Question: I am studying for an ex*m and need clear instructions on how you got the numbers you did. It would be very much appreciated. Thank

I am studying for an ex*m and need clear instructions on how you got the numbers you did. It would be very much appreciated. Thank you so much.

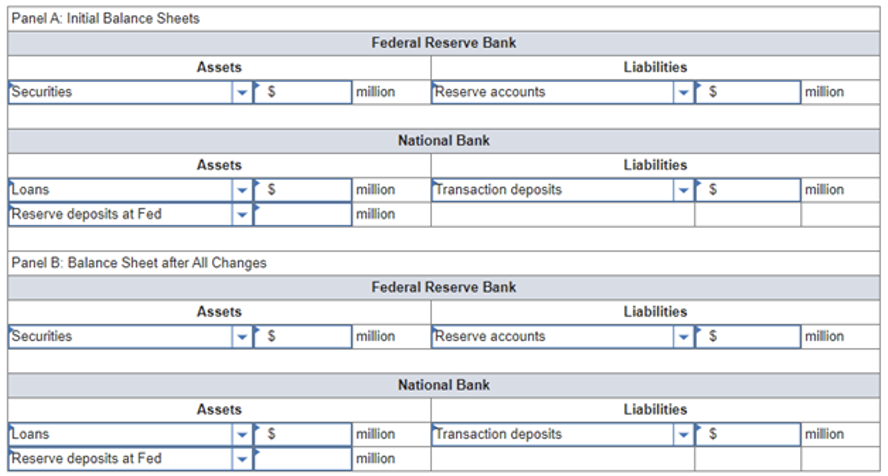

National Bank currently has $1,500 million in transaction deposits on its balance sheet. The current reserve requirement is 12 percent, but the Federal Reserve is decreasing this requirement to 10 percent. a. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts all excess reserves to loans, but borrowers return only 50 percent of these funds to National Bank as transaction deposits.

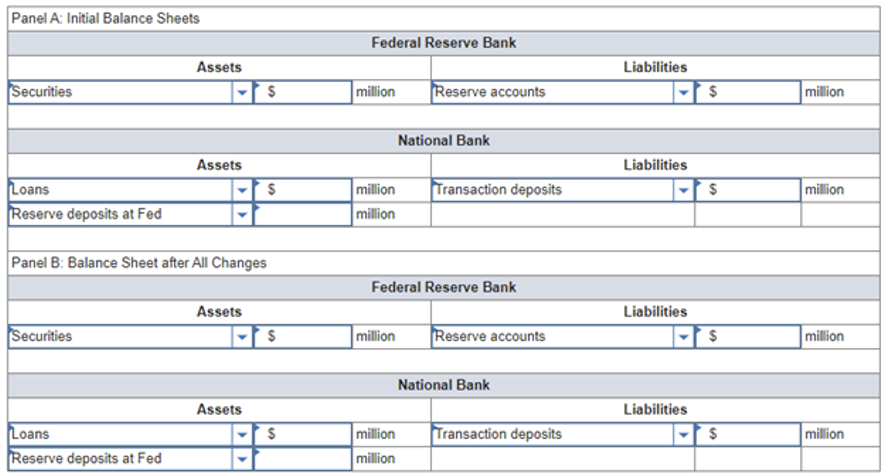

b. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts 90 percent of its excess reserves to loans and borrowers return 70 percent of these funds to National Bank as transaction deposits.

Panel A: Initial Balance Sheets Federal Reserve Bank Liabilities Assets MS Securities million Reserve accounts million National Bank Assets Liabilities $ Transaction deposits $ million Loans Reserve deposits at Fed million million Panel B: Balance Sheet after All Changes Federal Reserve Bank Assets Liabilities Securities million Reserve accounts $ million National Bank Assets Liabilities $ Transaction deposits $ million Loans Reserve deposits at Fed million million Panel A: Initial Balance Sheets Federal Reserve Bank Liabilities Assets MS Securities million Reserve accounts million National Bank Assets Liabilities $ Transaction deposits $ million Loans Reserve deposits at Fed million million Panel B: Balance Sheet after All Changes Federal Reserve Bank Assets Liabilities Securities million Reserve accounts $ million National Bank Assets Liabilities $ Transaction deposits $ million Loans Reserve deposits at Fed million million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts