Question: I believe that the answer is found using Div. discount model.... please show all work... I will give a upvote! You are valuing a company

I believe that the answer is found using Div. discount model.... please show all work... I will give a upvote!

I believe that the answer is found using Div. discount model.... please show all work... I will give a upvote!

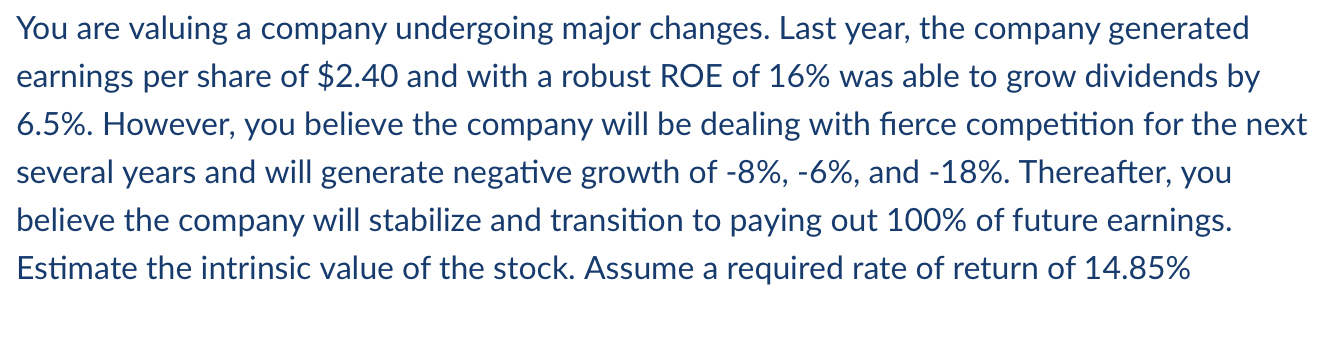

You are valuing a company undergoing major changes. Last year, the company generated earnings per share of $2.40 and with a robust ROE of 16% was able to grow dividends by 6.5%. However, you believe the company will be dealing with fierce competition for the next several years and will generate negative growth of -8%, -6%, and -18%. Thereafter, you believe the company will stabilize and transition to paying out 100% of future earnings. Estimate the intrinsic value of the stock. Assume a required rate of return of 14.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts