Question: I am having trouble solving this question At the end of the prior year, Durney's Outdoor Outfitters reported the following information. Accounts Receivable, Dec. 31

I am having trouble solving this question

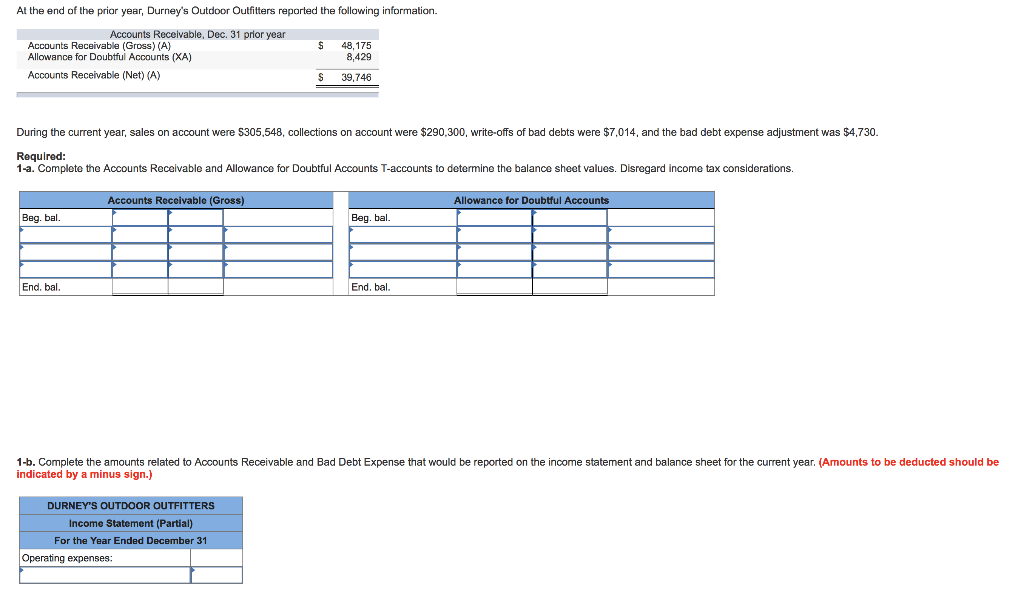

At the end of the prior year, Durney's Outdoor Outfitters reported the following information. Accounts Receivable, Dec. 31 prior year Accounts Receivable (Gross) (A) Allowance for Doubtful Accounts (XA) $ 48,175 8,429 Accounts Receivable (Net) (A) $ 39,746 During the current year, sales on account were S305,548, collections on account were $290,300, write-offs of bad debts were $7,014, and the bad debt expense adjustment was $4,730 Required: 1-a. Complete the Accounts Recelvable and Allowance for Doubtful Accounts T-accounts to determine the balance sheet values. Disregard income tax considerations. Accounts Receivable (Gross)Allowance for Doubtfhul Accounts Beg. bal. Beg. bal End. bal. End, bal 1-b. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the income statement and balance sheet for the current year. (Amounts to be deducted should be indicated by a minus sign.) DURNEYS OUTDOOR OUTFITTERS Income Statement (Partial) For the Year Ended December 31 Operating expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts