Question: I am not sure what I am doing wrong! Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would

I am not sure what I am doing wrong!

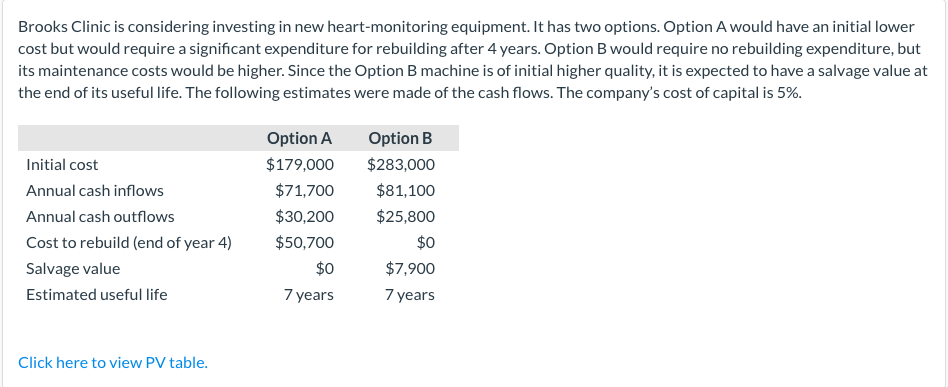

Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The companys cost of capital is 5%.

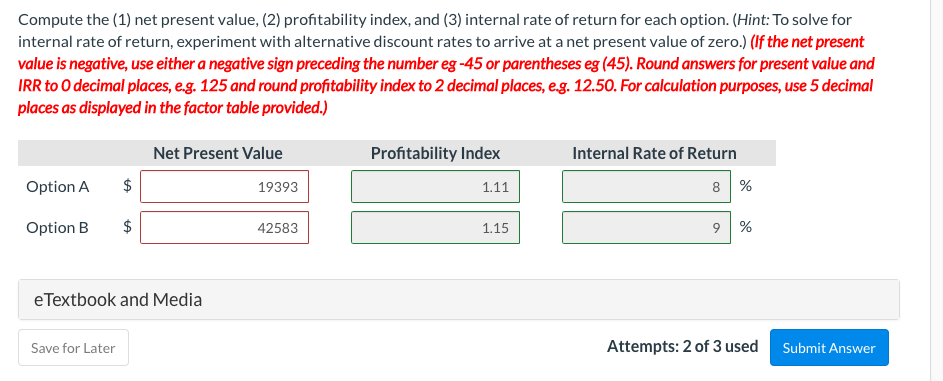

Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Option A $179,000 $71,700 $30,200 $50,700 $0 7 years Option B $283,000 $81,100 $25,800 Initial cost Annual cash inflows Annual cash outflows Cost to rebuild (end of year 4) Salvage value Estimated useful life $0 $7,900 7 years Click here to view PV table. Compute the (1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for internal rate of return, experiment with alternative discount rates to arrive at a net present value of zero.) (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answers for present value and IRR to O decimal places, e.g. 125 and round profitability index to 2 decimal places, eg. 12.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net Present Value Profitability Index Internal Rate of Return Option A $ 19393 1.11 8 % Option B $ 42583 1.15 9 % e Textbook and Media Save for Later Attempts: 2 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts