Question: I am having trouble with this problem. Questions 1-5 are for homework. Would you be kind enough to explain while you answer them? thank you.

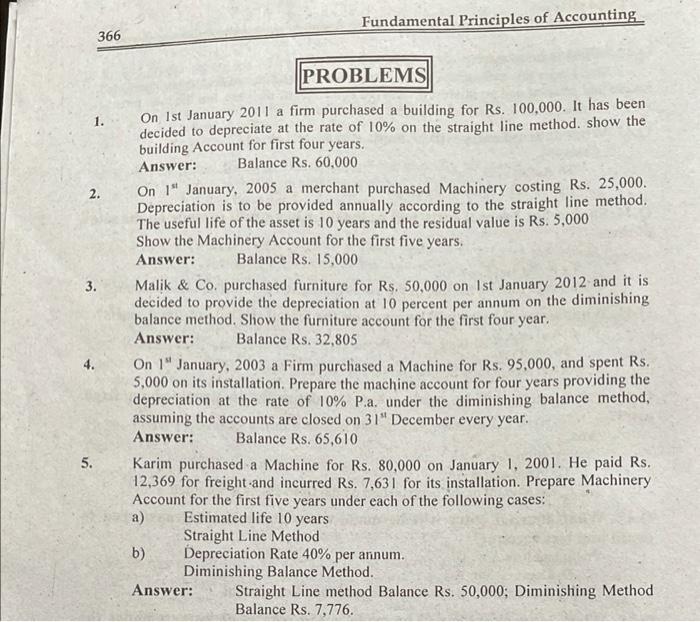

Fundamental Principles of Accounting 366 1. 2. 3. PROBLEMS On 1st January 2011 a firm purchased a building for Rs. 100,000. It has been decided to depreciate at the rate of 10% on the straight line method. show the building Account for first four years. Answer: Balance Rs. 60,000 On 1" January, 2005 a merchant purchased Machinery costing Rs. 25,000 Depreciation is to be provided annually according to the straight line method. The useful life of the asset is 10 years and the residual value is Rs. 5,000 Show the Machinery Account for the first five years. Answer: Balance Rs. 15,000 Malik & Co, purchased furniture for Rs. 50,000 on 1st January 2012 and it is decided to provide the depreciation at 10 percent per annum on the diminishing balance method. Show the furniture account for the first four year. Answer: Balance Rs. 32,805 On 1" January, 2003 a Firm purchased a Machine for Rs. 95,000, and spent Rs. 5,000 on its installation. Prepare the machine account for four years providing the depreciation at the rate of 10% P.a. under the diminishing balance method, assuming the accounts are closed on 31" December every year. Answer: Balance Rs. 65,610 Karim purchased a Machine for Rs. 80,000 on January 1, 2001. He paid Rs. 12,369 for freight-and incurred Rs. 7,631 for its installation. Prepare Machinery Account for the first five years under each of the following cases: a) Estimated life 10 years Straight Line Method b) Depreciation Rate 40% per annum. Diminishing Balance Method. Answer: Straight Line method Balance Rs. 50,000; Diminishing Method Balance Rs. 7,776. 4. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts