Question: I am quite pressed for time! Can someone help me find this solution? You are given the following information: Stock return (rs) Probability (p) Market

I am quite pressed for time! Can someone help me find this solution?

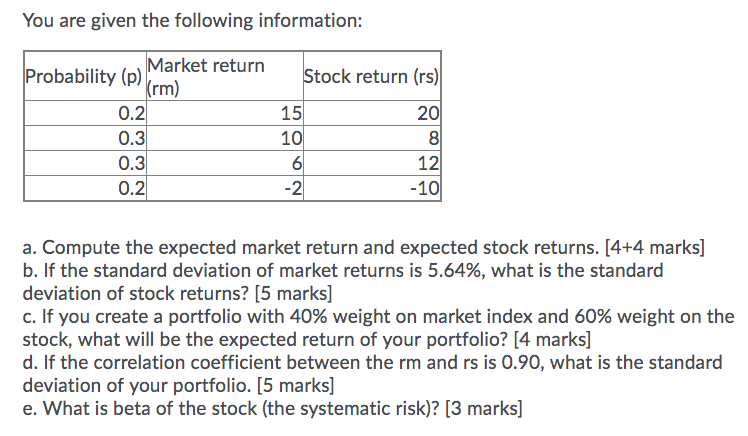

You are given the following information: Stock return (rs) Probability (p) Market return Krm) 0.2 15 10 0.3 0.3 0.2 a. Compute the expected market return and expected stock returns. [4+4 marks] b. If the standard deviation of market returns is 5.64%, what is the standard deviation of stock returns? (5 marks) c. If you create a portfolio with 40% weight on market index and 60% weight on the stock, what will be the expected return of your portfolio? [4 marks] d. If the correlation coefficient between the rm and rs is 0.90, what is the standard deviation of your portfolio. (5 marks] e. What is beta of the stock (the systematic risk)? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts