Question: I am having trouble calculating part b( after the repurchase). Any help would be greatly appreciated! Hewlard Pocket's market value balance sheet is given. Assets

I am having trouble calculating part b( after the repurchase). Any help would be greatly appreciated!

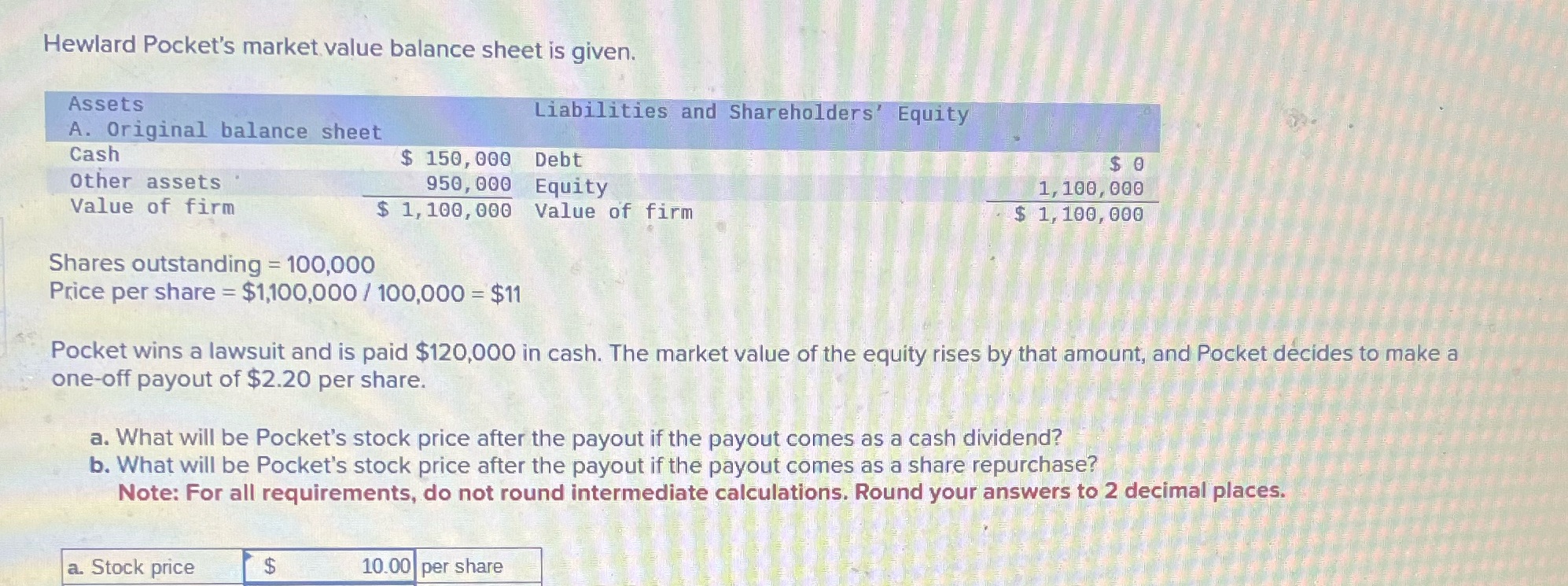

Hewlard Pocket's market value balance sheet is given. Assets Liabilities and Shareholders' Equity A. Original balance sheet Cash $ 150, 000 Debt $0 Other assets 950, 000 Equity 1, 100, 090 Value of firm $ 1, 100, 000 Value of firm $ 1, 100, 000 Shares outstanding = 100,000 Price per share = $1,100,000 / 100,000 = $11 Pocket wins a lawsuit and is paid $120,000 in cash. The market value of the equity rises by that amount, and Pocket decides to make a one-off payout of $2.20 per share. a. What will be Pocket's stock price after the payout if the payout comes as a cash dividend? b. What will be Pocket's stock price after the payout if the payout comes as a share repurchase? Note: For all requirements, do not round intermediate calculations, Round your answers to 2 decimal places. a. Stock price $ 10.00 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts