Question: I am not sure if the first two are correct. Thank you so much! (Related to Checkpoint 3.1) (Working with the income statement) At the

I am not sure if the first two are correct. Thank you so much!

I am not sure if the first two are correct. Thank you so much!

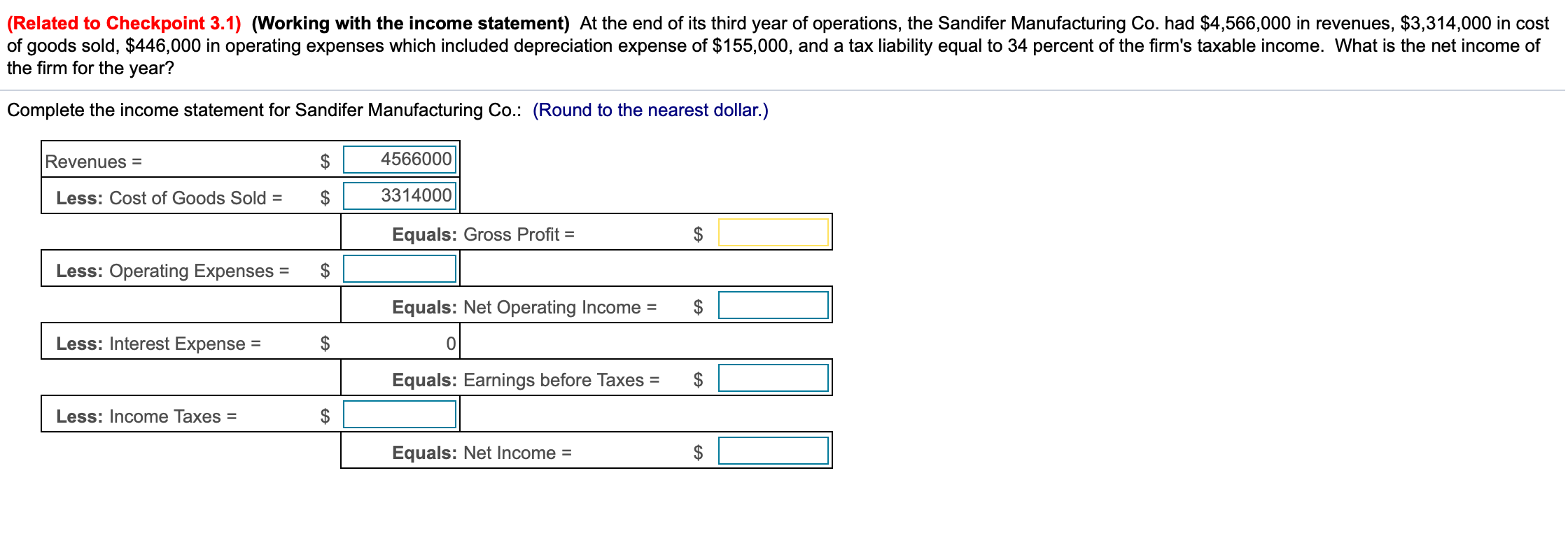

(Related to Checkpoint 3.1) (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,566,000 in revenues, $3,314,000 in cost of goods sold, $446,000 in operating expenses which included depreciation expense of $155,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.) Revenues = $ 4566000 Less: Cost of Goods Sold = $ 3314000 Equals: Gross Profit = $ Less: Operating Expenses $ Equals: Net Operating Income = $ Less: Interest Expense = $ 0 Equals: Earnings before Taxes = $ Less: Income Taxes = $ Equals: Net Income = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts