Question: I am looking for answer for question 2 please. i got an answer for question 1 (A) (B) and (C). so NO need answer for

I am looking for answer for question 2 please. i got an answer for question 1 (A) (B) and (C). so NO need answer for that.

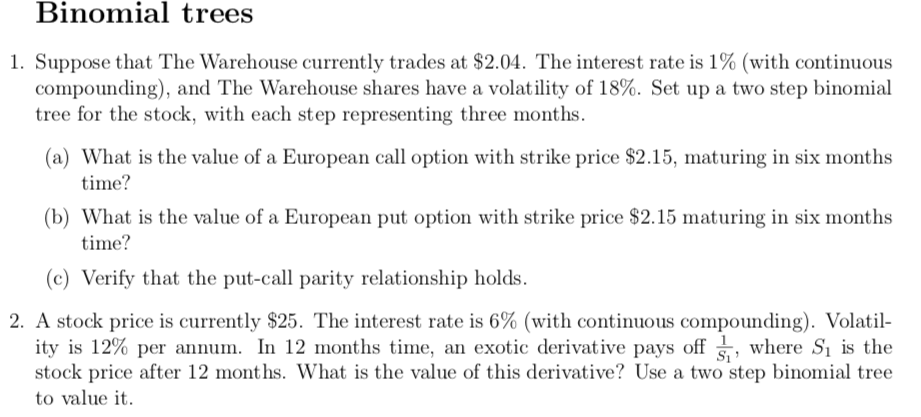

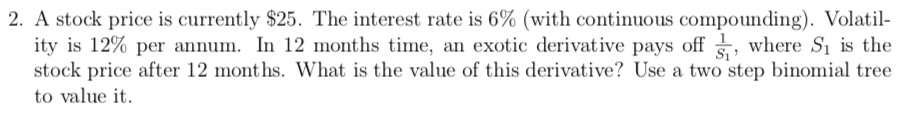

Binomial trees I. Suppose that The Warehouse currently trades at $2.04. The interest rate is 1% (with continuous compounding), and The Warehouse shares have a volatility of 18%. Set up a two step binomial tree for the stock, with each step representing three months (a) What is the value of a European call option with strike price $2.15, maturing in six months time (b) What is the value of a European put option with strike price $2.15 maturing in six months time (c) Verify that the put-call parity relationship holds 2 A stock price is currently $25. The interest rate is 6% (with continuous compounding). Volati- ity is 12% per annum. In 12 months time, an exotic derivative pays off s-, where Si s the stock price after 12 months. What is the value of this derivative? Use a two step binomial tree to value it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts