Question: I am having trouble with this question. 3 Problem 14-16 (Algo) Debt Issue costs; Issuance; expensing; early extinguishment; straight-line amortization [LO14-2, 14-5] 20 points Cupola

I am having trouble with this question.

![Issue costs; Issuance; expensing; early extinguishment; straight-line amortization [LO14-2, 14-5] 20 points](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667ea98ea142d_974667ea98e8e845.jpg)

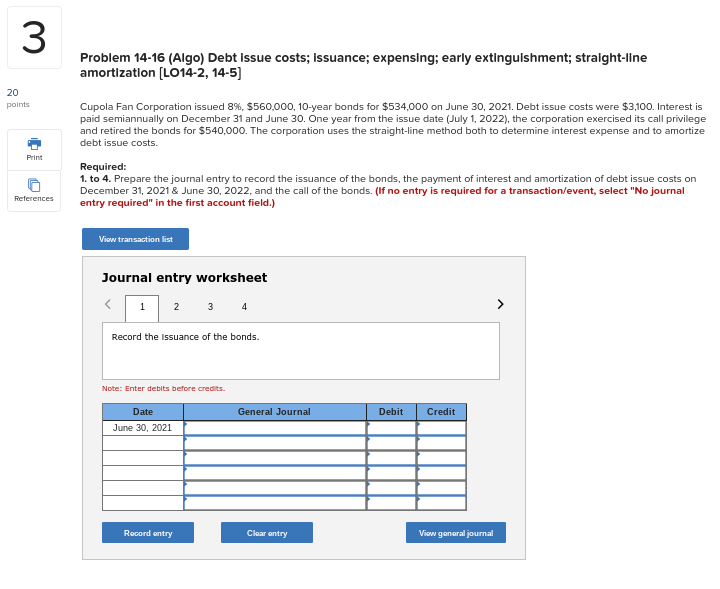

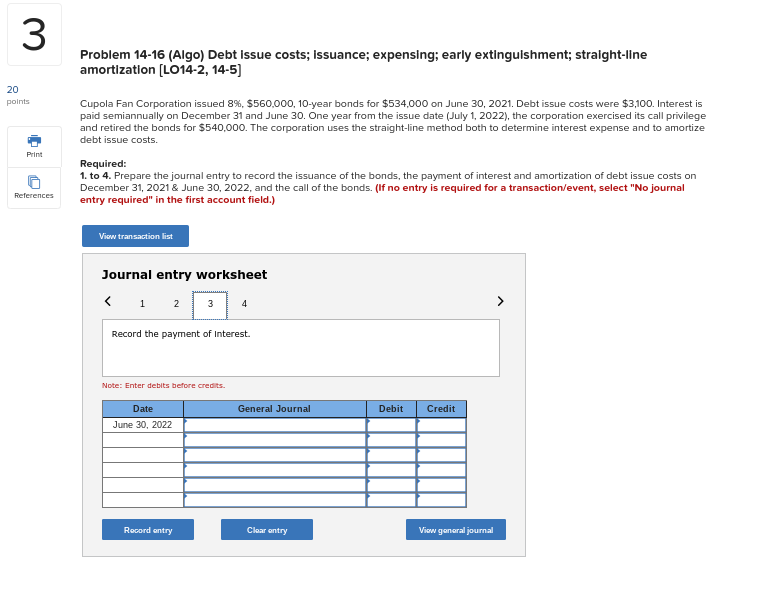

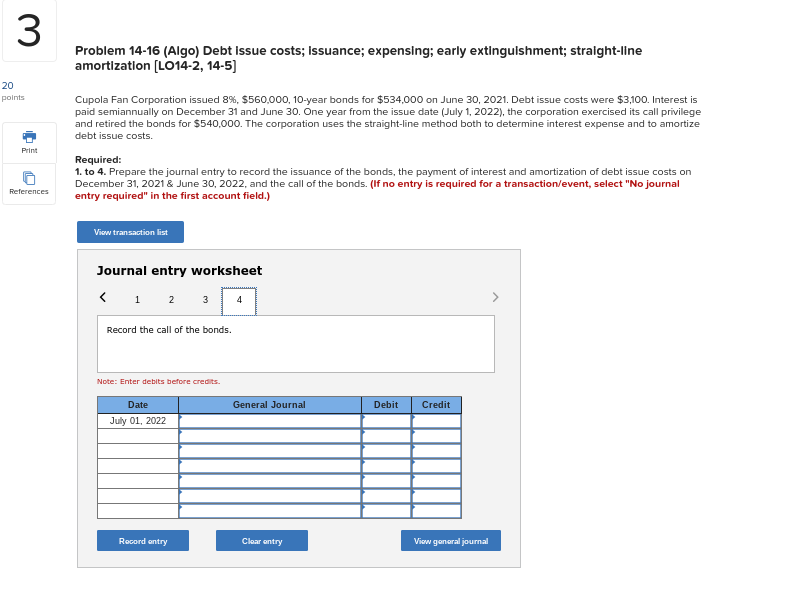

3 Problem 14-16 (Algo) Debt Issue costs; Issuance; expensing; early extinguishment; straight-line amortization [LO14-2, 14-5] 20 points Cupola Fan Corporation issued 8%, $560,000, 10-year bonds for $534,000 on June 30, 2021. Debt issue costs were $3,100. Interest is paid semiannually on December 31 and June 30. One year from the issue date (July 1, 2022), the corporation exercised its call privilege and retired the bonds for $540,000. The corporation uses the straight-line method both to determine interest expense and to amortize debt issue costs. Print Required: 1. to 4. Prepare the journal entry to record the issuance of the bonds, the payment of interest and amortization of debt issue costs on References December 31, 2021 & June 30, 2022, and the call of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 Record the Issuance of the bonds. Note: Enter debits before credits. Date General Journal Debit Credit June 30, 2021 Record entry Clear entry View general journal3 Problem 14-16 (Algo) Debt Issue costs; Issuance; expensing; early extinguishment; straight-lin amortization [LO14-2, 14-5] 20 points Cupola Fan Corporation issued 8%, $560,000, 10-year bonds for $534,000 on June 30, 2021. Debt issue costs were $3,1 paid semiannually on December 31 and June 30. One year from the issue date (July 1, 2022), the corporation exercised and retired the bonds for $540,000. The corporation uses the straight-line method both to determine interest expense a debt issue costs. Print Required: 1. to 4. Prepare the journal entry to record the issuance of the bonds, the payment of interest and amortization of debt is References December 31, 2021 & June 30, 2022, and the call of the bonds. (If no entry is required for a transaction/event, select" entry required" in the first account field.) View transaction list Journal entry worksheet Record the payment of Interest. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general journal3 Problem 14-16 (Algo) Debt issue costs; issuance; expensing; early extinguishment; straight-line amortization [LO14-2, 14-5] 20 points Cupola Fan Corporation issued 8%, $560,000, 10-year bonds for $534,000 on June 30, 2021. Debt issue costs were $3,100. Interest is paid semiannually on December 31 and June 30. One year from the issue date (July 1, 2022), the corporation exercised its call privilege and retired the bonds for $540,000. The corporation uses the straight-line method both to determine interest expense and to amortize debt issue costs. Print Required: 1. to 4. Prepare the journal entry to record the issuance of the bonds, the payment of interest and amortization of debt issue costs on References December 31, 2021 & June 30, 2022, and the call of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the payment of Interest. Note: Enter debits before credits. Date General Journal Debit Credit June 30, 2022 Record entry Clear entry View general journal3 Problem 14-16 (Algo) Debt issue costs; Issuance; expensing; early extinguishment; straight-line amortization [LO14-2, 14-5] 20 points Cupola Fan Corporation issued 8%, $560,000, 10-year bonds for $534,000 on June 30, 2021. Debt issue costs were $3,100. Interest is paid semiannually on December 31 and June 30. One year from the issue date (July 1, 2022), the corporation exercised its call privilege and retired the bonds for $540,000. The corporation uses the straight-line method both to determine interest expense and to amortize debt issue costs. Print Required: 1. to 4. Prepare the journal entry to record the issuance of the bonds, the payment of interest and amortization of debt issue costs on References December 31, 2021 & June 30, 2022, and the call of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts