Question: I am looking for steps to try and solve this problem. On January 1, 2014, Bretz, Inc., acquired 60 percent of the outstanding shares of

I am looking for steps to try and solve this problem.

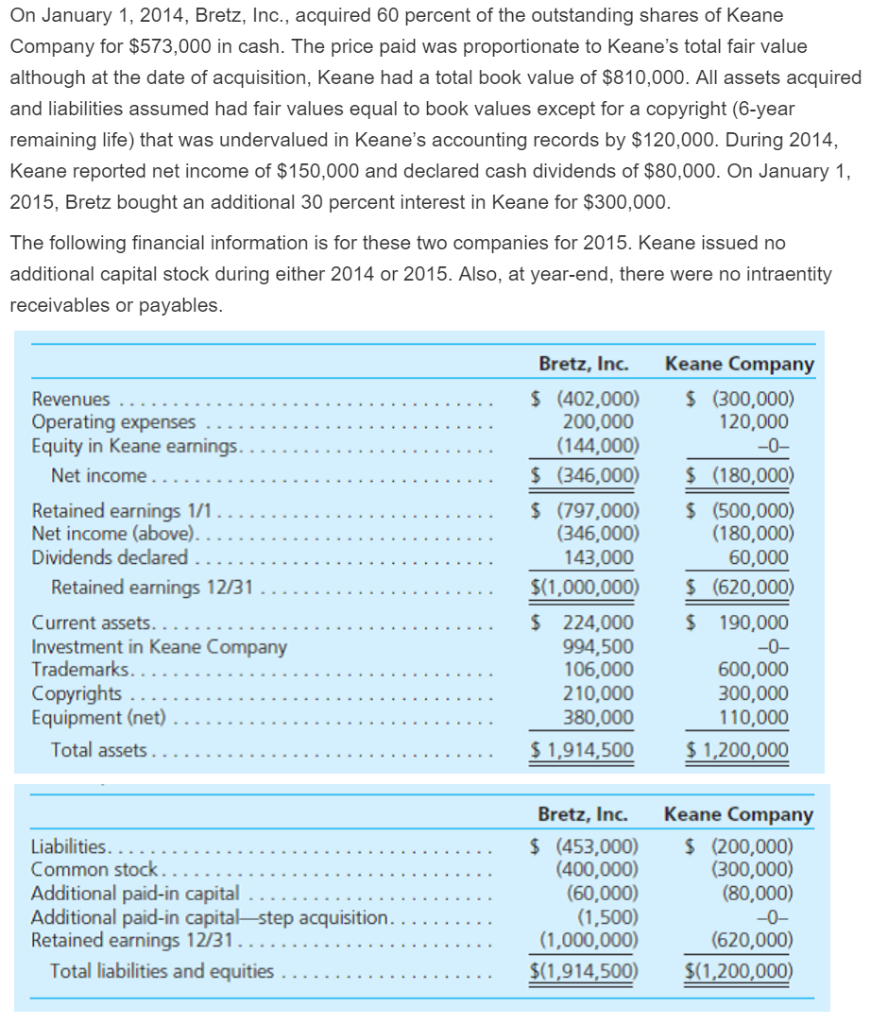

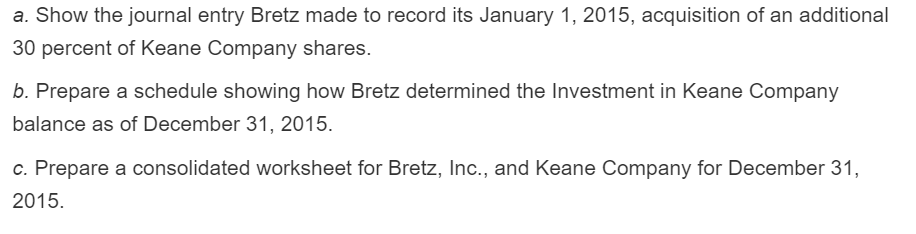

On January 1, 2014, Bretz, Inc., acquired 60 percent of the outstanding shares of Keane Company for $573,000 in cash. The price paid was proportionate to Keane's total fair value although at the date of acquisition, Keane had a total book value of $810,000. All assets acquired and liabilities assumed had fair values equal to book values except for a copyright (6-year remaining life) that was undervalued in Keane's accounting records by $120,000. During 2014, Keane reported net income of $150,000 and declared cash dividends of $80,000. On January 1, 2015, Bretz bought an additional 30 percent interest in Keane for $300,000. The following financial information is for these two companies for 2015. Keane issued no additional capital stock during either 2014 or 2015. Also, at year-end, there were no intraentity receivables or payables Bretz, Inc. Keane Company . (402,000) (300,000) 120,000 200,000 (144,000) S (346,000) (180,000) (500,000) (180,000) 60,000 Retained earnings 12/31... _ _ _ . . . . _ _ _ _ . . _ _ _. ..$(1,000,000) (620,000) Net income . __ . . . . __ . . _ _ . . . . _ _ . . . Retained earnings 1/1... Net income (above). Dividends declared $ (797,000) (346,000) 143,000 S 224,000 994,500 106,000 210,000 380,000 S 190,000 Investment in Keane Company Trademarks. ._... _ _ . _ . . _ _ _ _ . . . _ _ _ . . .. _ _ . . . . Copyrights Equipment (net) 600,000 300,000 110,000 1,914,500 1,200,000 Total assets ..._... __ _ _. .._ _ _ _ . _ . _ _ _ . _ . . . _ ...$ Bretz, Inc. Keane Company (400,000) (60,000) (1,500) (1,000,000) Common stock (300,000) (80,000) (620,000) Total liabilities and equities . .....__ . . . . . . . . . ...$(1.914,500) (1,200,000) a. Show the journal entry Bretz made to record its January 1, 2015, acquisition of an additional 30 percent of Keane Company shares. b. Prepare a schedule showing how Bretz determined the Investment in Keane Company balance as of December 31,2015. c. Prepare a consolidated worksheet for Bretz, Inc., and Keane Company for December 31, 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts