Question: I asked this question before but the answer was not clear and the NPV was not given within 2 decimal places. Thank you in advance

I asked this question before but the answer was not clear and the NPV was not given within 2 decimal places. Thank you in advance

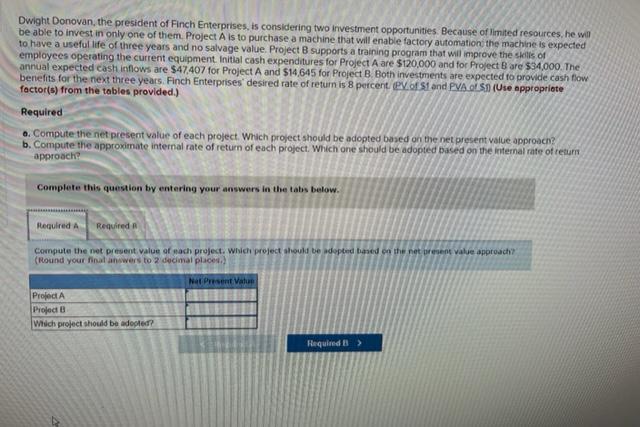

Dwight Donovan, the president of Finch Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation the machine is expected to have a useful life of three years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $120,000 and for Project Bare $34,000. The annual expected cash inflows are $47.407 for Project A and $14,645 for Project B. Both investments are expected to provide cash flow benefits for the next three years. Finch Enterprises desired rate of return is 8 percent. Pof S1 and PVA OLSA (Ure appropriate factor(s) from the tables provided.) Required a. Compute the net present value of each project. Which project should be adopted based on the net present value approsen? b. Compute the approximate internal rate of return of each project. Which one should be adopted based on the Internal rate of retum approache Complete this question by entering your answers in the tabs below. Required A Required Compute the net present value of each project. Which project should be adopted based on the net present value approach? (Round your final answers to 2 decimal places) Net Present Value Project A Project Which project should be adopted? Hequind 1>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts