Question: I am not clear what the comment, this method refers to? Question 7: Tax incidence in a Bertrand duopoly [35 marks) There are two firms,

I am not clear what the comment, "this method" refers to?

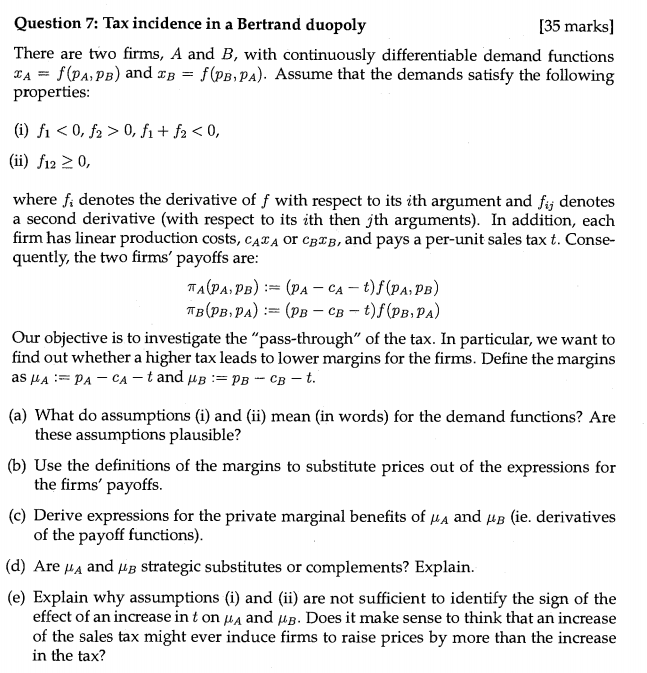

Question 7: Tax incidence in a Bertrand duopoly [35 marks) There are two firms, A and B, with continuously differentiable demand functions IA = f (PA, PB) and IB = f(PB, PA). Assume that the demands satisfy the following properties: (i) fi 0, f1 + f2 0, where fi denotes the derivative of f with respect to its ith argument and fij denotes a second derivative (with respect to its ith then jth arguments). In addition, each firm has linear production costs, CAT A Or CBIB, and pays a per-unit sales tax t. Conse- quently, the two firms' payoffs are: TA(PA, PB) := (PA CA t)f (PA, PB) TB(PB, PA) := (PB - CB t)f(PB, PA) Our objective is to investigate the pass-through" of the tax. In particular, we want to find out whether a higher tax leads to lower margins for the firms. Define the margins as a:= PA - CA-t and us := PB - CB-t. (a) What do assumptions (i) and (ii) mean (in words) for the demand functions? Are these assumptions plausible? (b) Use the definitions of the margins to substitute prices out of the expressions for the firms' payoffs. (c) Derive expressions for the private marginal benefits of ua and HB (ie. derivatives of the payoff functions). (d) Are MA and B strategic substitutes or complements? Explain. (e) Explain why assumptions (i) and (ii) are not sufficient to identify the sign of the effect of an increase in t on Maand jb. Does it make sense to think that an increase of the sales tax might ever induce firms to raise prices by more than the increase in the tax? Question 7: Tax incidence in a Bertrand duopoly [35 marks) There are two firms, A and B, with continuously differentiable demand functions IA = f (PA, PB) and IB = f(PB, PA). Assume that the demands satisfy the following properties: (i) fi 0, f1 + f2 0, where fi denotes the derivative of f with respect to its ith argument and fij denotes a second derivative (with respect to its ith then jth arguments). In addition, each firm has linear production costs, CAT A Or CBIB, and pays a per-unit sales tax t. Conse- quently, the two firms' payoffs are: TA(PA, PB) := (PA CA t)f (PA, PB) TB(PB, PA) := (PB - CB t)f(PB, PA) Our objective is to investigate the pass-through" of the tax. In particular, we want to find out whether a higher tax leads to lower margins for the firms. Define the margins as a:= PA - CA-t and us := PB - CB-t. (a) What do assumptions (i) and (ii) mean (in words) for the demand functions? Are these assumptions plausible? (b) Use the definitions of the margins to substitute prices out of the expressions for the firms' payoffs. (c) Derive expressions for the private marginal benefits of ua and HB (ie. derivatives of the payoff functions). (d) Are MA and B strategic substitutes or complements? Explain. (e) Explain why assumptions (i) and (ii) are not sufficient to identify the sign of the effect of an increase in t on Maand jb. Does it make sense to think that an increase of the sales tax might ever induce firms to raise prices by more than the increase in the tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts