Question: I am trying to learn how to answer question 5-100, from the textbook Engineering Economic Analysis, 13th Edition, by Newnan, Eschebach, and Lavelle. I need

I am trying to learn how to answer question 5-100, from the textbook Engineering Economic Analysis, 13th Edition, by Newnan, Eschebach, and Lavelle. I need the method to solve this question by hand, using only the Texas Instruments BAII Plus calculator or equivalent. (no excel)

Please see attached picture.

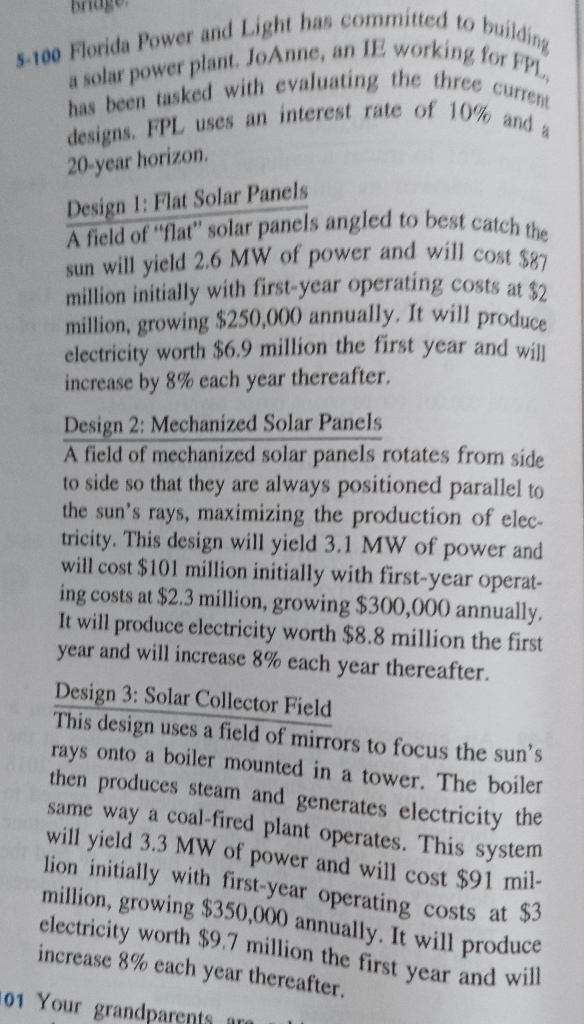

$.100 Florida Power and Light has committed te solar power plant. JoAnne, an IE working to buildin for ta has been tasked with evaluating the threer and designs, FPL uses an interest rate of 10%, urrent 20-year horizon. Design I: Flat Solar Panels A field of "flat" solar panels angled to best catch the sun will yield 2.6 MW of power and will cost $82 million initially with first-year operating costs at $2 million, growing $250,000 annually. It will produce electricity worth $6.9 million the first year and will increase by 8% each year thereafter Design 2: Mechanized Solar Panels A field of mechanized solar panels rotates from side to side so that they are always positioned parallel to the sun's rays, maximizing the production of elec- tricity. This design will yield 3.1 MW of power and will cost $101 million initially with first-year operat- ing costs at $2.3 million, growing $300,000 annually. It will produce electricity worth $8.8 million the first year and will increase 8% each year thereafter. Design 3: Solar Collector Field This design uses a field of mirrors to focus the sun's rays onto a boiler mounted in a tower. The boiler then produces steam and generates electricity the same way a coal-fired plant operates. This system will yield 3.3 MW of power and will cost $91 mil- lion initially with first-year operating costs at $3 million, growing $350,000 annually. It will produce electricity worth $9.7 million the first year and will increase 8% each year thereafter. 01 Your grandparents a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts