Question: I am not doing this right. What is the correct way to do this? Thank you. During 2021, Jos, a self-employed technology consultant, made gifts

I am not doing this right. What is the correct way to do this? Thank you.

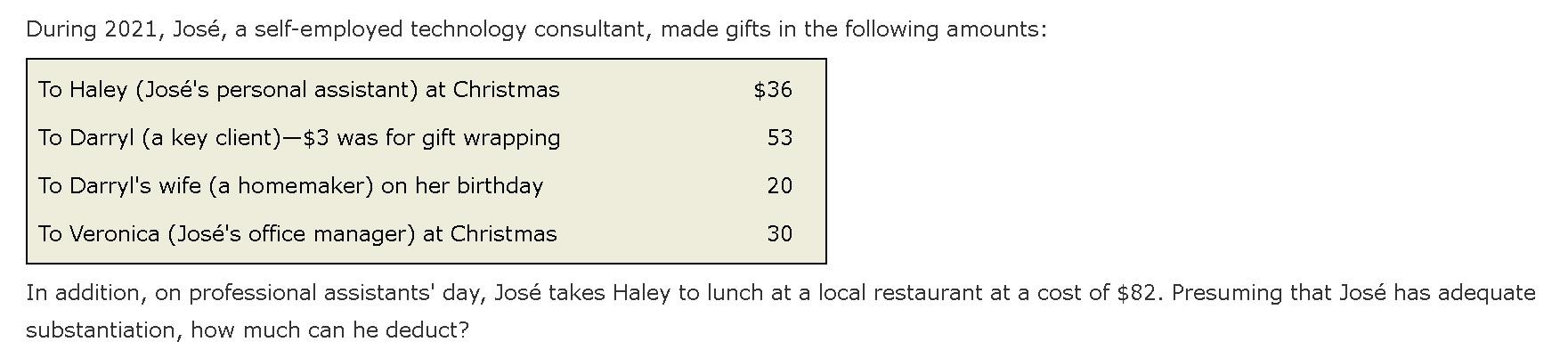

During 2021, Jos, a self-employed technology consultant, made gifts in the following amounts: To Haley (Jos's personal assistant) at Christmas $36 To Darryl (a key client)-$3 was for gift wrapping 53 To Darryl's wife (a homemaker) on her birthday To Veronica (Jos's office manager) at Christmas 20 30 In addition, on professional assistants' day, Jos takes Haley to lunch at a local restaurant at a cost of $82. Presuming that Jos has adequate substantiation, how much can he deduct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts