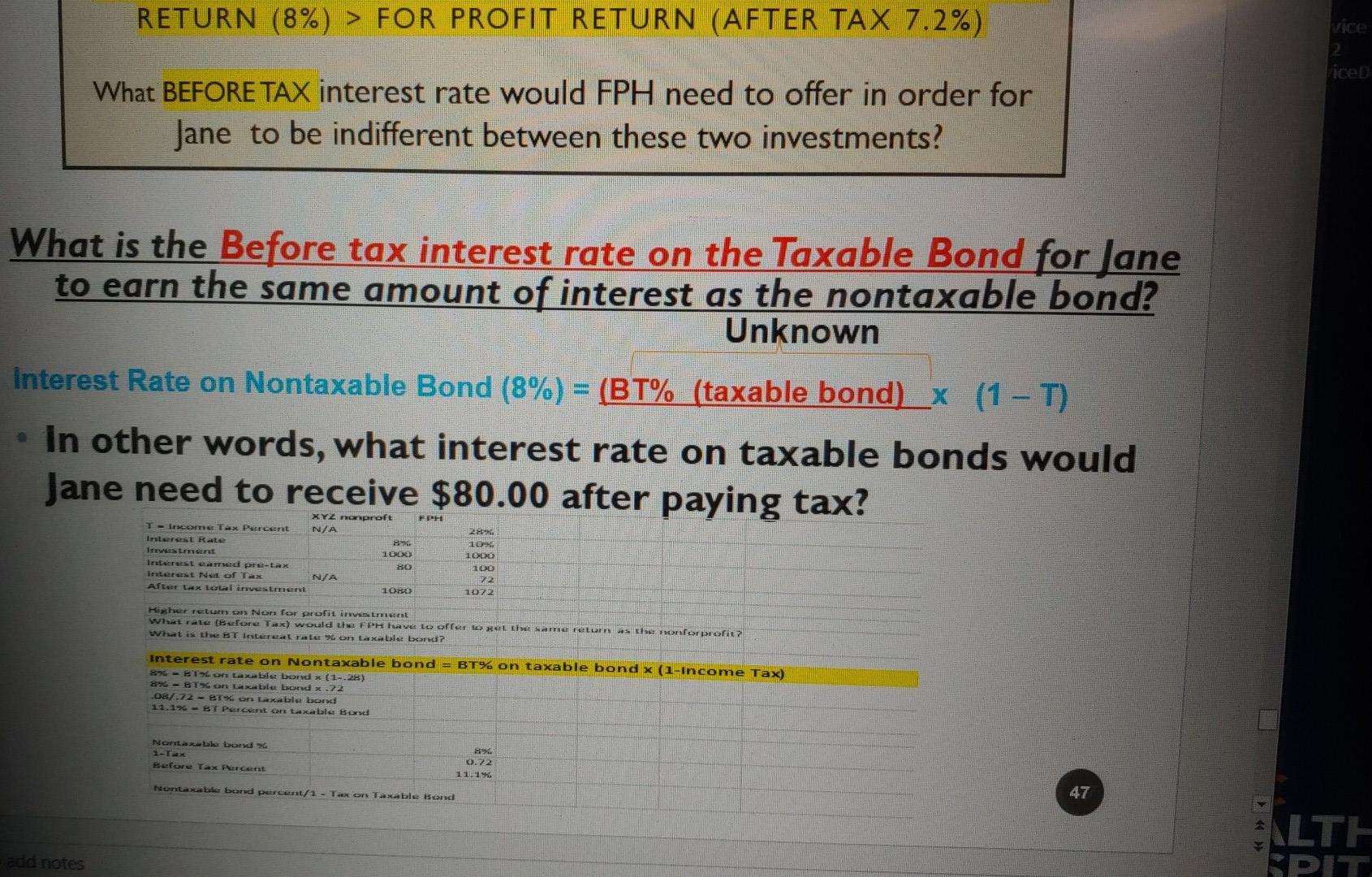

SCENARIO #2: POINT OF INDIFFERENCE WHEN NON PROFIT RETURN (8%) > FOR PROFIT RETURN (AFTER TAX 7.2%) What BEFORE TAX interest rate would FPH need to offer in order for Jane to be indifferent between these two investments? What is the Before tax interest rate on the Taxable Bond for to earn the same amount of interest as the nontaxable bon Unknown nterest Rate on Nontaxable Bond (8%) = (BT% (taxable bond) x (1 -T) In other words, what interest rate on taxable bonds woL Jane need to receive $80.00 after paying tax? FPH T=Income Tax Percent Interest Rate investment Interest earned pre-tax interest Net of Tax After tax total investment XYZ nonproft N/A 896 1000 80 N/A 1080 2896 10% 1000 100 72 1072 Higher return on Non for profit investment What rate (Before Tax) would the FPH have to offer to get the same return as the nonforprofit? What is the BT Intereat rate 96 on taxable bond? Interest rate on Nontaxable bond = BT% on taxable bond X (1-Income Tax) 896 - BT96 on taxable bond X (1-28) 896 = BT96 on taxable bond x 72 .08/.72 - BT96 on taxable bond 11.196 = BT Percent on taxable Bond Nontaxable bond 36 1-Tax Before Tax Percent 896 0.72 11.1% Nontaxable bond percent/1 - Tax on Taxable Bond Problem #2: Assume you have the option of investing $10,000 in a nonprofit that offers an investment at an interest rate of 7.5% or a for profit that offers an investment at a 12.75% interest rate. You are in the 36% tax racket. A) Which investment would you choose? B) What is the point of indifference? oblem #3: ne Smith, who is in the 40% tax bracket, holds tax-exempt bonds 5 Healthcare that pay 7% interest. Her broker wants her to buy kable bonds. With all else the same, what rate must be set on th kable bonds to make Jane interested in making a switch? What BEFORE TAX interest rate would FPH need to offer in order for Jane to be indifferent between these two investments? What is the Before tax interest rate on the Taxable Bond for Jane to earn the same amount of interest as the nontaxable bond? Unknown Interest Rate on Nontaxable Bond (8%) = (BT% (taxable bond) x (1 - T) In other words, what interest rate on taxable bonds would Jane need to receive $80.00 after paying tax? FPH XYZ nonproft T = Income Tax Percent N/A Interest Rate 8% Investment 1000 Interest earned pre-tax 80 Interest Net of Tax N/A After tax total investment 1080 28% 10% 1000 100 72 1072 as the nonforprofit? Higher return on Non for profit investment What rate (Before Tax) would the FPH have to offer to get the same return What is the BT Intereat rate % on taxable bond? Interest rate on Nontaxable bond = BT% on taxable bond x (1-Income Tax) 8% = BT% on taxable bond x (1-.28) 8% = BT% on taxable bond x .72 .08/.72 = BT% on taxable bond 11.1% = BT Percent on taxable Bond 8% 0.72 11.1% Nontaxable bond % 1-Tax Before Tax Percent 47 Nontaxable bond percent/1 - Tax on Taxable Bond RETURN (8%) > FOR PROFIT RETURN (AFTER TAX 7.2%) vice What BEFORE TAX interest rate would FPH need to offer in order for Jane to be indifferent between these two investments? What is the Before tax interest rate on the Taxable Bond for Jane to earn the same amount of interest as the nontaxable bond? Unknown Interest Rate on Nontaxable Bond (8%) = (BT% (taxable bond) x (1 T) In other words, what interest rate on taxable bonds would Jane need to receive $80.00 after paying tax? XYZ nonproft PEH T-score T. Percent N/A Interest Rate x Ir Linsert 16 Interest id pre-tax 80 Intett Nof Tax NA After a local investment 1OBO 2. 10 1000 100 72 1070 Hixhrretum cor Nors for profit investment Whatrate (Bufora Tax) would the FPH have to offer to the same return the monferprofit? What is the BE Testercatat 9 on Laktla bord? Interest rate on Nontaxable bond = BT% on taxable bondx (1-Income Tax) - Bon Laxable borx (1.28) 8%-BTX on Lutxable bond x .72 08/:72 - BIX on Laxable to 11.1%-BTPort on taxabla Bexd Noxhe Lord 1-Tex Before Tax Pharcerat 0.72 11.1% Notable bond percent/1 - Taxon Taxable Bond 47 ELTE add notes SPIT. SCENARIO #2: POINT OF INDIFFERENCE WHEN NON PROFIT RETURN (8%) > FOR PROFIT RETURN (AFTER TAX 7.2%) What BEFORE TAX interest rate would FPH need to offer in order for Jane to be indifferent between these two investments? What is the Before tax interest rate on the Taxable Bond for to earn the same amount of interest as the nontaxable bon Unknown nterest Rate on Nontaxable Bond (8%) = (BT% (taxable bond) x (1 -T) In other words, what interest rate on taxable bonds woL Jane need to receive $80.00 after paying tax? FPH T=Income Tax Percent Interest Rate investment Interest earned pre-tax interest Net of Tax After tax total investment XYZ nonproft N/A 896 1000 80 N/A 1080 2896 10% 1000 100 72 1072 Higher return on Non for profit investment What rate (Before Tax) would the FPH have to offer to get the same return as the nonforprofit? What is the BT Intereat rate 96 on taxable bond? Interest rate on Nontaxable bond = BT% on taxable bond X (1-Income Tax) 896 - BT96 on taxable bond X (1-28) 896 = BT96 on taxable bond x 72 .08/.72 - BT96 on taxable bond 11.196 = BT Percent on taxable Bond Nontaxable bond 36 1-Tax Before Tax Percent 896 0.72 11.1% Nontaxable bond percent/1 - Tax on Taxable Bond Problem #2: Assume you have the option of investing $10,000 in a nonprofit that offers an investment at an interest rate of 7.5% or a for profit that offers an investment at a 12.75% interest rate. You are in the 36% tax racket. A) Which investment would you choose? B) What is the point of indifference? oblem #3: ne Smith, who is in the 40% tax bracket, holds tax-exempt bonds 5 Healthcare that pay 7% interest. Her broker wants her to buy kable bonds. With all else the same, what rate must be set on th kable bonds to make Jane interested in making a switch? What BEFORE TAX interest rate would FPH need to offer in order for Jane to be indifferent between these two investments? What is the Before tax interest rate on the Taxable Bond for Jane to earn the same amount of interest as the nontaxable bond? Unknown Interest Rate on Nontaxable Bond (8%) = (BT% (taxable bond) x (1 - T) In other words, what interest rate on taxable bonds would Jane need to receive $80.00 after paying tax? FPH XYZ nonproft T = Income Tax Percent N/A Interest Rate 8% Investment 1000 Interest earned pre-tax 80 Interest Net of Tax N/A After tax total investment 1080 28% 10% 1000 100 72 1072 as the nonforprofit? Higher return on Non for profit investment What rate (Before Tax) would the FPH have to offer to get the same return What is the BT Intereat rate % on taxable bond? Interest rate on Nontaxable bond = BT% on taxable bond x (1-Income Tax) 8% = BT% on taxable bond x (1-.28) 8% = BT% on taxable bond x .72 .08/.72 = BT% on taxable bond 11.1% = BT Percent on taxable Bond 8% 0.72 11.1% Nontaxable bond % 1-Tax Before Tax Percent 47 Nontaxable bond percent/1 - Tax on Taxable Bond RETURN (8%) > FOR PROFIT RETURN (AFTER TAX 7.2%) vice What BEFORE TAX interest rate would FPH need to offer in order for Jane to be indifferent between these two investments? What is the Before tax interest rate on the Taxable Bond for Jane to earn the same amount of interest as the nontaxable bond? Unknown Interest Rate on Nontaxable Bond (8%) = (BT% (taxable bond) x (1 T) In other words, what interest rate on taxable bonds would Jane need to receive $80.00 after paying tax? XYZ nonproft PEH T-score T. Percent N/A Interest Rate x Ir Linsert 16 Interest id pre-tax 80 Intett Nof Tax NA After a local investment 1OBO 2. 10 1000 100 72 1070 Hixhrretum cor Nors for profit investment Whatrate (Bufora Tax) would the FPH have to offer to the same return the monferprofit? What is the BE Testercatat 9 on Laktla bord? Interest rate on Nontaxable bond = BT% on taxable bondx (1-Income Tax) - Bon Laxable borx (1.28) 8%-BTX on Lutxable bond x .72 08/:72 - BIX on Laxable to 11.1%-BTPort on taxabla Bexd Noxhe Lord 1-Tex Before Tax Pharcerat 0.72 11.1% Notable bond percent/1 - Taxon Taxable Bond 47 ELTE add notes SPIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts