Question: I am really struggling with this question, any help is very appreciated!! Course Note Packet Chapter 182 Page 12-13 Use the accompanying data table regarding

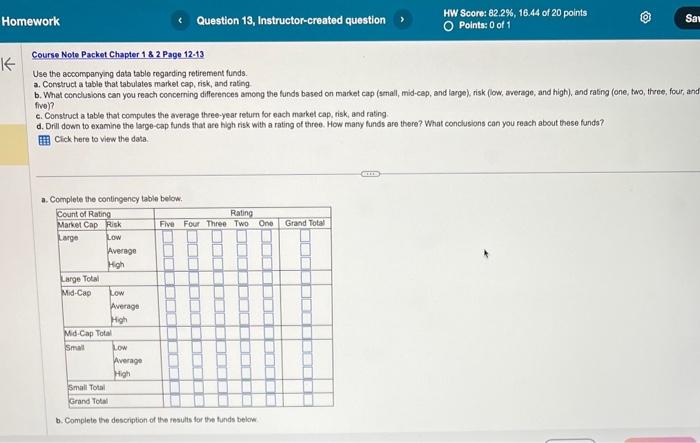

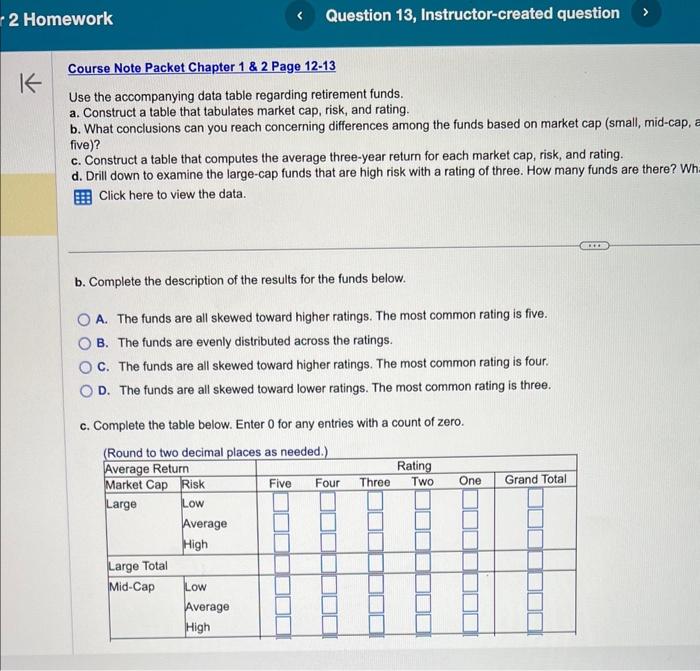

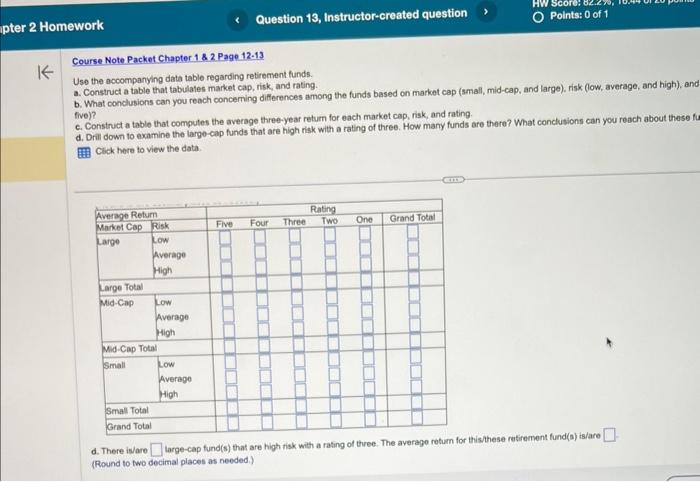

Course Note Packet Chapter 182 Page 12-13 Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates market cap, risk, and rating. b. What conclusions can you reach concerning differences among the funds based on market cap (small, mid-cap, and large), risk (fow, average, and high), and rating (one, two, three, four, and five)? c. Construct a table that compules the average three-year return for each market cap, risk, and rating d. Drill down to examine the large-cap funds that are high risk with a rating of three. How many funds are thore? What conclusions can you feach about these funds? Cick here to view the data. a. Complete the contingency table below. b. Complete the description of the results far the funds below Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates market cap, risk, and rating. b. What conclusions can you reach concerning differences among the funds based on market cap (small, mid-cap, five)? c. Construct a table that computes the average three-year return for each market cap, risk, and rating. d. Drill down to examine the large-cap funds that are high risk with a rating of three. How many funds are there? Wh Click here to view the data. b. Complete the description of the results for the funds below. A. The funds are all skewed toward higher ratings. The most common rating is five. B. The funds are evenly distributed across the ratings. C. The funds are all skewed toward higher ratings. The most common rating is four. D. The funds are all skewed toward lower ratings. The most common rating is three. c. Complete the table below. Enter 0 for any entries with a count of zero. Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates market cap, risk, and rating. b. What conclusions can you reach concerning differences among the funds based on market cap (small, mid-cap, and large), risk (low, average, and high), any five)? c. Construct a table that computes the average three-year return for each market cap, risk, and rating d. Drili down to examine the large-cap funds that are high risk with a rating of three. How many funds are there? What condusions can you reach about these f CIf Cick here to view the data. d. There isare large-cap fund(s) that are high risk with a rating of three. The average retum for thisthese rutirement fund(a) is/are (Round to two decinal places as needed.) Course Note Packet Chapter 182 Page 12-13 Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates market cap, risk, and rating. b. What conclusions can you reach concerning differences among the funds based on market cap (small, mid-cap, and large), risk (fow, average, and high), and rating (one, two, three, four, and five)? c. Construct a table that compules the average three-year return for each market cap, risk, and rating d. Drill down to examine the large-cap funds that are high risk with a rating of three. How many funds are thore? What conclusions can you feach about these funds? Cick here to view the data. a. Complete the contingency table below. b. Complete the description of the results far the funds below Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates market cap, risk, and rating. b. What conclusions can you reach concerning differences among the funds based on market cap (small, mid-cap, five)? c. Construct a table that computes the average three-year return for each market cap, risk, and rating. d. Drill down to examine the large-cap funds that are high risk with a rating of three. How many funds are there? Wh Click here to view the data. b. Complete the description of the results for the funds below. A. The funds are all skewed toward higher ratings. The most common rating is five. B. The funds are evenly distributed across the ratings. C. The funds are all skewed toward higher ratings. The most common rating is four. D. The funds are all skewed toward lower ratings. The most common rating is three. c. Complete the table below. Enter 0 for any entries with a count of zero. Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates market cap, risk, and rating. b. What conclusions can you reach concerning differences among the funds based on market cap (small, mid-cap, and large), risk (low, average, and high), any five)? c. Construct a table that computes the average three-year return for each market cap, risk, and rating d. Drili down to examine the large-cap funds that are high risk with a rating of three. How many funds are there? What condusions can you reach about these f CIf Cick here to view the data. d. There isare large-cap fund(s) that are high risk with a rating of three. The average retum for thisthese rutirement fund(a) is/are (Round to two decinal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts