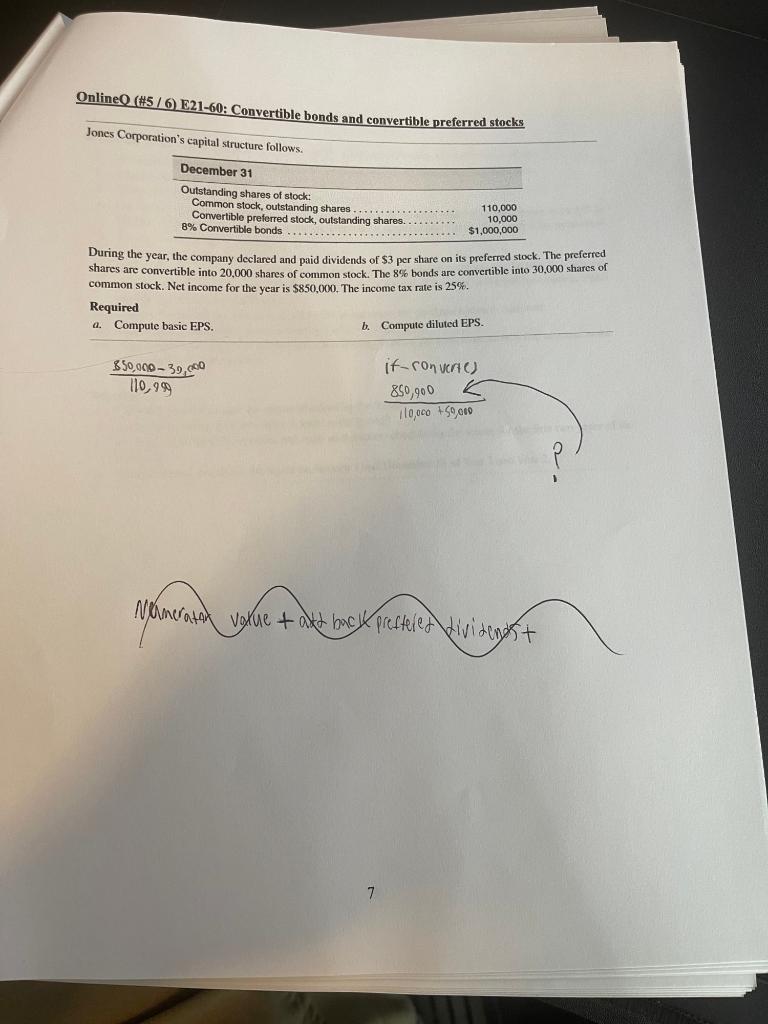

Question: I am trying to compute Diluted EPS under the if-converted method, which is part b. ignore part a. I got the denominator right in the

I am trying to compute Diluted EPS under the "if-converted" method, which is part b. ignore part a.

I got the denominator right in the formula for dilutive EPS, but I don't know how to solve for the numerator value, can you give me some simple formula I can apply to solve for the numerator value in future EPS problems that involve the if-converted method?

the answer to part b. is EPS = 5.69 I just need help with how to get there via the numerator value in part b

OnlineQ ( 5 / 6) E21-60: Convertible bonds and convertible preferred stocks Jones Corporation's capital structure followe During the year, the company declared and paid dividends of $3 per share on its preferred stock. The preferred shares are convertible into 20,000 shares of common stock. The 8% bonds are convertible into 30,000 shares of common stock. Net income for the year is $850,000. The income tax rate is 25%. Required a. Compute basic EPS. b. Compute diluted EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts