Question: i apologize, did not mean to add all question please just answer what you can, thanks for the help! One year ago, bill bought 300

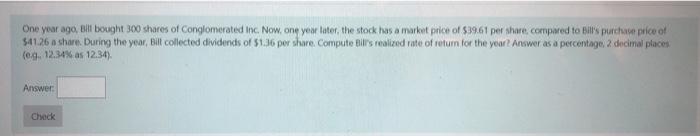

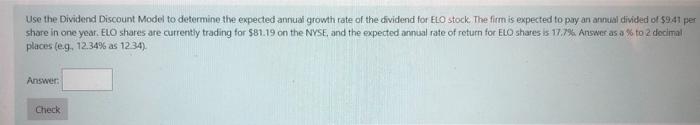

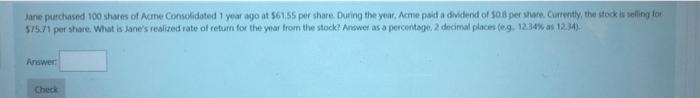

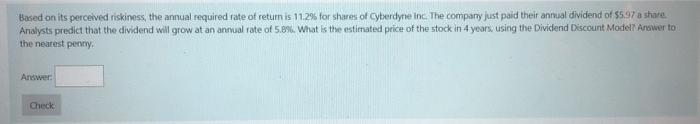

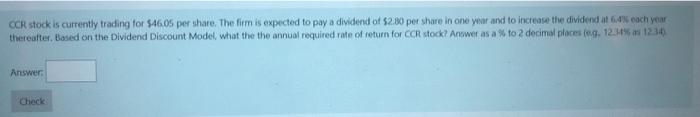

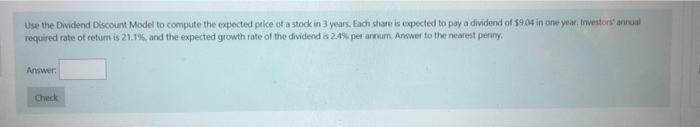

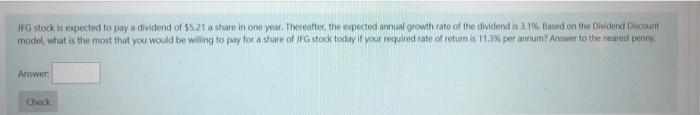

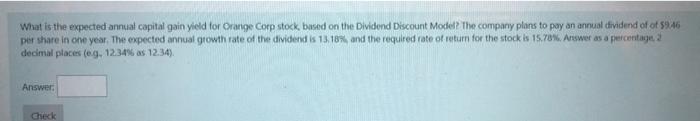

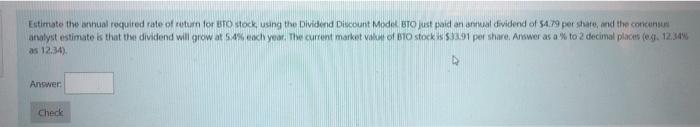

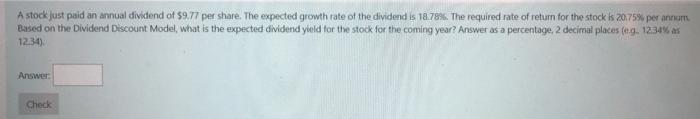

One year ago, bill bought 300 shares of Conglomerated Inc. Now, one year later, the stock has a market price of $39.61 per share.compared to Bills purchase price of 54126 a share. During the year, Bill collected dividends of 51.36 por share. Computebill's realized rate of return for the year? Answer as a percentage, 2 decimal places (eg. 12.34% as 12.34) Answer: Check Use the Dividend Discount Model to determine the expected annual growth rate of the dividend for ELO stock The firm is expected to pay an annual divided of 59.41 per share in one year. ELO share are currently trading for $81.19 on the NYSE, and the expected annual rate of return for ELO shares is 17.7%. Answer as a % to 2 decimal places (eg, 12.34% as 12.34) Answer: Check jane purchased 100 shares of Acme Consolidated 1 year ago at $6155 per share. During the year, Acme paid a dividend of 0.8 persone. Currently, the stock li selling for $75.71 per share. What is lane's realized rate of return for the year from the stock? Answer as a percentag, 2 decimal places (eg, 12:39%, 12.1) Answer Check Based on its perceived riskiness, the annual required rate of return is 11.2% for shares of Cytserdyne Inc. The company just paid their annual dividend of $5.97 a share Analysts predict that the dividend will grow at an annual rate of 5.8%. What is the estimated price of the stock in 4 years, using the Dividend Discount Model? Answer to the nearest perey Answer: Check OCR stock is currently trading for $46:05 per share. The firm is expected to pay a dividend of 2.00 per share in one year and to increase the dividend at each year thereafter. Based on the Dividend Discount Model, what the the annual required rate of return for con stock? Answer as a % to 2 decimal places to g. 12,1% 12.30) Answer: Check JEG stock is expected to pay a dividend of 5521 a share in one year. Thereafter, the expected annual growth rate of the dividend is 3.166. Based on the Dividend Discount model, what is the most that you would be willing to pay for a shore of a stock tecay if your required rate of return is 11.3% per annum? Answer to the nearest per Answer: Check What is the expected annual capital gain yield for Orange Corp stock based on the Dividend Discount Model? The company plans to pay an annual dividend of ot 59:46 per share in one year. The expected annual growth rate of the dividend is 13.18%, and the required rate of return for the stock is 15.70%. Answer as a percentage 2 decimal places (eg. 12.34% as 12,34). Answer Check Estimate the annual required rate of return for uro stock, using the Dividend Discount Model BTO just paid on annual dividend of 54.79 per share, and the concert analyst estimate as that the dividend will grow at 54% eady year. The current market value of B10 stock $33.91 per share. Answer as a % to 2 decimal places (eg. 12:34% as 12.34) Answer Check A stock just paid an annual dividend of $9.77 per share. The expected growth rate of the dividend is 18.7896. The required rate of return for the stock is 20.75% per annum Based on the Dividend Discount Model, what is the expected dividend yield for the stock for the coming year? Answer as a percentage, 2 decimal places (4.9.12.31% 1234) Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts