Question: I AT&T LTE 12:36 AM * 53% e Sign in or Sign Up ' e Chegg Study l Gui ' D https://schools. in e chegg

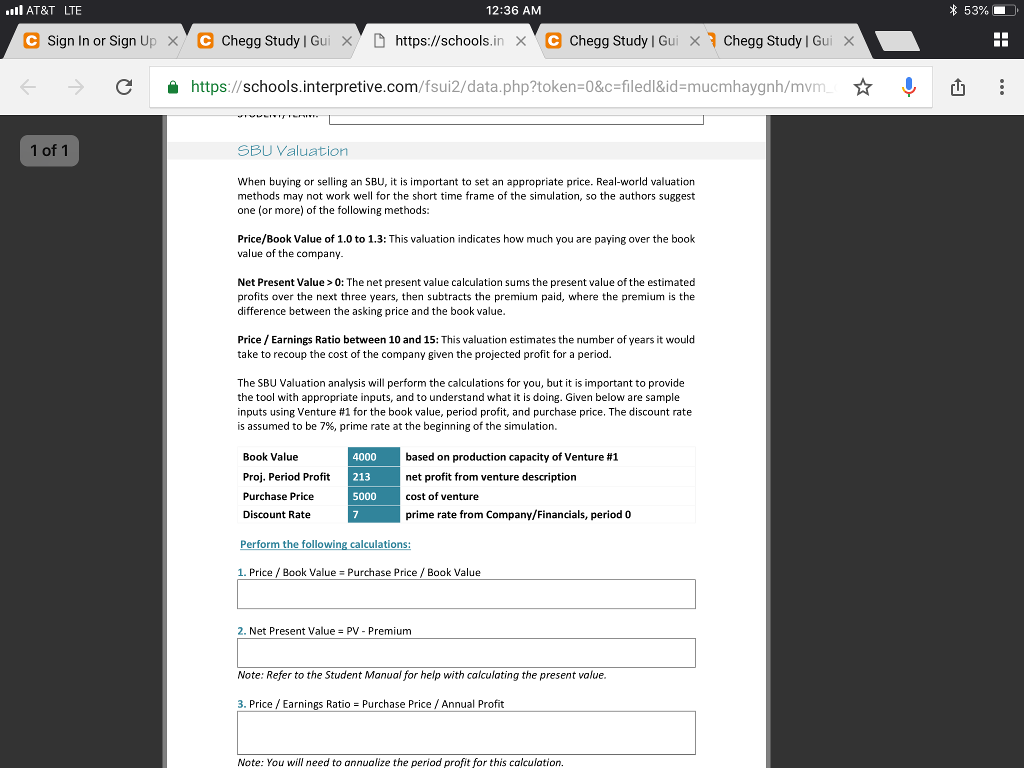

I AT&T LTE 12:36 AM * 53% e Sign in or Sign Up ' e Chegg Study l Gui ' D https://schools. in e chegg Study l Gui 1 Chegg Study I GuX C https://schools.interpretive.com/fsui2/data.php?token-0&c-filedl&id-mucmhaygnh/mvm SBU Valuation When buying or selling an SBU, it is important to set an appropriate price. Real-world valuation methods may not work well for the short time frame of the simulation, so the authors suggest one (or more) of the following methods: Price/Book Value of 1.0 to 1.3: This valuation indicates how much you are paying over the boolk value of the company. Net Present Value>0: The net present value calculation sums the present value of the estimated profits over the next three years, then subtracts the premium paid, where the premium is the difference between the asking price and the book value Price/Earnings Ratio between 10 and 15: This valuation estimates the number of years it would take to recoup the cost of the company given the projected profit for a period. The SBU Valuation analysis will perform the calculations for you, but it is important to provide the tool with appropriate inputs, and to understand what it is doing. Given below are sample inputs using Venture #1 for the book value, period profit, and purchase price. The discount rate is assumed to be 7%, prime rate at the beginning of the simulation. Book Value Proj. Period Profit2 Purchase Price Discount Rate 4000 213 5000 based on production capacity of Venture #1 net profit from venture description cost of venture prime rate from Company/Financials, period 0 Perform the following calculations: 1. Price /Book Value Purchase Price Book Value 2. Net Present Value PV Premium Note: Refer to the Student Manual for help with calculating the present value Price/Earnings Ratio Purchase Price/Annual Profit Note: You will need to annualize the period profit for this calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts