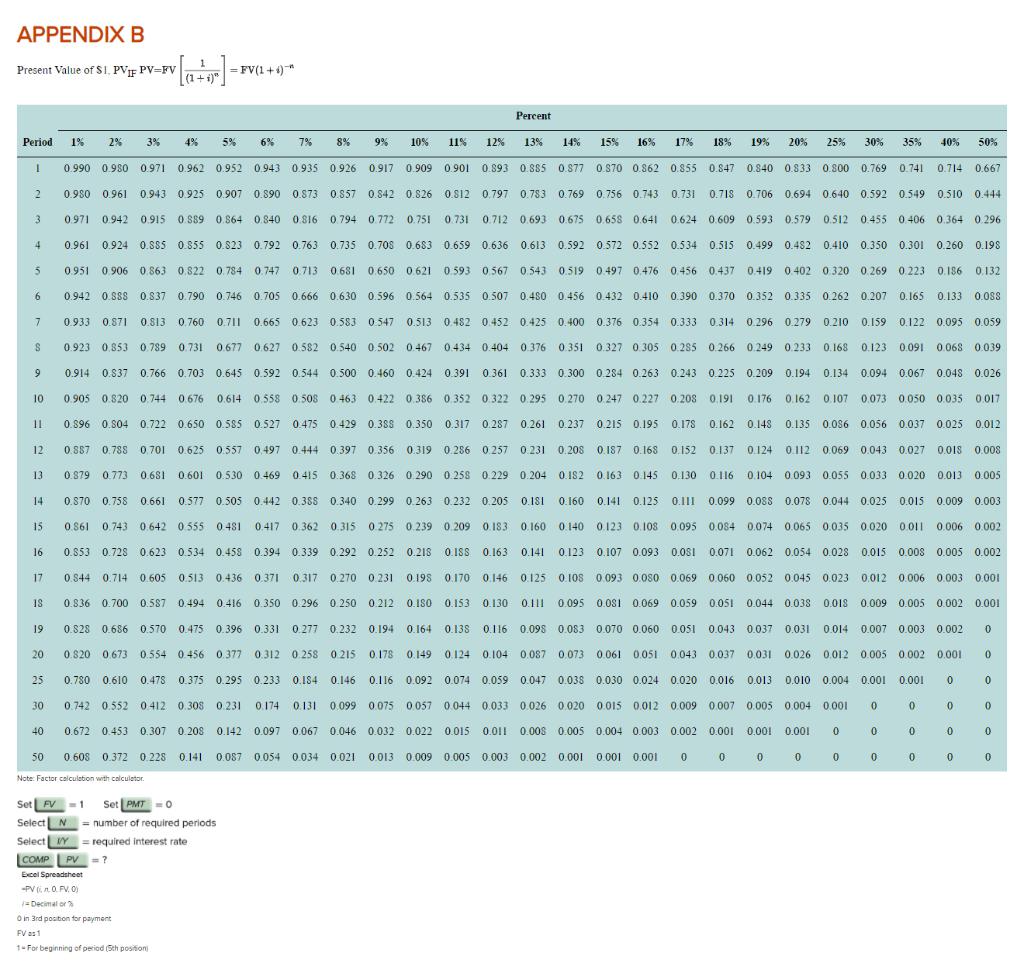

Question: I am posting this question second time please make sure you get the right answer Present Value of $1,PVIFPV=FV[(1+i)n1]=FV(1+i)t PVFAAPVA=A[i1(1+i)x1]=A[i1(1+i)a] Hamilton Steel Company has a

![the right answer Present Value of $1,PVIFPV=FV[(1+i)n1]=FV(1+i)t PVFAAPVA=A[i1(1+i)x1]=A[i1(1+i)a] Hamilton Steel Company has](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670264e2dec1d_146670264e2520ae.jpg) I am posting this question second time please make sure you get the right answer

I am posting this question second time please make sure you get the right answer

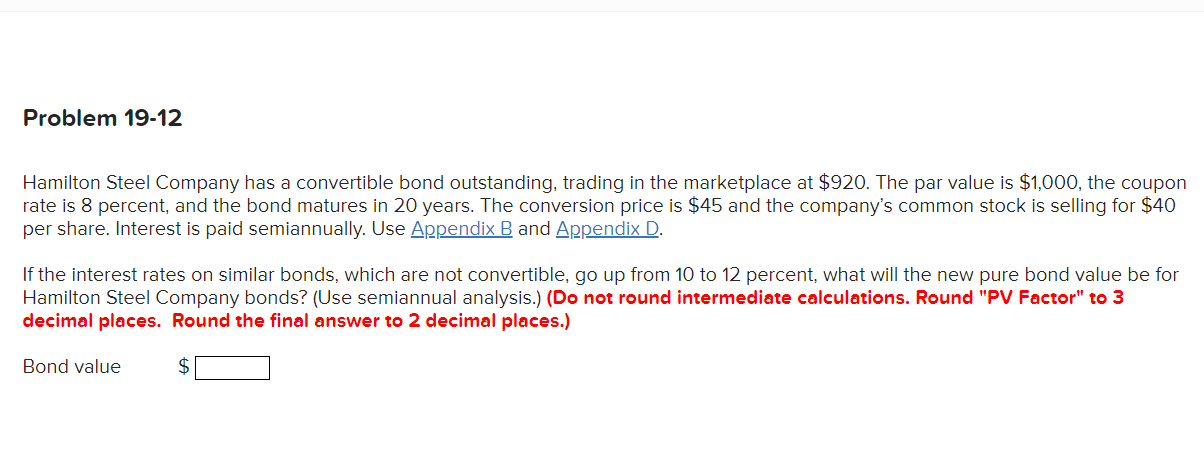

Present Value of $1,PVIFPV=FV[(1+i)n1]=FV(1+i)t PVFAAPVA=A[i1(1+i)x1]=A[i1(1+i)a] Hamilton Steel Company has a convertible bond outstanding, trading in the marketplace at $920. The par value is $1,000, the coupon rate is 8 percent, and the bond matures in 20 years. The conversion price is $45 and the company's common stock is selling for $40 per share. Interest is paid semiannually. Use AppendixB and AppendixD. If the interest rates on similar bonds, which are not convertible, go up from 10 to 12 percent, what will the new pure bond value be for Hamilton Steel Company bonds? (Use semiannual analysis.) (Do not round intermediate calculations. Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal places.) Bond value $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts