Question: I am not sure if I did it correctly Attempt due: Dec 25 Minutes, 12 Seconds Question 1 12.5 pts IBM stock currently sells for

I am not sure if I did it correctly

I am not sure if I did it correctly

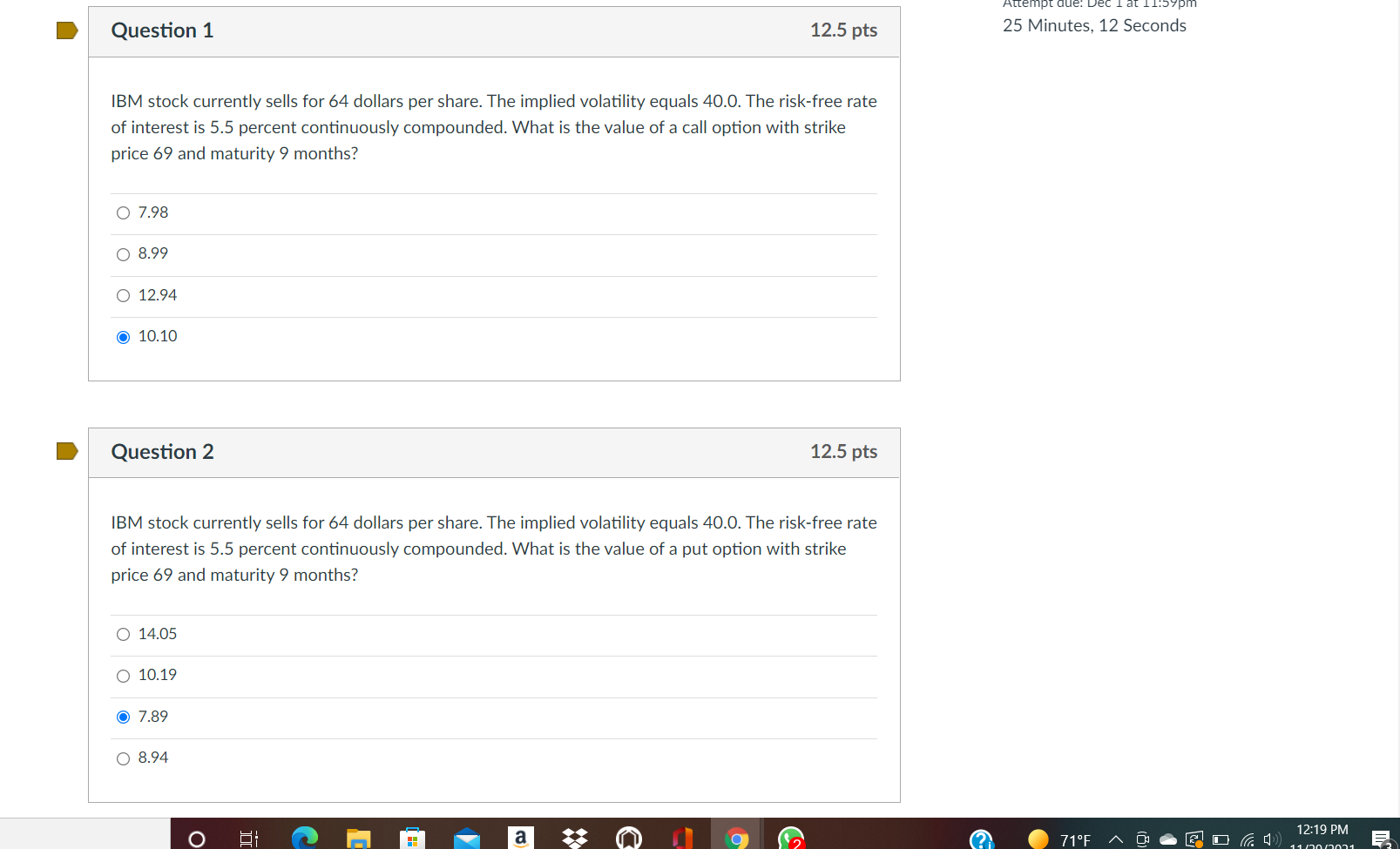

Attempt due: Dec 25 Minutes, 12 Seconds Question 1 12.5 pts IBM stock currently sells for 64 dollars per share. The implied volatility equals 40.0. The risk-free rate of interest is 5.5 percent continuously compounded. What is the value of a call option with strike price 69 and maturity 9 months? O 7.98 O 8.99 O 12.94 10.10 Question 2 12.5 pts IBM stock currently sells for 64 dollars per share. The implied volatility equals 40.0. The risk-free rate of interest is 5.5 percent continuously compounded. What is the value of a put option with strike price 69 and maturity 9 months? O 14.05 O 10.19 O 7.89 O 8.94 O 12:19 PM BI > a Ey 71F 111001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts