Question: I attempted to solve the question but my answer is incorrect. Above is the work I did to try and solve it. Please explain where

I attempted to solve the question but my answer is incorrect. Above is the work I did to try and solve it. Please explain where I went wrong and show how to properly solve. Thank you!

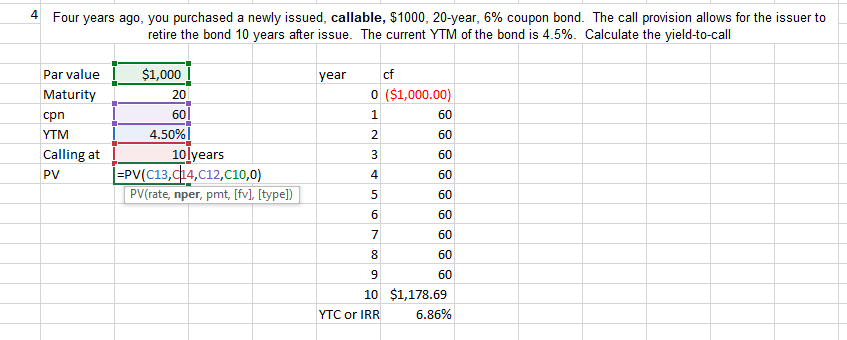

4 Four years ago, you purchased a newly issued, callable, $1000, 20-year, 6% coupon bond. The call provision allows for the issuer to retire the bond 10 years after issue. The current YTM of the bond is 4.5%. Calculate the yield-to-call year Par value Maturity cpn YTM Calling at PV $1,000 20 60 4.50% 1olyears =PV(C13,014, C12,010,0) PV (rate, nper, pmt, [fv], [type]) cf 0 ($1,000.00) 1 60 2 60 3 60 4 60 60 5 6 60 7 60 8 60 9 60 10 $1,178.69 YTC or IRR 6.86%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock