Question: I am not sure how Pearson got 11% for The IRR project 3, can someone go though the entire problem (a, b, c) of how

I am not sure how Pearson got 11% for The IRR project 3, can someone go though the entire problem (a, b, c) of how to do this? Thanks.

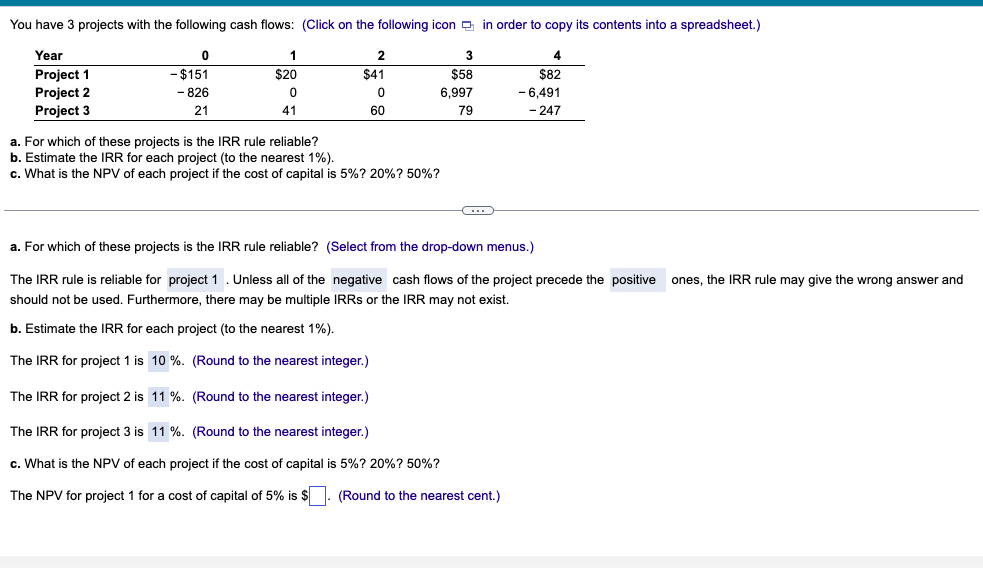

a. For which of these projects is the IRR rule reliable? b. Estimate the IRR for each project (to the nearest 1% ). c. What is the NPV of each project if the cost of capital is 5%?20% ? 50% ? a. For which of these projects is the IRR rule reliable? (Select from the drop-down menus.) should not be used. Furthermore, there may be multiple IRRs or the IRR may not exist. b. Estimate the IRR for each project (to the nearest 1\%). The IRR for project 1 is %. (Round to the nearest integer.) The IRR for project 2 is %. (Round to the nearest integer.) The IRR for project 3 is %. (Round to the nearest integer.) c. What is the NPV of each project if the cost of capital is 5% ? 20% ? 50%? The NPV for project 1 for a cost of capital of 5% is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts