Question: I am having trouble finding the solutions to these problems. I have posted these answers for them but I would like for someone to double

I am having trouble finding the solutions to these problems. I have posted these answers for them but I would like for someone to double check my work.

I am having trouble finding the solutions to these problems. I have posted these answers for them but I would like for someone to double check my work.

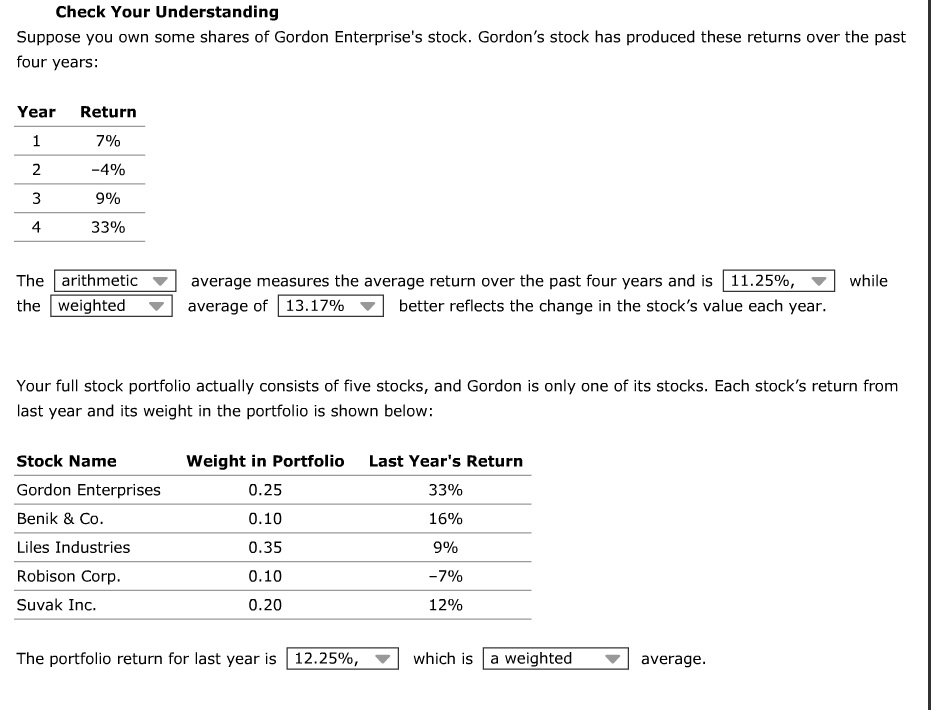

Check Your Understanding Suppose you own some shares of Gordon Enterprise's stock. Gordon's stock has produced these returns over the past four years Year Return 7% -4% 9% 3390 4 The arithmetic | average measures the average return over the past four years and is | 11.25%, | while the | weighted | average of 13.17% | better reflects the change in the stock's value each year Your full stock portfolio actually consists of five stocks, and Gordon is only one of its stocks. Each stock's return from last year and its weight in the portfolio is shown below Stock Name Gordon Enterprises Benik & Co Liles Industries Robison Corp Suvak Inc. Weight in Portfolio 0.25 0.10 0.35 0.10 0.20 Last Year's Return 33% 16% 9% 7% 12% The portfolio return for last year is 12.25%. | which is l a weighted | average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts