Question: I am having trouble calculating the E(Rm) update: Rd= 3.78% and Rf= 1.3% and Beta= 0.88 Purrently has 785000 shares of stock outstanding at a

I am having trouble calculating the E(Rm)

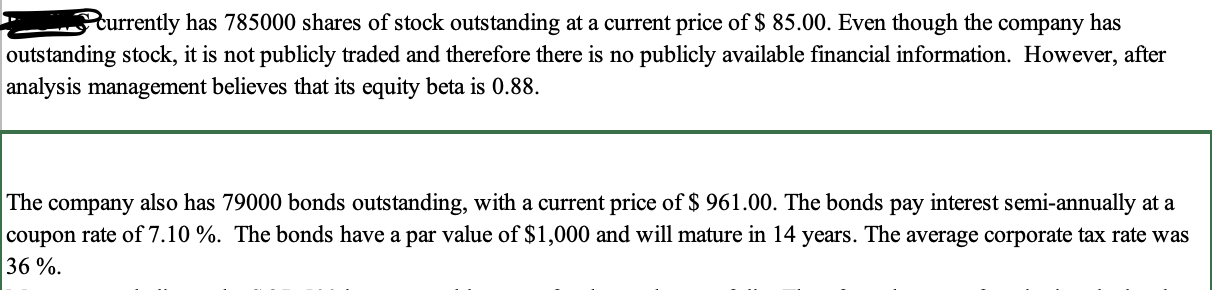

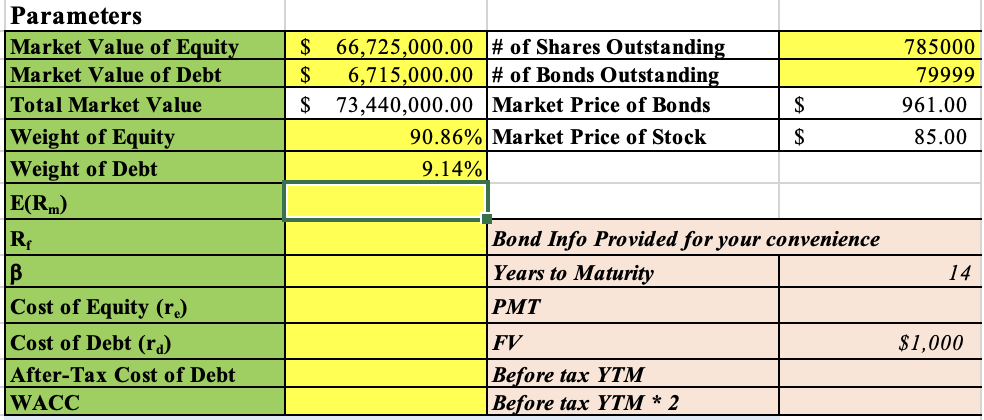

Purrently has 785000 shares of stock outstanding at a current price of \\( \\$ 85.00 \\). Even though the company has outstanding stock, it is not publicly traded and therefore there is no publicly available financial information. However, after analysis management believes that its equity beta is 0.88 . The company also has 79000 bonds outstanding, with a current price of \\( \\$ 961.00 \\). The bonds pay interest semi-annually at a coupon rate of \7.10. The bonds have a par value of \\( \\$ 1,000 \\) and will mature in 14 years. The average corporate tax rate was \36. Parameters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts