Question: I am having issues solving these question, thank you for your time and patience Intro An open-end mutual fund owns the following stocks: 18,000 shares

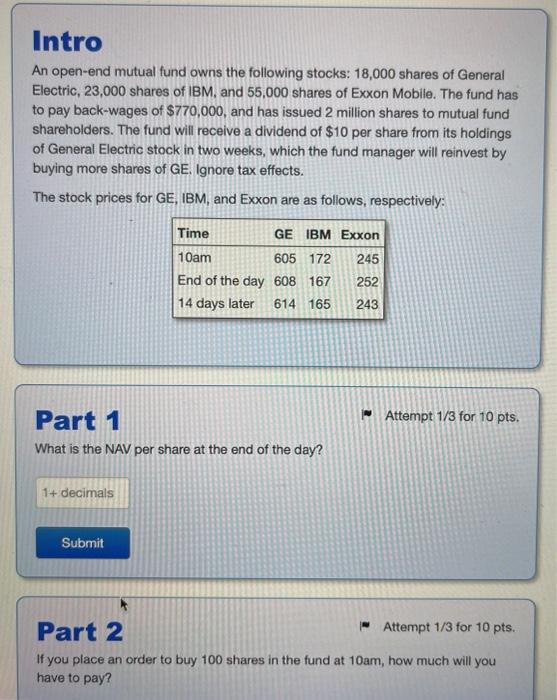

Intro An open-end mutual fund owns the following stocks: 18,000 shares of General Electric, 23,000 shares of IBM, and 55,000 shares of Exxon Mobile. The fund has to pay back-wages of $770,000, and has issued 2 million shares to mutual fund shareholders. The fund will receive a dividend of $10 per share from its holdings of General Electric stock in two weeks, which the fund manager will reinvest by buying more shares of GE. Ignore tax effects. The stock prices for GE, IBM, and Exxon are as follows, respectively: Time GE IBM Exxon 245 10am 605 172 End of the day 608 167 14 days later 614 165 252 243 Attempt 1/3 for 10 pts. Part 1 What is the NAV per share at the end of the day? 1+ decimals Submit Part 2 - Attempt 1/3 for 10 pts. If you place an order to buy 100 shares in the fund at 10am, how much will you have to pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts