Question: I am trying to understand how to do this problem. Please show work. I need the formulas and how to apply them. Thank you! Problem

I am trying to understand how to do this problem. Please show work. I need the formulas and how to apply them. Thank you!

I am trying to understand how to do this problem. Please show work. I need the formulas and how to apply them. Thank you!

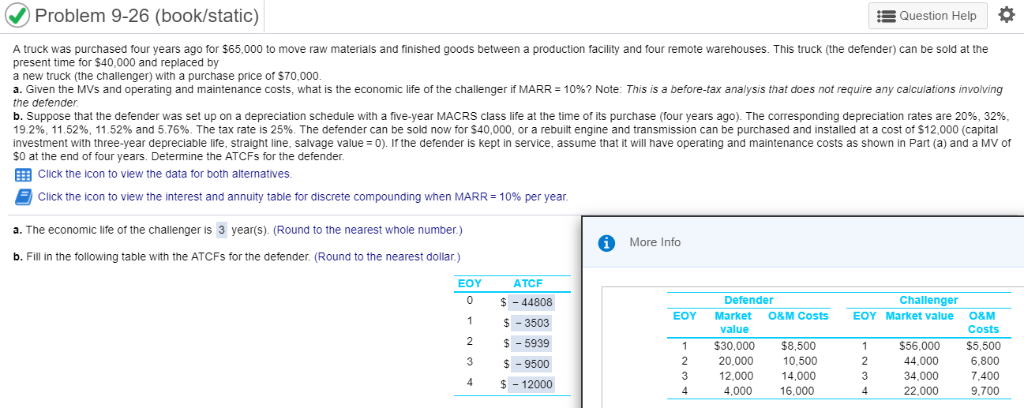

Problem 9-26 (book/static) Question Help A truck was purchased four years ago for $65,000 to move raw materials and finished goods between a production facility and four remote warehouses. This truck (the defender) can be sold at the present time for $40,000 and replaced by a new truck (the challenger) with a purchase price of $70,000 a. Given the MVs and operating and maintenance costs, what is the economic life of the challenger if MARR-10%? Note: This is a before-tax analysis that does not require any calculations involving the defender b. Suppose that the defender was set up on a depreciation schedule with a five-year MACRS class life at the time of its purchase (four years ago). The corresponding depreciation rates are 20%, 32%. 19.2%, 11.52%, 11.52% and 5.76%. The tax rate is 25% The defender can be sold now for $40,000, or a rebuit engine and transmission can be purchased and installed at a cost of $12,000 (capital investment with three-year depreciable life, straight line, salvage value 0). if the defender is kept in service, assume that it will have operating and maintenance costs as shown in Part (a) and a MV of $0 at the end of four years. Determine the ATCFs for the defender click the icon to view the data for both alternatives Click the icon to view the interest and annuity table for discrete compounding when MARR = 10% per year a. The economic life of the challenger is 3 year(s). (Round to the nearest whole number.) More Info b. Fill in the following table with the ATCFs for the defender. (Round to the nearest dollar.) EOY ATCF 0 $-44808 1 $-3503 2 $ 5939 $-9500 4 $-12000 Defender Challenger EOY Market O&M Costs EOY Market value 0&M Costs 1 $56,000 $5,500 6.800 7.400 9.700 value 1 $30,000 $8,500 10,500 14,000 4,000 16,000 20,000 2,000 14 44,000 34,000 22,000 Problem 9-26 (book/static) Question Help A truck was purchased four years ago for $65,000 to move raw materials and finished goods between a production facility and four remote warehouses. This truck (the defender) can be sold at the present time for $40,000 and replaced by a new truck (the challenger) with a purchase price of $70,000 a. Given the MVs and operating and maintenance costs, what is the economic life of the challenger if MARR-10%? Note: This is a before-tax analysis that does not require any calculations involving the defender b. Suppose that the defender was set up on a depreciation schedule with a five-year MACRS class life at the time of its purchase (four years ago). The corresponding depreciation rates are 20%, 32%. 19.2%, 11.52%, 11.52% and 5.76%. The tax rate is 25% The defender can be sold now for $40,000, or a rebuit engine and transmission can be purchased and installed at a cost of $12,000 (capital investment with three-year depreciable life, straight line, salvage value 0). if the defender is kept in service, assume that it will have operating and maintenance costs as shown in Part (a) and a MV of $0 at the end of four years. Determine the ATCFs for the defender click the icon to view the data for both alternatives Click the icon to view the interest and annuity table for discrete compounding when MARR = 10% per year a. The economic life of the challenger is 3 year(s). (Round to the nearest whole number.) More Info b. Fill in the following table with the ATCFs for the defender. (Round to the nearest dollar.) EOY ATCF 0 $-44808 1 $-3503 2 $ 5939 $-9500 4 $-12000 Defender Challenger EOY Market O&M Costs EOY Market value 0&M Costs 1 $56,000 $5,500 6.800 7.400 9.700 value 1 $30,000 $8,500 10,500 14,000 4,000 16,000 20,000 2,000 14 44,000 34,000 22,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts