Question: I am having difficulty with this practice problem. Could you please help show your work to walk me through how to solve parts A, B,

I am having difficulty with this practice problem. Could you please help show your work to walk me through how to solve parts A, B, and C? Thank you in advance!

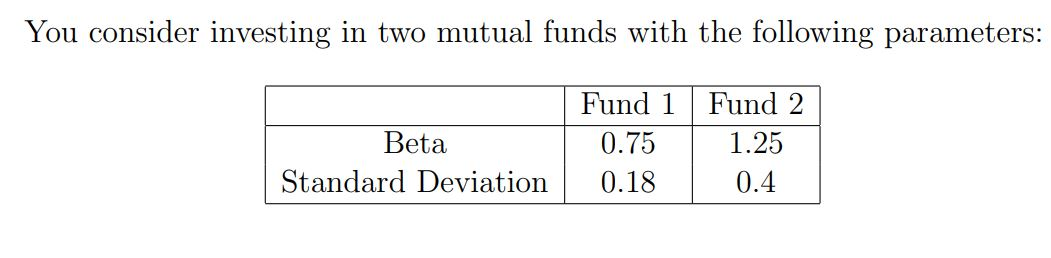

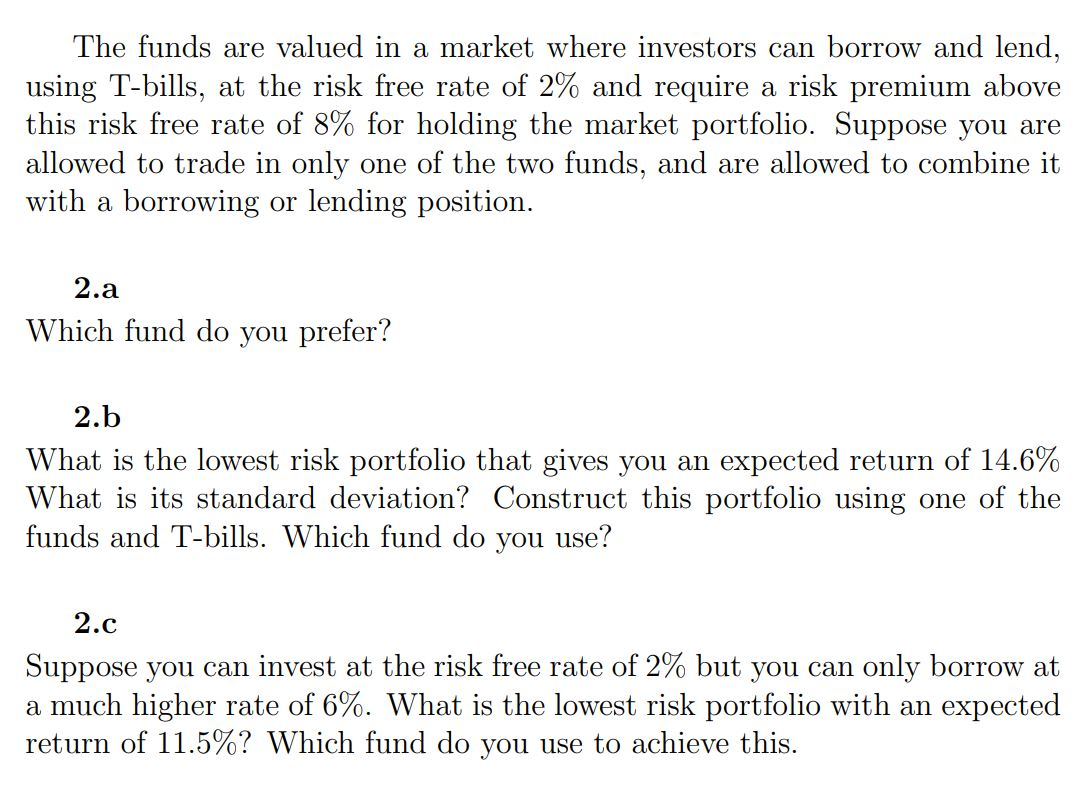

You consider investing in two mutual funds with the following parameters: Beta Standard Deviation Fund 1 0.75 0.18 Fund 2 1.25 0.4 The funds are valued in a market where investors can borrow and lend, using T-bills, at the risk free rate of 2% and require a risk premium above this risk free rate of 8% for holding the market portfolio. Suppose you are allowed to trade in only one of the two funds, and are allowed to combine it with a borrowing or lending position. 2.a Which fund do you prefer? 2.b What is the lowest risk portfolio that gives you an ex ed return of 14.6% What is its standard deviation? Construct this portfolio using one of the funds and T-bills. Which fund do you use? 2.c Suppose you can invest at the risk free rate of 2% but you can only borrow at a much higher rate of 6%. What is the lowest risk portfolio with an expected return of 11.5%? Which fund do you use to achieve this. You consider investing in two mutual funds with the following parameters: Beta Standard Deviation Fund 1 0.75 0.18 Fund 2 1.25 0.4 The funds are valued in a market where investors can borrow and lend, using T-bills, at the risk free rate of 2% and require a risk premium above this risk free rate of 8% for holding the market portfolio. Suppose you are allowed to trade in only one of the two funds, and are allowed to combine it with a borrowing or lending position. 2.a Which fund do you prefer? 2.b What is the lowest risk portfolio that gives you an ex ed return of 14.6% What is its standard deviation? Construct this portfolio using one of the funds and T-bills. Which fund do you use? 2.c Suppose you can invest at the risk free rate of 2% but you can only borrow at a much higher rate of 6%. What is the lowest risk portfolio with an expected return of 11.5%? Which fund do you use to achieve this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts