Question: I am trying to value Computer Industries (CI) , a privately held computer manufacturer. Computer Industries is currently all-equity financed with 10 mm shares outstanding.

I am trying to value Computer Industries (CI), a privately held computer manufacturer. Computer Industries is currently all-equity financed with 10 mm shares outstanding. They have $30 mm in excess cash. I expect CI to generate $8 mm in (after tax) free cash flow next year, and I expect their FCF to grow at a constant rate of 3% thereafter.

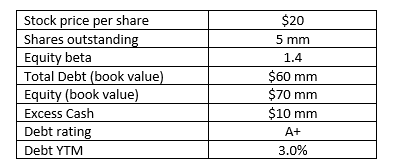

I observe the following information for Dell Computers (DELL), a publicly traded firm in the same industry and considered of comparable risk to CI:

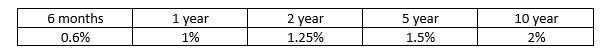

The current treasury yield curve is:

I estimate the market risk premium (relative to the 10-year Treasury rate) to be 5%. The corporate tax rate is 25%.

a.) Estimate of the asset cost of capital ( ) for Computer Industries?

) for Computer Industries?

b.) What price should I be willing to pay today for one share of Computer Industries stock?

Now suppose Computer Industries decides to change their financial structure to 25% debt (75% equity). They anticipate a cost of debt ( ) of 4%.

) of 4%.

c.) What will be Computer Industries equity cost of capital ( ) after the change in financial structure?

) after the change in financial structure?

d.) Would you expect this change in financial structure to impact the enterprise value of CI? Why or why not?

\\( r_{A} \\) \\begin{tabular}{|c|c|c|c|c|} \\hline 6 months & 1 year & 2 year & 5 year & 10 year \\\\ \\hline \0.6 & \1 & \1.25 & \1.5 & \2 \\\\ \\hline \\end{tabular} \\( r_{D} \\) \\( r_{E} \\) \\begin{tabular}{|l|c|} \\hline Stock price per share & \\( \\$ 20 \\) \\\\ \\hline Shares outstanding & \\( 5 \\mathrm{~mm} \\) \\\\ \\hline Equity beta & 1.4 \\\\ \\hline Total Debt (book value) & \\( \\$ 60 \\mathrm{~mm} \\) \\\\ \\hline Equity (book value) & \\( \\$ 70 \\mathrm{~mm} \\) \\\\ \\hline Excess Cash & \\( \\$ 10 \\mathrm{~mm} \\) \\\\ \\hline Debt rating & \\( \\mathrm{A}+ \\) \\\\ \\hline Debt YTM & \3.0 \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts