Question: I am not getting a correct answer for the LLC under FICA tax that Dave pays Problem 1 5 - 6 1 ( LO 1

I am not getting a correct answer for the LLC under FICA tax that Dave pays Problem LO Algo

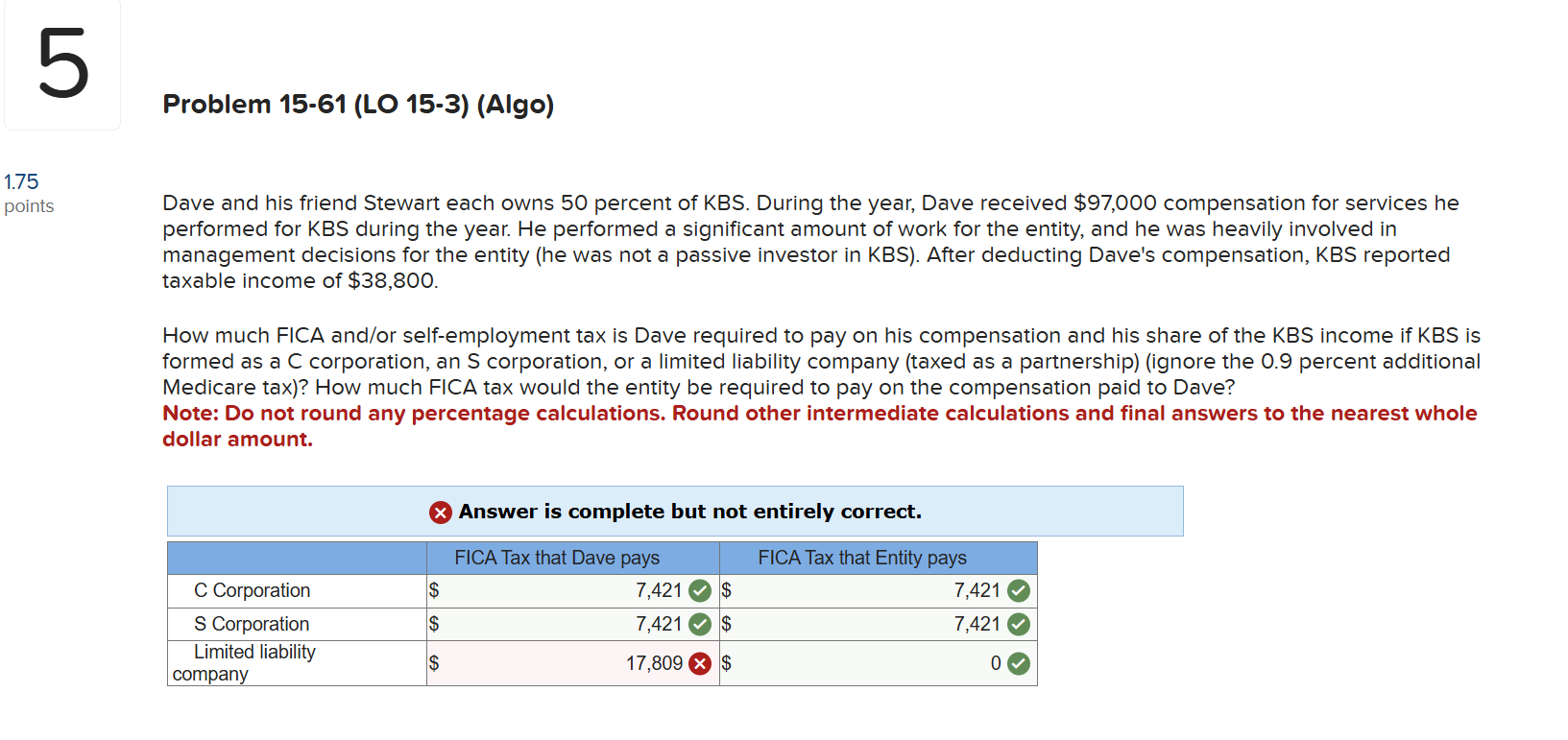

Dave and his friend Stewart each owns percent of KBS During the year, Dave received $ compensation for services he performed for KBS during the year. He performed a significant amount of work for the entity, and he was heavily involved in management decisions for the entity he was not a passive investor in KBS After deducting Dave's compensation, KBS reported taxable income of $

How much FICA andor selfemployment tax is Dave required to pay on his compensation and his share of the KBS income if KBS is formed as a C corporation, an S corporation, or a limited liability company taxed as a partnershipignore the percent additional Medicare tax How much FICA tax would the entity be required to pay on the compensation paid to Dave?

Note: Do not round any percentage calculations. Round other intermediate calculations and final answers to the nearest whole dollar amount.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock