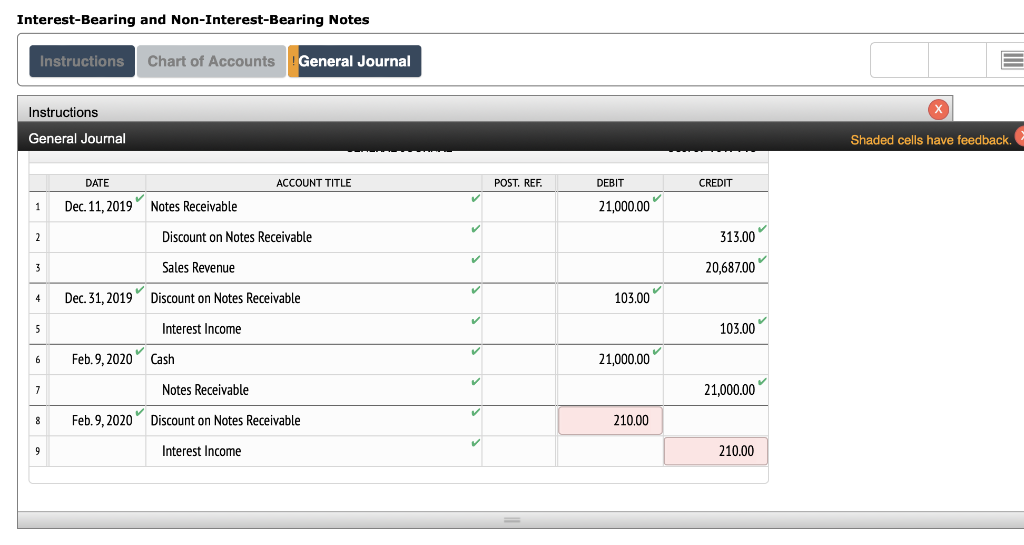

Question: I am not sure how the final entry could be any other number since it needs to equal $313. Interest-Bearing and Non-Interest-Bearing Notes Instructions On

I am not sure how the final entry could be any other number since it needs to equal $313.

I am not sure how the final entry could be any other number since it needs to equal $313.

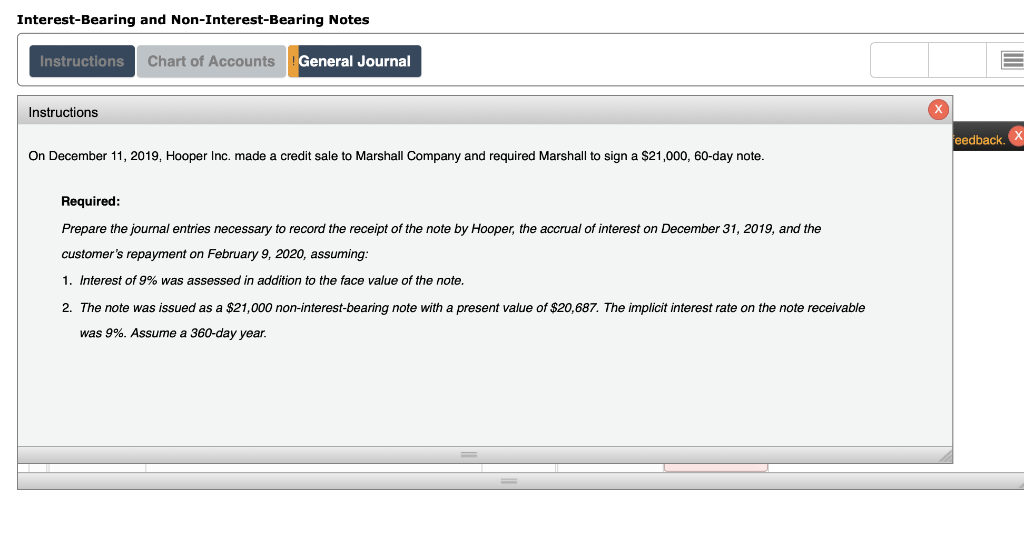

Interest-Bearing and Non-Interest-Bearing Notes Instructions On December 11, 2019, Hooper Inc. made a credit sale to Marshall Company and required Marshall to sign a $21,000,60-day note. Required: Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of interest on December 31, 2019, and the customer's repayment on February 9, 2020, assuming: 1. Interest of 9% was assessed in addition to the face value of the note. 2. The note was issued as a $21,000 non-interest-bearing note with a present value of $20,687. The implicit interest rate on the note receivable was 9%. Assume a 360-day year. Interest-Bearing and Non-Interest-Bearing Notes Interest-Bearing and Non-Interest-Bearing Notes Instructions On December 11, 2019, Hooper Inc. made a credit sale to Marshall Company and required Marshall to sign a $21,000,60-day note. Required: Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of interest on December 31, 2019, and the customer's repayment on February 9, 2020, assuming: 1. Interest of 9% was assessed in addition to the face value of the note. 2. The note was issued as a $21,000 non-interest-bearing note with a present value of $20,687. The implicit interest rate on the note receivable was 9%. Assume a 360-day year. Interest-Bearing and Non-Interest-Bearing Notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts