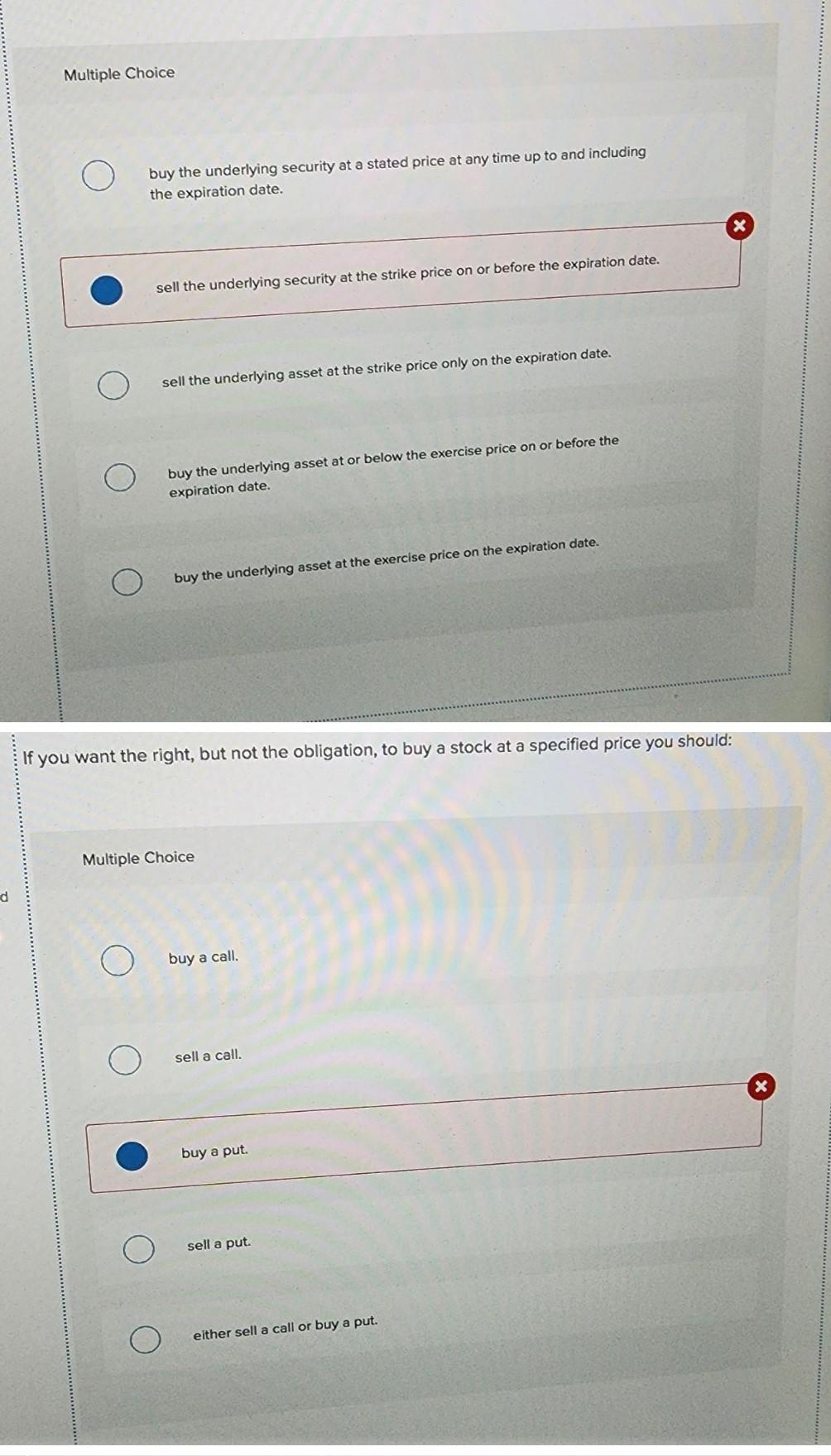

Question: I asked for these 2 questions last time because I got it wrong at b and C but chegg is still choosing it. Multiple Choice

I asked for these 2 questions last time because I got it wrong at b and C but chegg is still choosing it.

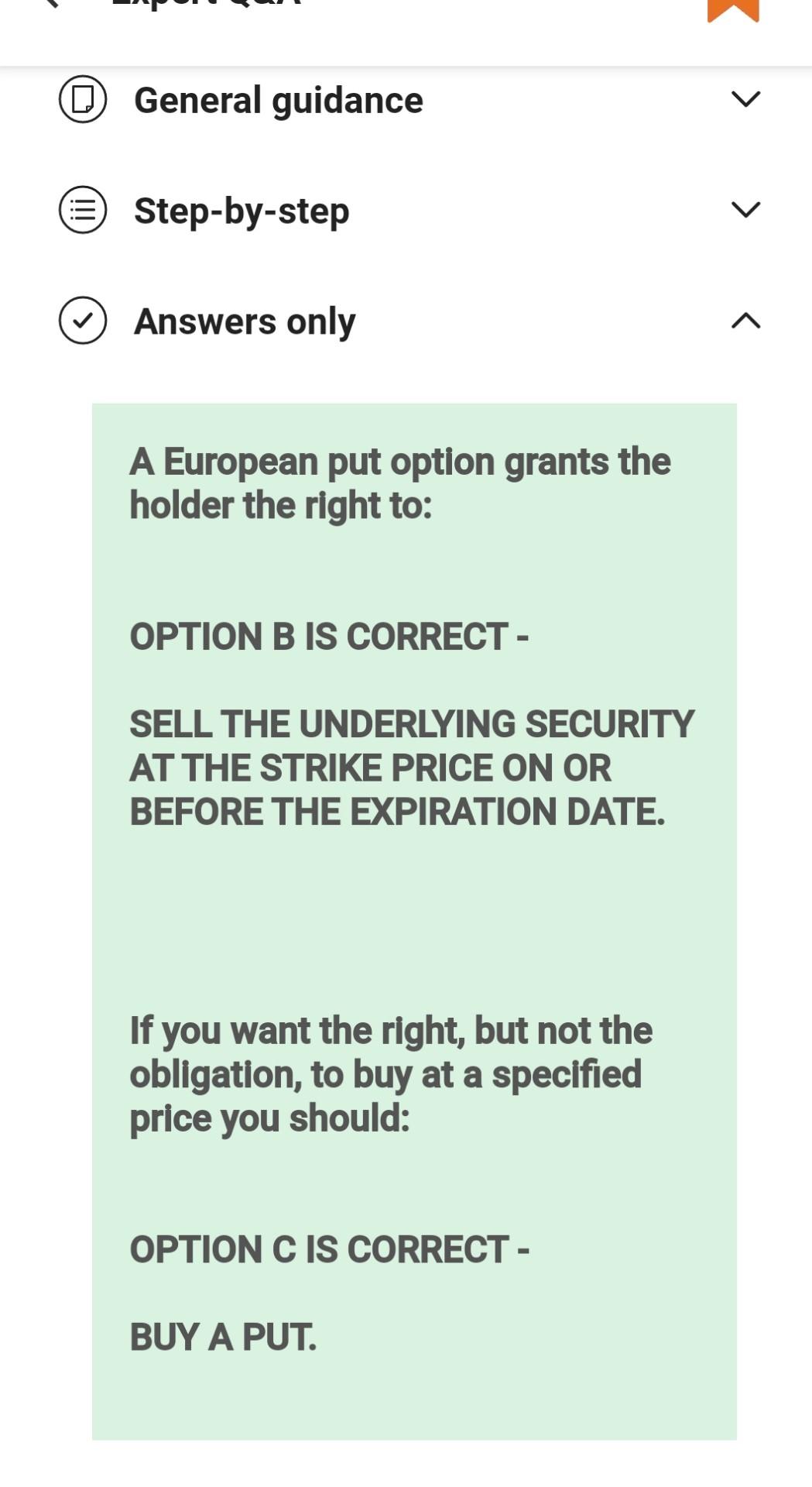

Multiple Choice buy the underlying security at a stated price at any time up to and including the expiration date. sell the underlying security at the strike price on or before the expiration date. sell the underlying asset at the strike price only on the expiration date. buy the underlying asset at or below the exercise price on or before the expiration date. buy the underlying asset at the exercise price on the expiration date. If you want the right, but not the obligation, to buy a stock at a specified price you should: Multiple Choice buy a call. sell a call. buy a put. sell a put. either sell a call or buy a put. General guidance Step-by-step Answers only A European put option grants the holder the right to: OPTION B IS CORRECT - SELL THE UNDERLYING SECURITY AT THE STRIKE PRICE ON OR BEFORE THE EXPIRATION DATE. If you want the right, but not the obligation, to buy at a specified price you should: OPTION C IS CORRECT - BUY A PUT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts