Question: i asked this question earlier but did not get a correft answer. these are my answers and some of my mistakes. help me fix them

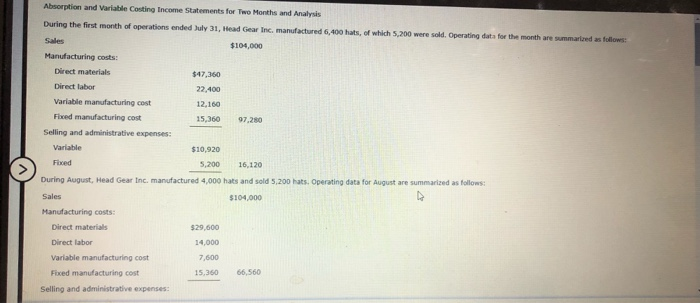

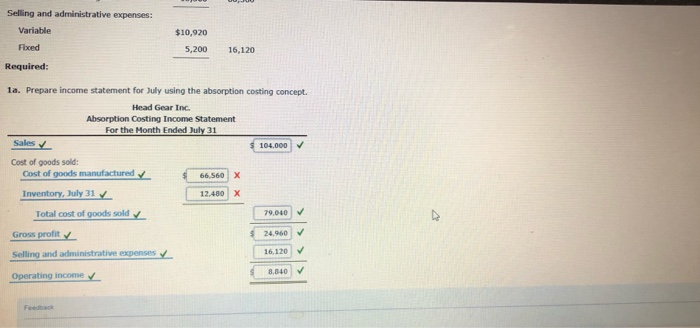

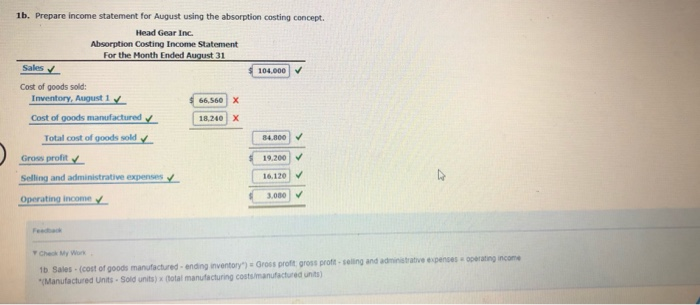

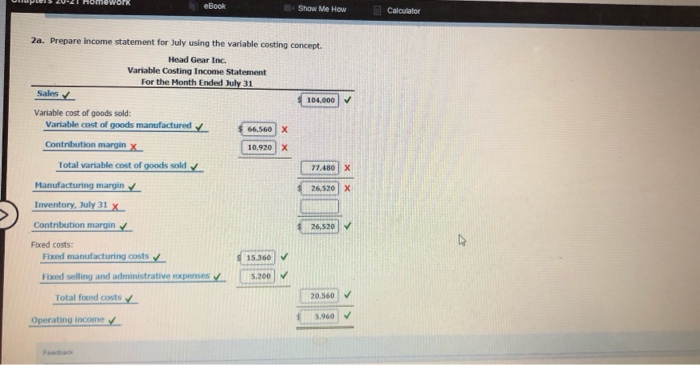

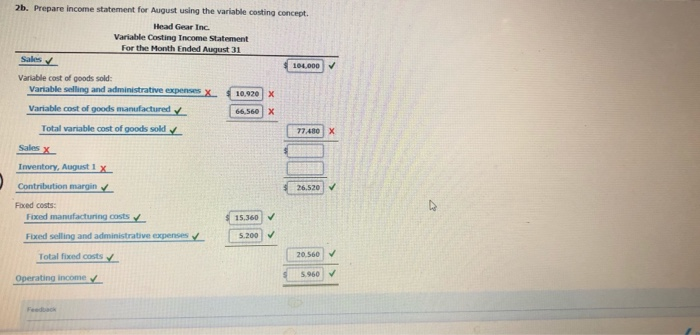

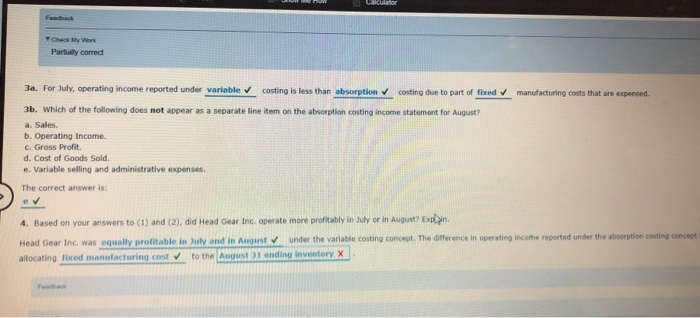

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows: Sales $104,000 Manufacturing costs: Direct materials $47,360 Direct labor 22.400 Variable manufacturing cost 12,160 Fixed manufacturing cost 15,360 97.280 Selling and administrative expenses: Variable $10.920 Fixed 5,200 16,120 During August, Head Gear Inc, manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows: Sales $104,000 Manufacturing costs: Direct materials $29,600 Direct labor 14,000 Variable manufacturing cost 7,600 Fixed manufacturing cost 15.360 66,560 Selling and administrative expenses: Selling and administrative expenses: Variable Fixed $10,920 5,200 16,120 Required: 1a. Prepare income statement for July using the absorption costing concept. Head Gear Inc Absorption Costing Income Statement For the Month Ended July 31 104.000 Sales 66 560 X 12.480 X Cost of goods sold: Cost of goods manufactured Inventory, July 31 Total cost of goods sold Gross profit Selling and administrative expenses 79,040 24,960 16,120 8,840 Operating income Feedback Sales 1b. Prepare income statement for August using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 104.000 Cost of goods sold: Inventory, August 1 66,560 X Cost of goods manufactured 18,240 X Total cost of goods sold 84.800 Grous profit 19.200 Selling and administrative expenses 16.120 3.000 Operating income Check My Work 1b Sales - cost of goods manufactured - ending inventory') Gross profit gross profit - Soling and administrative expenses rating income Manufactured Units - Sold units) x total manufacturing costs manufactured units) eBook Show Me How Calculator 2a. Prepare income statement for July using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended July 31 Sales 104.000 Variable cost of goods sold: Variable cost of goods manufactured 66,560 X Contribution margin X 10.920 X Total variable cost of goods sold 77.480X Manufacturing margin 26.520 X Inventory, July 31 x Contribution margin 26,520 Fixed costs: Fixed manufacturing costs 15.360 5.200 Fixed selling and administrative expenses Total find costs Operating income 20.5607 5.960 2b. Prepare income statement for August using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended August 31 104.000 Variable cost of goods sold: Variable selling and administrative expenses 10.920 X Variable cost of goods manufactured 66,560 X Total variable cost of goods sold 77.480 X Sales 26.520 Inventory, August 1 x Contribution margin Foxed costs: Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs 15.360 5.200 20.560 5.960 Operating income Feedback Calculator Feedback Oh My Work Partially correct 3a. For July, operating income reported under variable costing is less than absorption costing due to part of fixed manufacturing costs that are expensed. 3b. Which of the following does not appear as a separate line item on the absorption costing income statement for August? a. Sales b. Operating Income. c. Gross Profit d. Cost of Goods Sold. e. Variable selling and administrative expenses. The correct answer is: e 4. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? Explain Head Gear Inc. was equally profitable in July and in August under the variable costing concept. The difference in operating income reported under the absorption costing concept allocating fixed manufacturing cost to the Augustending inventory X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts