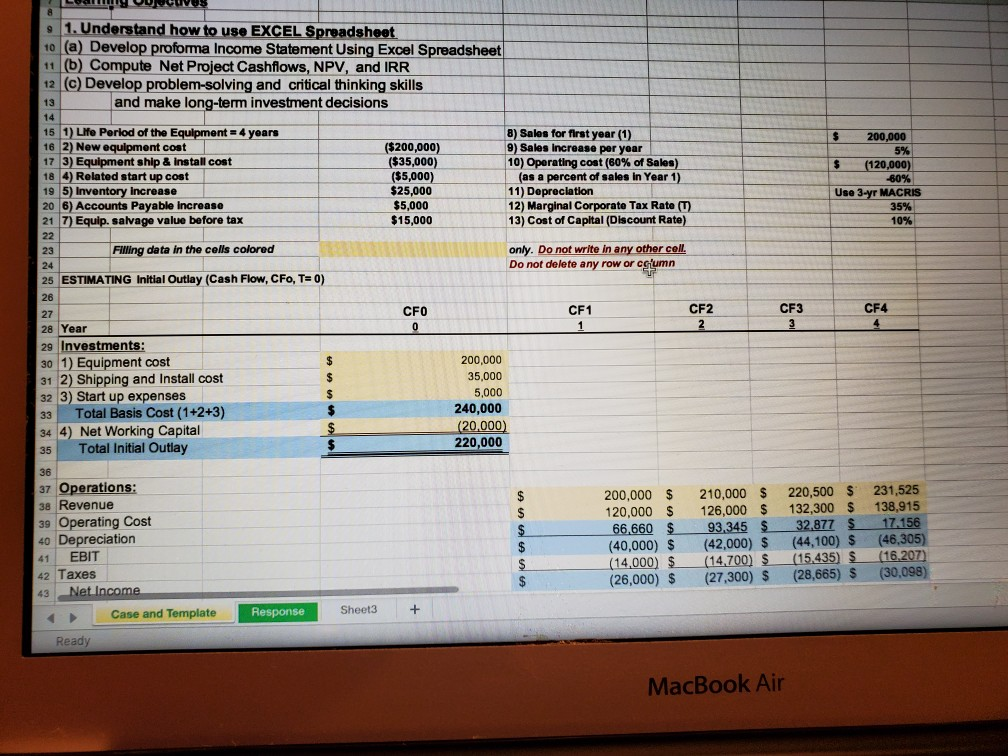

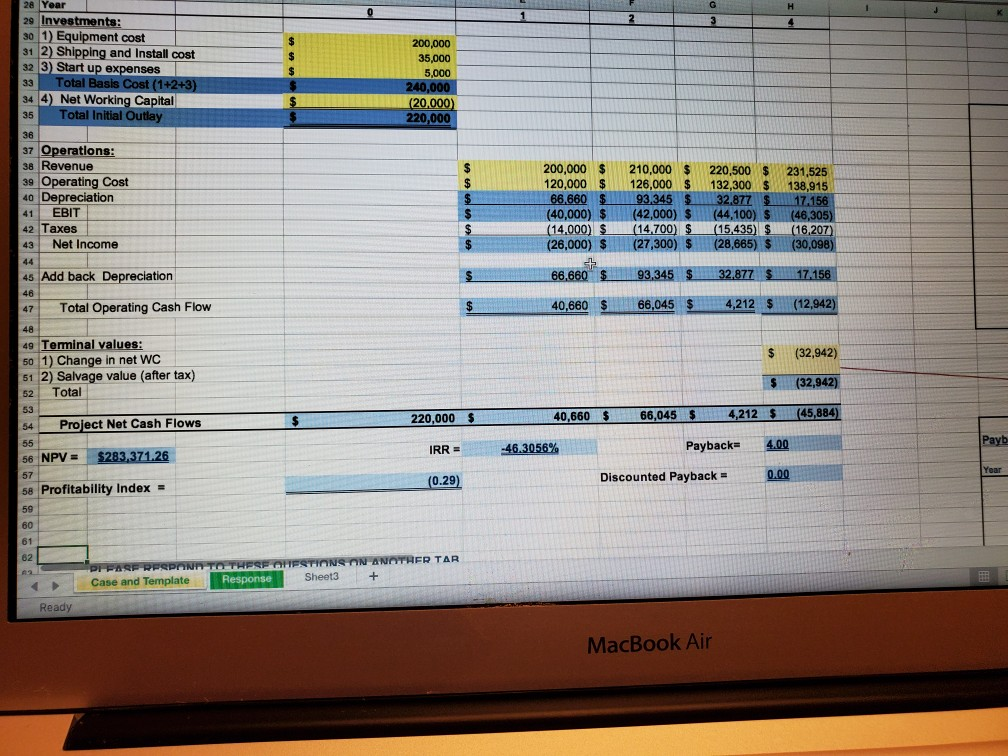

Question: I am having trouble finding the correct depreciation, ebit net income, total operating cash flow change in nwc the depreciation is based on the Macrs

I am having trouble finding the correct depreciation, ebit net income, total operating cash flow change in nwc the depreciation is based on the Macrs

Loomuotuvos . 1. Understand how to use EXCEL Spreadsheet 10 (a) Develop proforma Income Statement Using Excel Spreadsheet 11 (b) Compute Net Project Cashflows, NPV, and IRR 12 (C) Develop problem-solving and critical thinking skills and make long-term investment decisions $ 200,000 15 1) Life Period of the Equipment = 4 years 16 2) New equipment cost 17 3) Equipment ship & Install cost 18 4) Related start up cost 19 5) Inventory Increase 20 6) Accounts Payable increase 21 7) Equip. salvage value before tax ($200,000) ($35,000) ($5,000) $25,000 $5,000 $15,000 8) Sales for first year (1) 9) Sales Increase per year 10) Operating cost (60% of Sales) (as a percent of sales In Year 1) 11) Depreciation 12) Marginal Corporate Tax Rate (U) 13) Cost of Capital (Discount Rate) $ (120,000) -60% Use 3 yr MACRIS 35% 10% Filling data in the cells colored only. Do not write in any other cell. Do not delete any row or calumn 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) NNNNNN CFO 28 Year 29 Investments: 30 1) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 33 Total Basis Cost (1+2+3) 34 4) Net Working Capital 35 Total Initial Outlay kan 200,000 35,000 5,000 240,000 (20,000) 220,000 A 37 Operations: 38 Revenue 39 Operating Cost 40 Depreciation 41 EBIT 42 Taxes 43 Net Income Case and Template 200,000 $ 120,000 $ 66,660 $ (40,000) $ (14,000 $ (26,000) $ 210,000 $ 126,000 $ 93,345 $ (42,000) $ (14.700) S (27,300) $ 220,500 $ 132,300 $ 32.877 $ (44,100) $ (15,435) $ (28,665) S 231,525 138,915 17 156 (46,305) (16.207) (30.098) A A Response Sheet3 + Ready MacBook Air 29 Investments: 301) Equipment cost 31 2) Shipping and Install cost 323) Start up expenses 33 Total Basis Cost (1+2+3) 34 4) Net Working Capital 36 Total Initial Outlay 200,000 35,000 5,000 240,000 (20,000) 220,000 A A 37 Operations: 38 Revenue 39 Operating Cost 40 Depreciation 41 EBIT 42 Taxes 43 Net Income 200,000 $ 120,000 $ 66,660 $ (40,000) $ (14,000) $ (26,000) $ 210,000 $ 126,000 $ 93.345 $ (42,000) $ (14,700) $ (27,300) $ 220,500 $ 132,300 $ 32.877 $ (44,100) $ (15,435) $ (28,665) $ 231,525 138,915 17156 (46,305) (16,207) (30,098) en 45 Add back Depreciation 66,660 $ 93,345 $ 32.877 $ 17.156 40,660 66,045 $ 4,212 $ (12,942) 47 Total Operating Cash Flow 48 49 Terminal values: 501) Change in net WC 512) Salvage value (after tax) 1 Total $ (32,942) S (32,942) 54 Project Net Cash Flows 220,000 $ 40,660 $ 66,045 $ 4,212 $ (45,884) 56 NPV = $283,371.26 IRR = -46.3056% Payback 4.00 Payt 58 Profitability Index = (0.29) Discounted Payback = 0.00 PE FAST RESPOND TO THESE TERTIONS ON ANOTHER TAR Case and Template Response Sheet3 + Ready MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts