Question: I am not quite understanding the exact and specific answer to the following question that has already been answered. QUESTION: Develop a linear programming model

I am not quite understanding the exact and specific answer to the following question that has already been answered. QUESTION: Develop a linear programming model to minimize the total dollars needed to be invested now to meet the expansion cash needs in the next 8 years. Hint: this is the objective function. Use Excel Solver, solving method: Simplex LP. See problem below. Specifically, A) How do I develop the linear programming model B) how many units of each security 1, 2, and 3 should the corporation purchase? What is the investment amount in each security 1, 2, and 3 in year 1? C) how much should the corporation place in the savings account in each of the 8 years? D) assuming the corporation currently has 1.8 million available cash to invest and given the cash needs for the expansion, is the investment plan you developed feasible? Explain your answer and reasoning. Any help is greatly appreciated!

QUESTION: Develop a linear programming model to minimize the total dollars needed to be invested now to meet the expansion cash needs in the next 8 years. Hint: this is the objective function. Use Excel Solver, solving method: Simplex LP. See problem below.

Your corporation has just approved an 8-year expansion plan to grow its market share. The plan requires an influx of cash in each of the 8 years. Management wants to develop a financial plan to ensure the cash needed for the expansion will be available at the beginning of each of the 8 years.

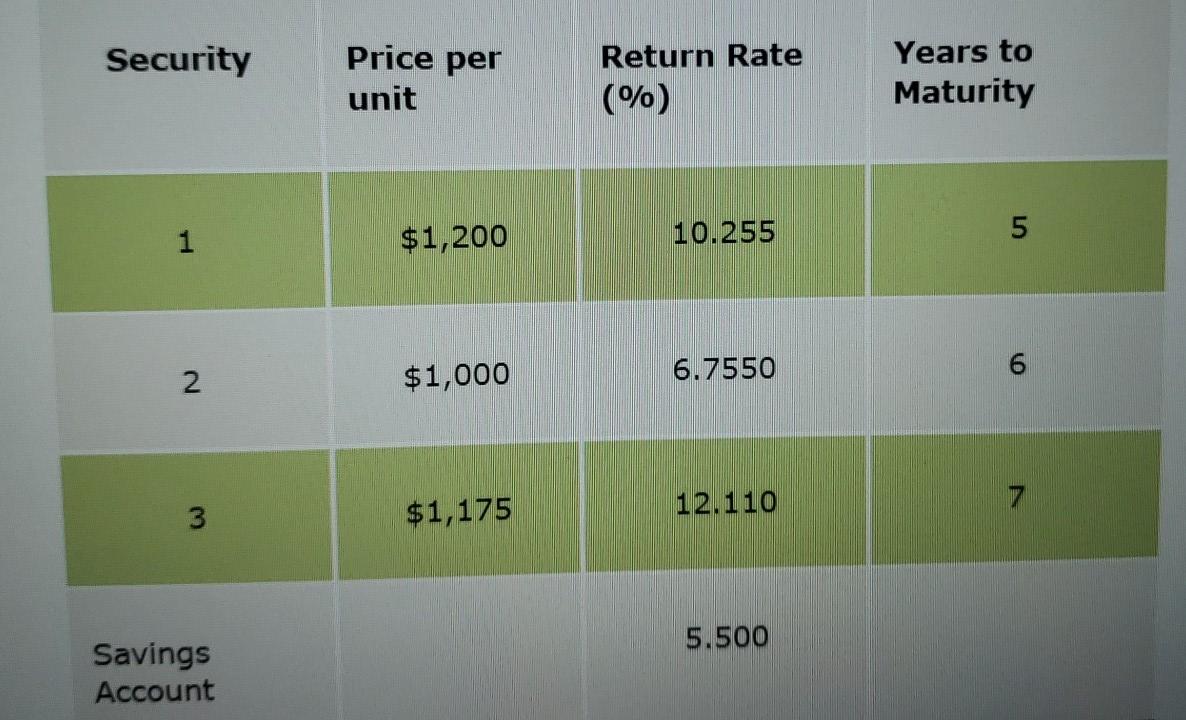

The corporation has the following investment options:

Security Price per unit Return Rate (%) Years to Maturity 1 $1,200 10.255 5 2 $1,000 6.7550 6 3 $1,175 12.110 7 Savings Account 5.500

Each unit of security 1, 2, and 3 guarantees to pay $1,000 at maturity. Investments in these securities must take place only at the beginning of year 1 and will be held until maturity. Any funds not invested in securities will be invested in a savings account that pays the annual interest rates noted above.

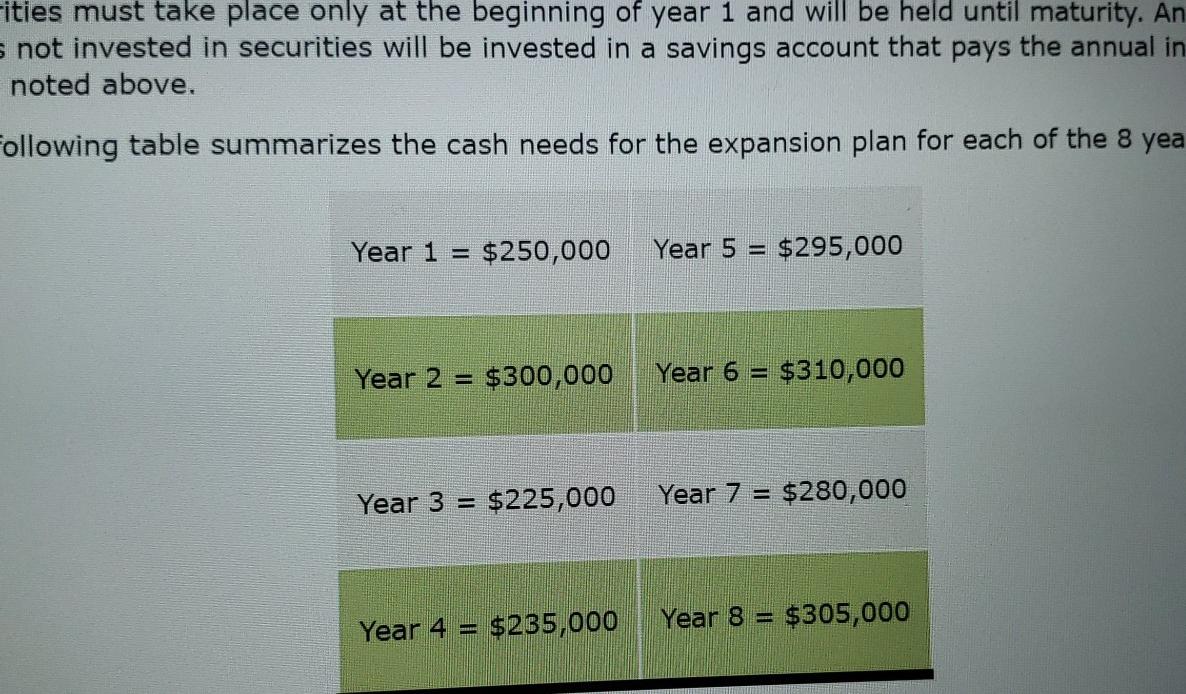

The following table summarizes the cash needs for the expansion plan for each of the 8 years:

Year 1 = $250,000 Year 5 = $295,000 Year 2 = $300,000 Year 6 = $310,000 Year 3 = $225,000 Year 7 = $280,000 Year 4 = $235,000 Year 8 = $305,000

Security Price per Return Rate (%) Years to Maturity unit 1 $1,200 10.255 5 2 6 $1,000 6.7550 12.110 7 3 $1,175 5.500 Savings Account ities must take place only at the beginning of year 1 and will be held until maturity. An not invested in securities will be invested in a savings account that pays the annual in noted above. Following table summarizes the cash needs for the expansion plan for each of the 8 yea Year 1 = $250,000 Year 5 $295,000 Year 2 = $300,000 Year 6 = $310,000 Year 3 = $225,000 Year 7 = $280,000 Year 4 = $235,000 Year 8 = $305,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts