Question: I believe I know how to do A and B but really need help with C. If possible, be specific as possible when explaining C.

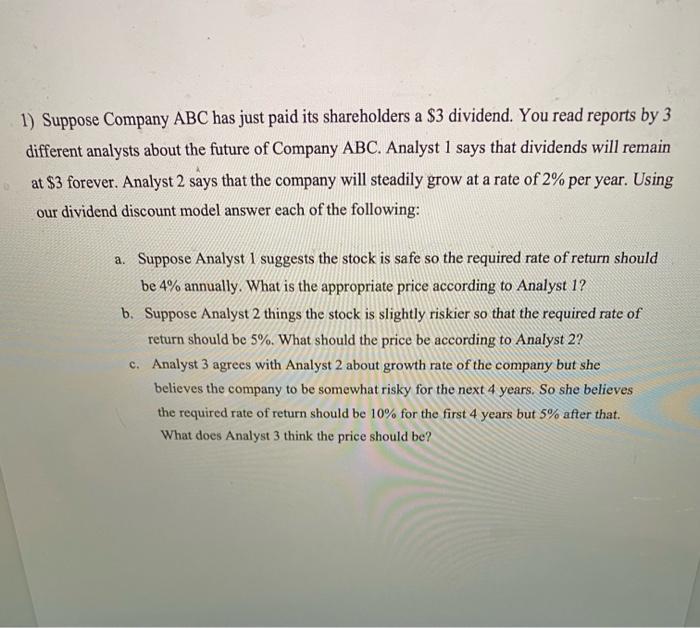

1) Suppose Company ABC has just paid its shareholders a $3 dividend. You read reports by 3 different analysts about the future of Company ABC. Analyst 1 says that dividends will remain at $3 forever. Analyst 2 says that the company will steadily grow at a rate of 2% per year. Using our dividend discount model answer each of the following: a. Suppose Analyst I suggests the stock is safe so the required rate of return should be 4% annually. What is the appropriate price according to Analyst 1? b. Suppose Analyst 2 things the stock is slightly riskier so that the required rate of return should be 5%. What should the price be according to Analyst 2? c. Analyst 3 agrees with Analyst 2 about growth rate of the company but she believes the company to be somewhat risky for the next 4 years. So she believes the required rate of return should be 10% for the first 4 years but 5% after that. What does Analyst 3 think the price should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts