Question: I am having trouble finding the methods for this in the book. Could you please use this example to demonstrate this concept to me. O

I am having trouble finding the methods for this in the book. Could you please use this example to demonstrate this concept to me.

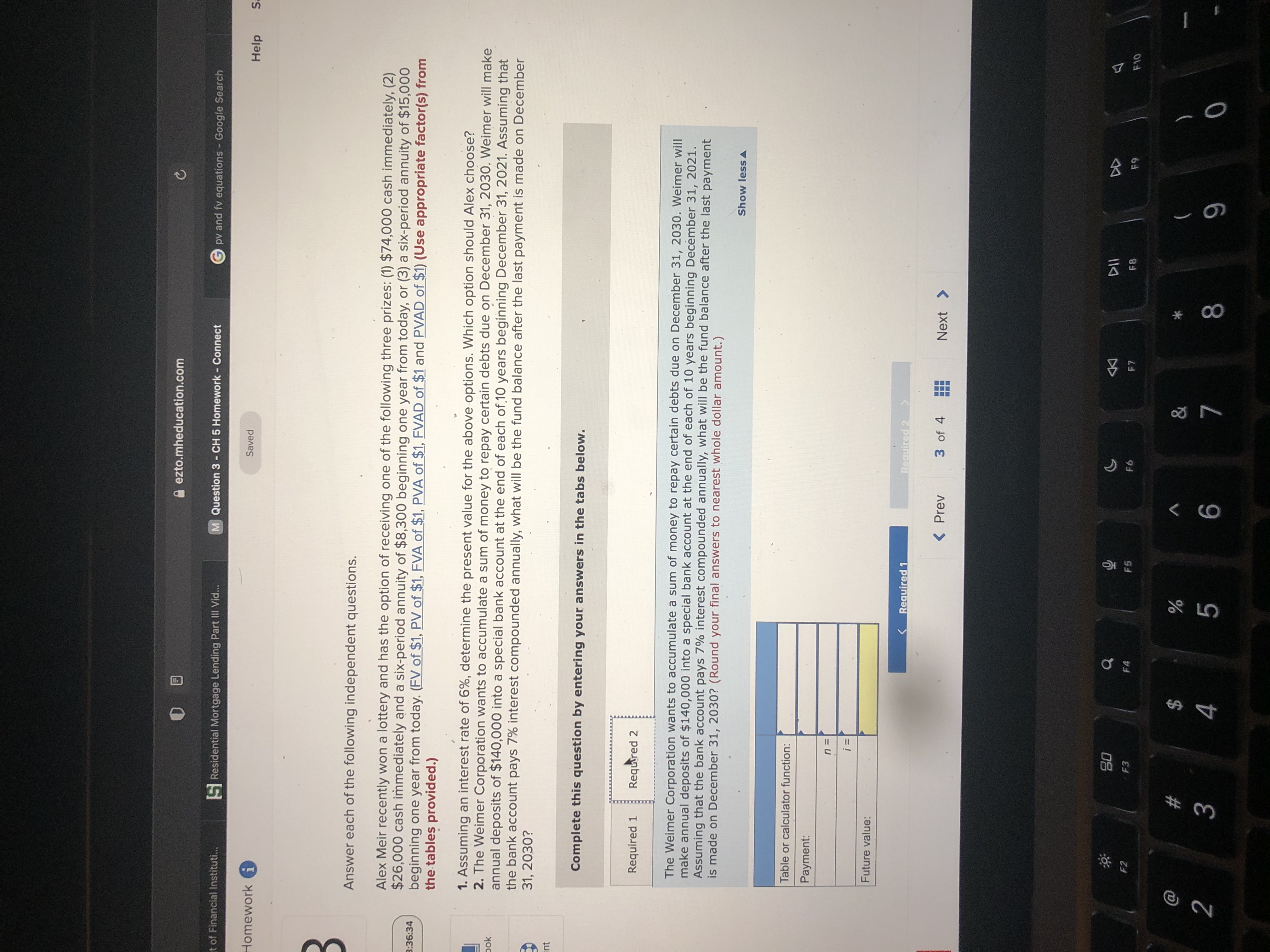

O a ezto.mheducation.com C of Financial Instituti Residential Mortgage Lending Part III Vid. M Question 3 - CH 5 Homework - Connect G pv and fv equations - Google Search Homework i Saved Help Answer each of the following independent questions. Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: (1) $74,000 cash immediately, (2) $26,000 cash immediately and a six-period annuity of $8,300 beginning one year from today, or (3) a six-period annuity of $15,000 3:36:34 beginning one year from today. (FV of $1, PV of $1, EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Assuming an interest rate of 6%, determine the present value for the above options. Which option should Alex choose? 2. The Weimer Corporation wants to accumulate a sum of money to repay certain debts due on December 31, 2030. Weimer will make annual deposits of $140,000 into a special bank account at the end of each of 10 years beginning December 31, 2021. Assuming that the bank account pays 7% interest compounded annually, what will be the fund balance after the last payment is made on December 31, 2030? Complete this question by entering your answers in the tabs below. Required 1 Required 2 The Weimer Corporation wants to accumulate a sum of money to repay certain debts due on December 31, 2030. Weimer will make annual deposits of $140,000 into a special bank account at the end of each of 10 years beginning December 31, 2021. Assuming that the bank account pays 7% interest compounded annually, what will be the fund balance after the last payment is made on December 31, 2030? (Round your final answers to nearest whole dollar amount. ) Show less A Table or calculator function: Payment: n = i= Future value:

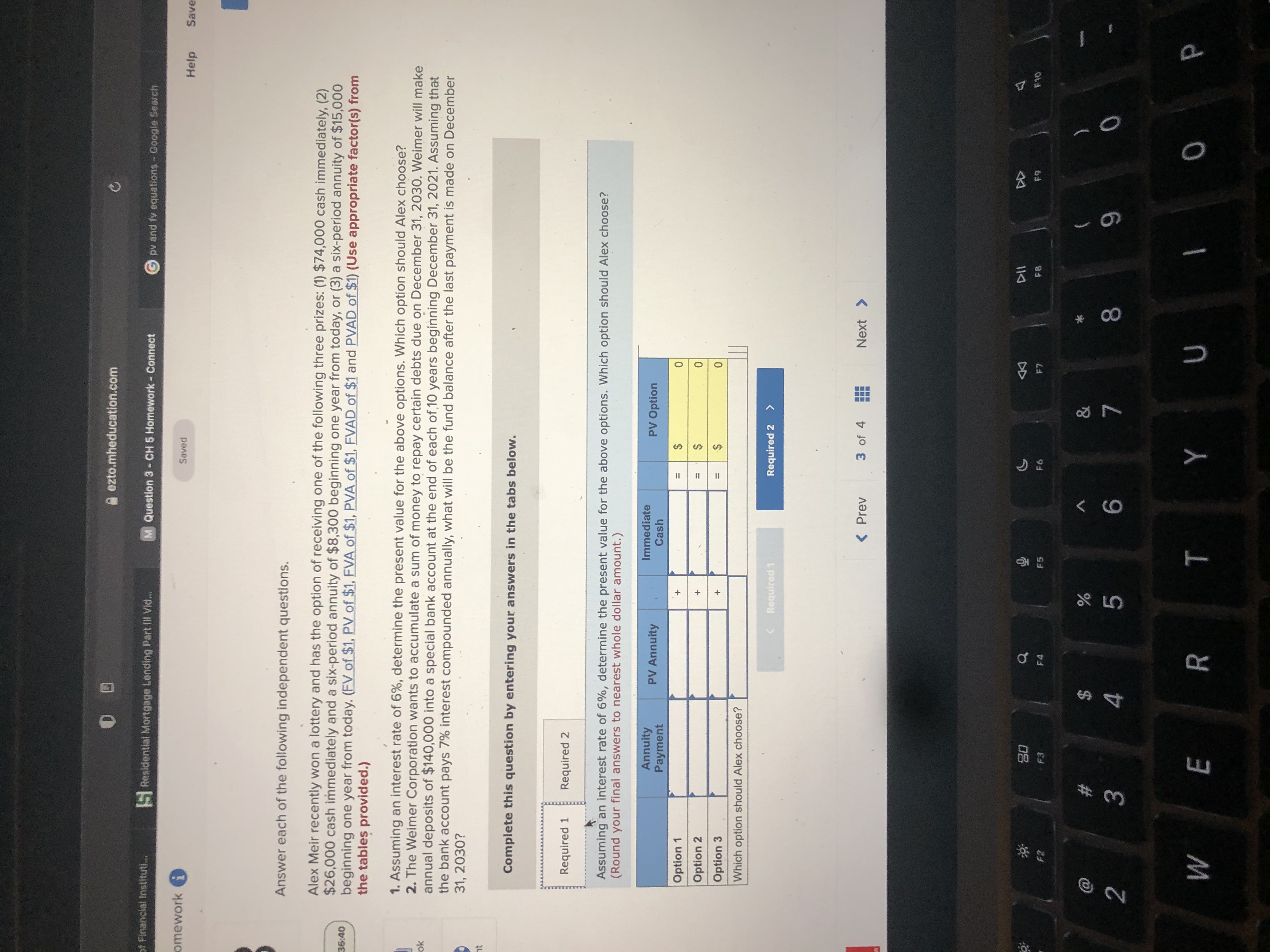

30 U DI A F2 F3 F4 E5 E6 F10 % A N 4 5 6 8 9 OO ezto.mheducation.com Financial Instituti Residential Mortgage Lending Part III Vid.. M Question 3 - CH 5 Homework - Connect G pv and fv equations - Google Search omework i Saved Help Save Answer each of the following independent questions. Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: (1) $74,000 cash immediately, (2) $26,000 cash immediately and a six-period annuity of $8,300 beginning one year from today, or (3) a six-period annuity of $15,000 36:40 beginning one year from today. (FV of $1, PV of $1, EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Assuming an interest rate of 6%, determine the present value for the above options. Which option should Alex choose? 2. The Weimer Corporation wants to accumulate a sum of money to repay certain debts due on December 31, 2030. Weimer will make annual deposits of $140,000 into a special bank account at the end of each of 10 years beginning December 31, 2021. Assuming that the bank account pays 7% interest compounded annually, what will be the fund balance after the last payment is made on December 31, 2030? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming an interest rate of 6%, determine the present value for the above options. Which option should Alex choose? (Round your final answers to nearest whole dollar amount.) Annuity PV Annuity Immediate PV Option Payment Cash Option 1 = $ o o Option 2 = $ Option 3 = $ Which option should Alex choose? Required 1 Required 2 > A O E6 co F10 @ % 5 6 O V 2 3 8 9 W E R T Y U O P