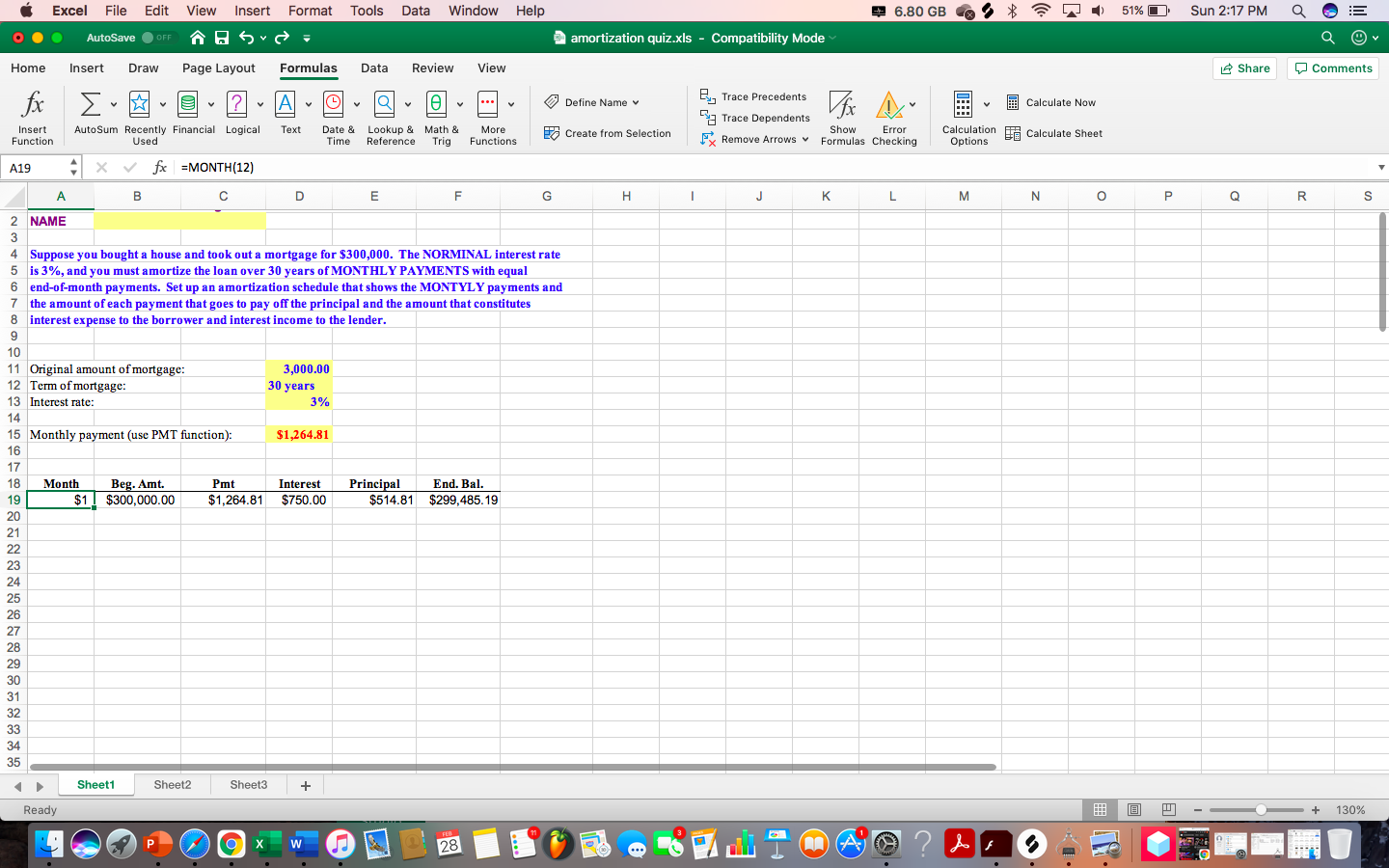

Question: I am having trouble doing the formulas in excel as I am not that experienced. I remember in class the teacher said you need to

I am having trouble doing the formulas in excel as I am not that experienced. I remember in class the teacher said you need to figure out one row and excel figures out the rest for you? But I am lost and need some help

Data Window Help 6.80 GB L) 51% 0 Sun 2:17 PM Q = Excel File Edit View Insert Format Tools AutoSave OFF HS- @amortization quiz.xls - Compatibility Mode Q Home Insert Draw Page Layout Formulas Data Review View Share Q Comments fx V ? AL ol e V Define Name v Ey, Trace Precedents a Trace Dependents FRemove Arrows Dix Calculate Now Text Insert Function AutoSum Recently Financial Logical Used Date & Lookup & Math & Time Reference Trig More Functions Create from Selection Show Error Formulas Checking Calculation calculate Sheet Options A19 4 x fx =MONTH(12) A B D E F G H 1 J L M N o P Q R S 2 NAME 3 4 Suppose you bought a house and took out a mortgage for $300,000. The NORMINAL interest rate 5 is 3%, and you must amortize the loan over 30 years of MONTHLY PAYMENTS with equal 6 end-of-month payments. Set up an amortization schedule that shows the MONTYLY payments and 7 the amount of each payment that goes to pay off the principal and the amount that constitutes 8 interest expense to the borrower and interest income to the lender. 9 10 11 Original amount of mortgage: 3,000.00 12 Term of mortgage: 30 years 13 Interest rate: 3% 14 15 Monthly payment (use PMT function): $1,264.81 16 17 18 Month Beg. Amt. Pmt Interest Principal End. Bal. 19 $1$300,000.00 $1,264.81 $750.00 $514.81 $299,485. 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Sheet1 Sheet2 Sheet3 + Ready + 130% TER W 28 LA ? ds HA Data Window Help 6.80 GB L) 51% 0 Sun 2:17 PM Q = Excel File Edit View Insert Format Tools AutoSave OFF HS- @amortization quiz.xls - Compatibility Mode Q Home Insert Draw Page Layout Formulas Data Review View Share Q Comments fx V ? AL ol e V Define Name v Ey, Trace Precedents a Trace Dependents FRemove Arrows Dix Calculate Now Text Insert Function AutoSum Recently Financial Logical Used Date & Lookup & Math & Time Reference Trig More Functions Create from Selection Show Error Formulas Checking Calculation calculate Sheet Options A19 4 x fx =MONTH(12) A B D E F G H 1 J L M N o P Q R S 2 NAME 3 4 Suppose you bought a house and took out a mortgage for $300,000. The NORMINAL interest rate 5 is 3%, and you must amortize the loan over 30 years of MONTHLY PAYMENTS with equal 6 end-of-month payments. Set up an amortization schedule that shows the MONTYLY payments and 7 the amount of each payment that goes to pay off the principal and the amount that constitutes 8 interest expense to the borrower and interest income to the lender. 9 10 11 Original amount of mortgage: 3,000.00 12 Term of mortgage: 30 years 13 Interest rate: 3% 14 15 Monthly payment (use PMT function): $1,264.81 16 17 18 Month Beg. Amt. Pmt Interest Principal End. Bal. 19 $1$300,000.00 $1,264.81 $750.00 $514.81 $299,485. 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Sheet1 Sheet2 Sheet3 + Ready + 130% TER W 28 LA ? ds HA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts