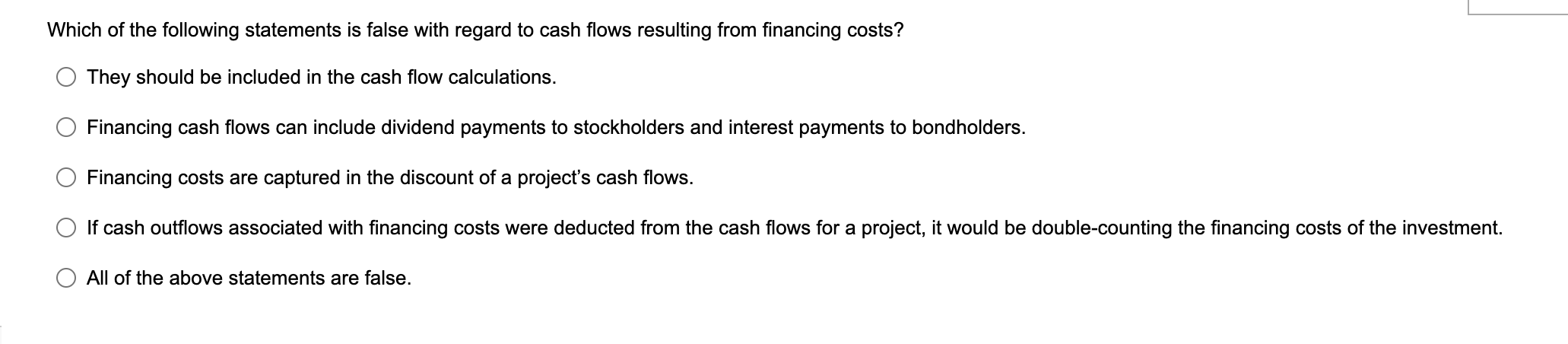

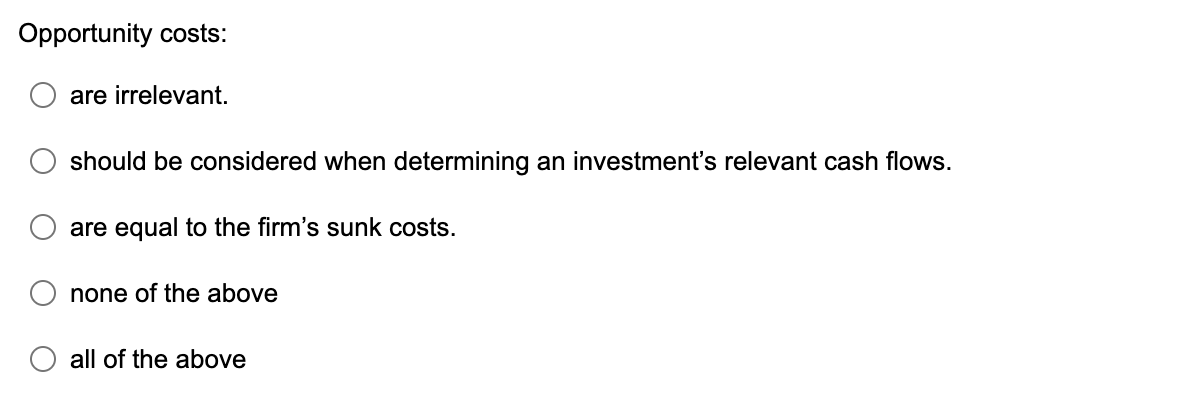

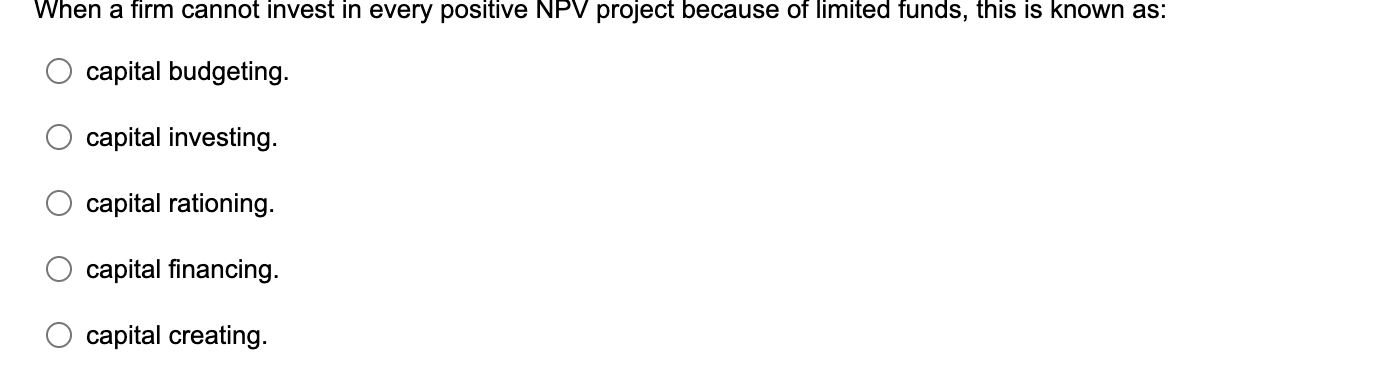

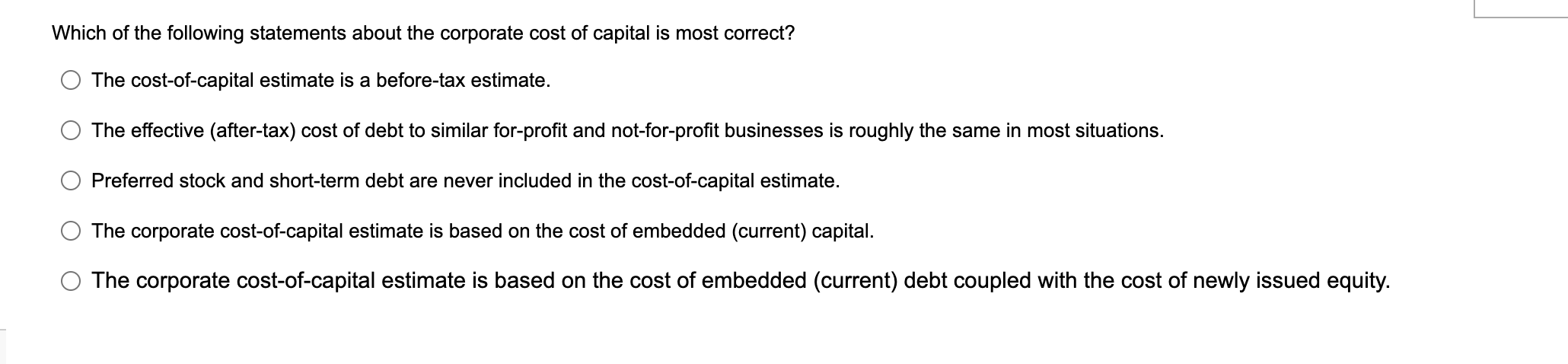

Question: I am needing help with these questions. I do not understand the following 4 questions. Which of the following statements is false with regard to

I am needing help with these questions. I do not understand the following 4 questions.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts